eBay doubles down on payments as it buys Bill Me Later; Lays off 1,000

EBay on Monday revamped its corporate portfolio laying off 1,000 workers, or 10 percent of its workforce, and buying online payment company Bill Me Later as well as a Denmark classifieds company.

The layoffs were largely expected, but the Bill Me Later purchase for $820 million in cash and $125 million in outstanding options is notable (statement). Simply put, eBay is doubling down on Bill Me Later--a company that depends on evaluating credit risks--during a credit crunch. But coupling Bill Me Later, which counts Walmart.com, Toys R Us and Apple as customers, with PayPal gives eBay a great one-two punch in online payments. Bill Me Later's market share rivals PayPal and gives eBay a dominant position in online payments.

The message behind eBay's Bill Me Later acquisition: Auctions may be slowing but online payments are still growing strong. Could eBay be the Visa or Mastercard of online payments?

On a conference call detailing the Bill Me Later deal, eBay CEO John Donahoe said he's confident the company is on the right path. Donahoe has made PayPal a centerpiece of eBay's growth strategy. He has also revamped fees to get more inventory and sales volume on eBay.

Donahoe also disclosed that PayPal, which accounts for a third of eBay's revenue, is going after large merchants. "PayPal's total market is all e-commerce and it's just beginning," said Donahoe. "PayPal and Bill Me Later just go together. We have been talking for two years now. Bill Me Later brings a strong complementary merchant base, delivers a compelling consumer proposition and gives us leverage to lower transaction expenses."

On the conference call, Donahoe was asked why eBay went after Bill Me Later now rather than later when valuations for privately held companies was falling. Donahoe noted that the time was right, but another thread could be that the Bill Me Later acquisition was defensive as well as offensive. To wit: Amazon late last year disclosed that it invested in Bill Me Later. Bill Me Later was going to be acquired by someone and eBay just couldn't afford to allow Amazon to swoop it in. If Amazon took out Bill Me Later, eBay would have to compete with Jeff Bezos & Co. on all fronts. Amazon's third party merchant network and fixed pricing structure is giving eBay fits as it is. While Amazon didn't appear to be a bidder for Bill Me Later today it didn't take a psychic to figure out that the e-commerce giant would have been later.

Also see: eBay has Amazon envy: Cuts fees to get more fixed pricing

EBay said separately that Bill Me Later will generate $150 million in revenue in 2009, but dilute earnings 3 cents a share to 5 cents a share in the fourth quarter. In 2009, the Bill Me Later acquisition will cut eBay's earnings between 6 cents a share to 13 cents a share. Bill Me Later will add earnings in 2011.

However, eBay is looking to future growth with the Bill Me Later purchase.

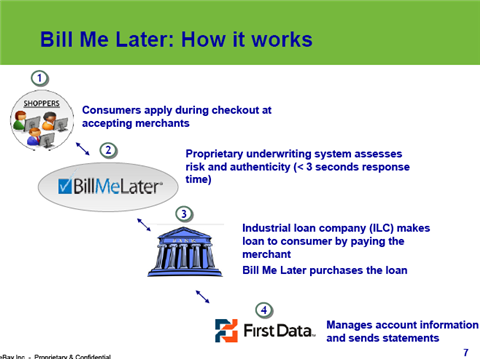

EBay also noted in a presentation that Bill Me Later's credit model was performing well in a downturn. That's no small issue given the current credit crunch and the fact that Bill Me Later's model depends on assessing consumers' ability to pay the company back. Bill Me Later CEO Gary Marino added that the company does not issue credit lines. It makes its loan decisions case by case and aims to collect interest on reasonable terms--also known as the tried and true banking model.

I'd argue that it's still early in the credit crunch to proclaim Bill Me Later's model as superior. Time will tell.

EBay also confirmed that its third quarter revenue will hit the low end of its outlook due to a stronger dollar and weak economic environment. But the company said it would top its earnings targets. Wall Street is expecting the company to report earnings of 32 cents a share on revenue of $2.16 billion. Excluding options expenses, eBay is expected to report earnings of 41 cents a share, according to Thomson Reuters.

As for the $390 million purchase of dba.dk and vehicles site bilbasen.dk it's more international expansion for eBay.

Why the shuffling at eBay? The online auctioneer is being squeezed by rivals like Amazon and taking a hit from a slowing economy. Another theme: It's unclear whether consumers want to screw around with auctions long term.

As a result, eBay's traditional growth is slipping. The company said it is cutting 10 percent of its workforce along with temp workers and open positions. eBay said it will take charges of $70 million to $80 million in the fourth quarter.