CommBank chops IT spend

update Commonwealth Bank CEO Ralph Norris today said the bank had cut its technology spend by 6 per cent on last year, and had claimed "first-mover advantage" in its decision to overhaul its core banking systems ahead of other major rivals.

CBA had spent $826 million on technology in the past 12 months leading to 30 June 2008 — 6 per cent less than the $833 million it spent in the previous financial year, representing around 12 per cent of the bank's $7 billion operational costs, according to Norris, speaking at the bank's full-year earnings announcement today.

However, the cost reduction comes as CBA plans to invest $580 million over five years on its core banking systems. The bank in April nominated SAP and system integrators Accenture to lead the systems upgrade.

Norris said that the bank's full modernisation program would be spearheaded by its core banking system overhaul.

Norris told investors that the modernisation was "a project that will deliver a world class technology platform and enhanced customer service."

He also claimed the "first-mover advantage" in the bank's decision to target its core banking systems. CBA announced the move four months before NAB showed its hand last week, when the company said it had earmarked $1 billion to overhaul its ageing core banking systems.

While CBA has planned a wholesale overhaul of its systems, with CIO Michael Harte having said he expected customers to experience "real-time banking" by 2009, NAB CIO Michelle Tredenick has outlined a more cautious path. NAB has planned to spend just $30 million in the first year, targeted towards its new Star Direct Bank project it has planned to launch later this year.

Buy or sell? iPhone becomes CBA's tech-driven growth strategy

(Credit: CBA).

While CBA's core banking replacement had only just begun, it claimed today that "significant efficiency savings [have been] achieved — on a recurrent basis".

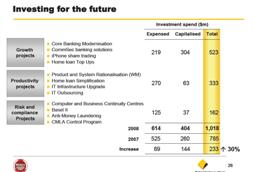

Norris separated the core banking overhaul from other projects that are planned to target the bank's productivity goals, such as its simplified home loan processes, IT infrastructure upgrades as well as recently cemented IT outsourcing contracts. Productivity projects are worth $333 million, according to CBA.

Meanwhile, CBA's growth strategy, has included its recently launched CommSec iPhone application launch, along with the core banking overhaul. Growth projects make up $523 million of the $826 million in total technology spending.

Risk and compliance projects, which cover CBA's business disaster recovery and continuity plans, as well as investments in technology to support anti-money laundering requirements were the smallest category at $162 million.

The right time

This year was "absolutely the right time" for

Commonwealth Bank's core banking systems refresh, which was showing

"encouraging results", Norris told reporters during a telephone briefing later in the day.

"The group has spent two years to get to the point where confident in our ability to successfully execute such a program," he added.

Technology analysts have warned that system overhauls of this magnitude will likely result in major hiccups. However, today Norris said the bank had, just four months in to the five year project, achieved "encouraging results".

In previous years, the focus had been on frontline customer interface technologies, he said, however those types of upgrades would not be enough to progress the bank.

"For the group to take the next move, significant impediments in our back end systems needed to be addressed," he said.