Dell: Turnaround interruptus as share grab hurts net, margins

Dell's second quarter earnings fell short of projections, but revenue was well ahead of targets. Translation: Dell is gaining share at the expense of its bottom line as price competition heats up.

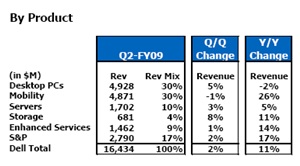

Dell reported fiscal second quarter earnings of 31 cents a share on revenue of $16.4 billion, up 11 percent from a year ago. Dell in its statement noted that it gained share across the board.

The problem: Dell was expected to report fiscal second quarter earnings of 36 cents a share on revenue of $15.95 billion, according to Thomson Reuters. The company said it took a hit of 2 cents a share related to restructuring and acquisition charges. Even excluding those charges Dell's earnings tally is well short of expectations.

Meanwhile, Dell's outlook left a little to be desired (especially the IT spending part): The company said:

Dell will continue to incur costs as it realigns its business to improve competitiveness, reduce headcount and invest in infrastructure and acquisitions. The company sees continued conservatism in IT spending in the U.S., which has extended into Western Europe and several countries in Asia. Demand also is impacted by currency fluctuations. Dell will continue to benefit from improving performance in areas such as emerging countries, notebooks, and enterprise and services, which collectively are driving a more diversified portfolio of geographies and products. The company continues to work aggressively on cost initiatives that will benefit its P&L over time with improved growth, profitability and cash flow.

CEO Michael Dell said on a conference call that margins were hurt by a strategic pricing decision in the Europe, Middle East and Africa to grab share and boost growth. Meanwhile, Dell's consumer expansion cost more as it tried to grab retail shelf space. Dell admitted that the company's quarters are "non-linear"--a nice way to say lumpy--but maintained the Dell is on the right track. Dell also reiterated that its goal is to grow faster than the industry and profits will ultimately follow.

Analysts had high hopes going into Dell's earnings, but had them dashed by the earnings miss. Here's the afterhours reaction:

Among other conference call highlights:

- Dell added that "there is still a lot of work to do" as the company cuts costs and positions for growth.

- CFO Brian Gladden said Dell was chosen to build Salesforce.com's Singapore data center and that the SaaS leader will migrate its existing supplier out of its U.S. location in favor of Dell. Gladden didn't mention the other supplier, but Sun has bragged about Salesforce.com as a customer for years. The Register reported last month that Sun got the boot from Salesforce.com.

- Analysts questioned whether Dell saw a July falloff in demand in Europe and tried to sugarcoat it by saying it made an aggressive pricing move. Dell disputed that assessment and hinted that the pricing moves in Europe were to address market share among consumer PCs. Analysts weren't buying it.

- The best line of the day came when an analyst told Dell that he was sounding similar to the way HP used to "in a previous administration." As a refresher, HP used to repeatedly talk about share gains while missing profit targets before CEO Mark Hurd arrived on the scene. The previous administration reference picked on former HP CEO Carly Fiorina. But HP's conference calls were disasters under former CEO Lew Platt too.

- Dell was also asked about HP's acquisition of EDS, which is a partner. Dell said that EDS' business (now a part of HP) isn't material to Dell on an annual basis. Meanwhile, the company is getting friendlier with EDS rivals so it's not helping out nemesis HP.

By the numbers:

- Dell's operating expenses as a percentage of revenue were 12.2 percent, the lowest level in six quarters.

- Dell reiterated that it will save $3 billion in annualized costs by 2011.

- Consumer revenue was up 28 percent to $2.8 billion in the second quarter, but the unit only broke even due to channel investments. Global shipments jumped 53 percent as market share rose to 9.1 percent.

- In the Americas, commercial revenue was up 5 percent to $8.1 billion as units shipped jumped 7 percent. Server shipments were up 18 percent and notebooks jumped 12 percent. In Asia Pacific and Japan, revenue was up 16 percent to more than $2 billion. In Europe, Middle East and Africa, commercial revenue was up 11 percent to $3.5 billion with shipments jumping 20 percent.

- Notebook revenue was up 26 percent in the quarter.

- 47 percent of Dell's revenue came from abroad. Brazil, Russia, India and China (so called BRIC countries) showed revenue growth of 41 percent with a 46 percent increase in units. What's worrisome here is that Dell has half of its business abroad, is getting help from a weak dollar and still can't hit its earnings targets.

Here's a look at the product trends:

And the metrics of note:

The bottom line: Dell remains a work in progress and talk that the company was ready to return to the glory days looks premature. However, IT buyers may have a good time. Dell seems willing to gain share at the expense of margins. And that means better pricing for you.