Cisco's Q2 sees weaker sales, profits; no widespread layoffs planned

updated: Despite the uncertain economic challenges in the future and a quarter that saw weaker sales and profits from a year ago, Cisco Systems remains optimistic about its ride through the downturn and is looking ahead at the recovery by focusing on a realignment and reorganization plan instead of widespread layoffs.

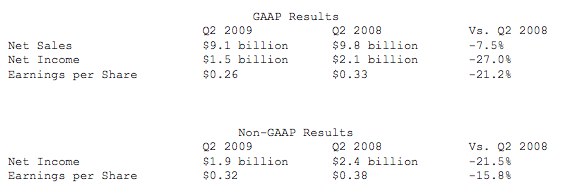

The company reported a second-quarter net income of $1.9 billion, or 32 cents per share, on sales of $9.1 billion, beating Wall Street's estimates of 30 cents per share on sales of $9 billion. Revenue for the quarter dipped more than 7 percent from the same quarter a year ago. Net income was down more than 21 percent from the year-ago quarter and eps dropped almost 16 percent. Cash and cash equivalents and investments were $29.5 billion, up $2.7 billion from $26.8 billion at the end of the first quarter. (Statement)

In a call with analysts, CEO John Chambers didn't completely rule out a workforce reduction but put his own definition on "company-wide layoffs" at 10 percent of the 67,000-person workforce. "We are not going to consider a layoff at this time," he said. Instead, the company is focusing on a realignment and reorganization process that likely will include re-shuffling of jobs within the company, as well as some elimination of jobs in the neighborhood of 1,500 to 2,000. Chambers called this sort of reduction "a normal process."

Back in November, the company - like many others feeling the pinch of the economy - slashed its forecasts and said it would cut costs by $1 billion in the current fiscal year. Despite that, Wall Street has largely remained bullish on Cisco - confident in the long-term but uneasy about how bad things might get before there's a recovery. The company is still largely tied to sales of networking equipment - one-time revenue generators, compared to on-going revenue sources, such as licensing fees.

On the conference call, Chambers - emphasizing the uncertainty of the economic future - said that the company expects Q3 revenue to drop 15-20 percent for the third quarter. At a time when many companies have halted guidance - largely because of the economic uncertainty - Cisco bucked the trend by giving shareholders a forecast. In addition, Chambers shared product order data for the quarter, giving an idea of how the company has been impacted. Year over year, orders were down 9 percent in November, 11 percent in December, and 20 percent in January.

The Q3 forecast assumes that the slowdown in product orders will continue to slide, Chamber said, but added that he wouldn't be surprised to see actual numbers shift to either a positive or negative from the guidance figures. That's how strong the uncertainty is - and Cisco's performance has long been tied to "major economic patterns."

But business-as-usual is starting to see some change at Cisco. The company is gearing up for what has been referred to as a technology war. Later this year, Cisco is expected to launch a new product - a computer server that combines networking and storage to allow business customers to better manage data centers through virtualization software - that would put them head-to-head with its own partners, names such as IBM, Dell and HP.

Other highlights from the quarter:

- Cisco repurchased 37 million shares of common stock at an average price of $16.40 per share for an aggregate purchase price of $600 million. As of January 24, 2009, Cisco had repurchased and retired 2.7 billion shares of Cisco common stock at an average price of $20.57 per share for an aggregate purchase price of approximately $55.2 billion since the inception of the stock repurchase program. The remaining authorized repurchase amount as of January 24, 2009 was $6.8 billion with no termination date.

- It completed the acquisition of Denver-based Jabber, Inc., a provider of presence and messaging software. It is now part of the Cisco Collaboration Software Group.

- The company announced an increased equity stake in VMware, Inc., taking Cisco's holding to approximately 1.7 percent of VMware's total outstanding common stock.

Shares of Cisco Systems were up slightly in regular trading, closing at $15.84. Shares were fluctuating in after-hours trading.