Earnings take-away: Microsoft is still powered by Windows

Microsoft's brass is always looking for the next billion dollar business and has stuck a toe into everything from healthcare to energy monitoring. But as the company's second quarter earnings for fiscal 2010, which Microsoft released on January 28, show, Windows is still the big wheel that keeps on turning in Redmond.

Consumer sales of Windows 7 buoyed Microsoft to report record earnings, even after deferrals were figured in. Microsoft reported net income of $6.66 billion, or 74 cents a share, on revenue of $19.02 billion, which included $1.71 billion in Windows 7 deferred revenue for the quarter.

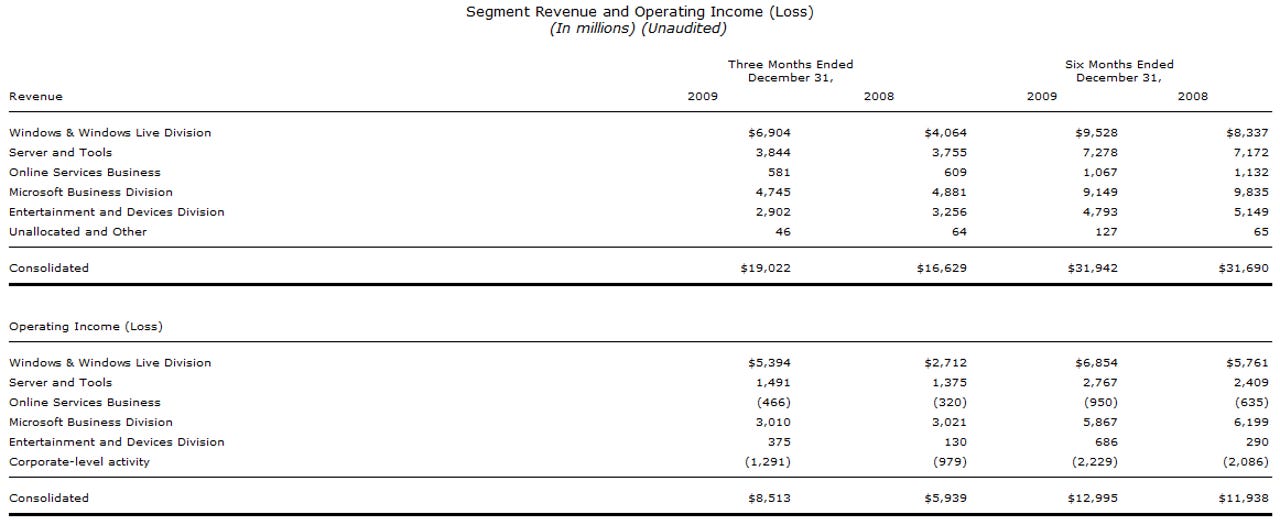

As part of that announcement, Microsoft reported that it has sold more than 60 million Windows 7 licenses to date. The combined Windows and the Windows Live division had operating income of $5.39 billion on revenue of $6.9 billion, compared to the year-ago quarter's operating income of $2.71 billion on revenue of $4.06 billion.

Business sales of Windows 7 -- unsurprisingly, given typical enterprise sales, testing and deployment cycles -- have yet to kick in for Windows 7. That isn't because business users are waiting for Windows 7 Service Pack (SP) 1, which is widely expected to ship some time this calendar year, Microsoft officials said. In fact, Microsoft is seeing more business activity around upgrades to the latest version of Windows than it has with previous launches, according to Microsoft's new Chief Financial Officer Peter Klein.

"People want Windows 7 on all devices on all form factors," said Klein during today's call with Wall Street analysts. (In case you were wondering, that question wasn't prompted by a question about the Apple iPad. Nobody asked about it during the Q&A session.)

Klein noted that netbooks currently comprise about 11 percent of the PC market and Windows is currently on 90 percent of these machines. Windows 7 is more than half of that base (XP, and to a much lesser extent, Vista) are on the rest of the Windows netbooks.

Yes, Office is still the other big Microsoft cash cow (with revenues of $4.74 billion for the Business Division this quarter), and that unit ended up really kicking in for Microsoft when the economy and Vista sales were down. But in Q2, Business Division revenues and operating income were both down, compared to the year-ago quarter. Microsoft officials attributed the decline, in part, to the imminent arrival of Office 2010. (Office sales comprise more than 90 percent of the Business Division's revenues; Dynamics products are the other 10 percent.)

(Detailed breakdowns for each division can be found in Microsoft's latest 10-Q, filed on January 28.)

Server and Tools held its own (revenues up two percent, primarily because of Enterprise Client Access License (CAL) suites, System Center and SQL Server). But services/consulting revenues were down two percent, or $32 million. The Online Services Division (the search/advertising unit) is still in the red. Online access (dial-up) continues to plummet, and online advertising was off. In Entertainment and Devices, gaming console and game sales were down, but Xbox Live revenues were up.

Here's a more detailed breakdown by division of revenue and operating income (click on the image below to enlarge).

Microsoft cut 800 jobs in the second quarter of FY 2010 and spent $59 million in severance payments. No analyst on today's call asked whether there would be more layoffs planned for this year. The Softies did say they planned to continue to keep a tight rein on costs. While the Windows division spent more than usual on sales/marketing because of Windows 7 launch-related activities and ads, other divisions cut back on not just headcount, but also sales and marketing, as well as research and development expenses.