Enterprise apps: The state of the big players

The enterprise application landscape is shifting, but Microsoft and Adobe appear to have momentum as the entrenched players stay strong, but technology buyers are looking to date around and pick new winners.

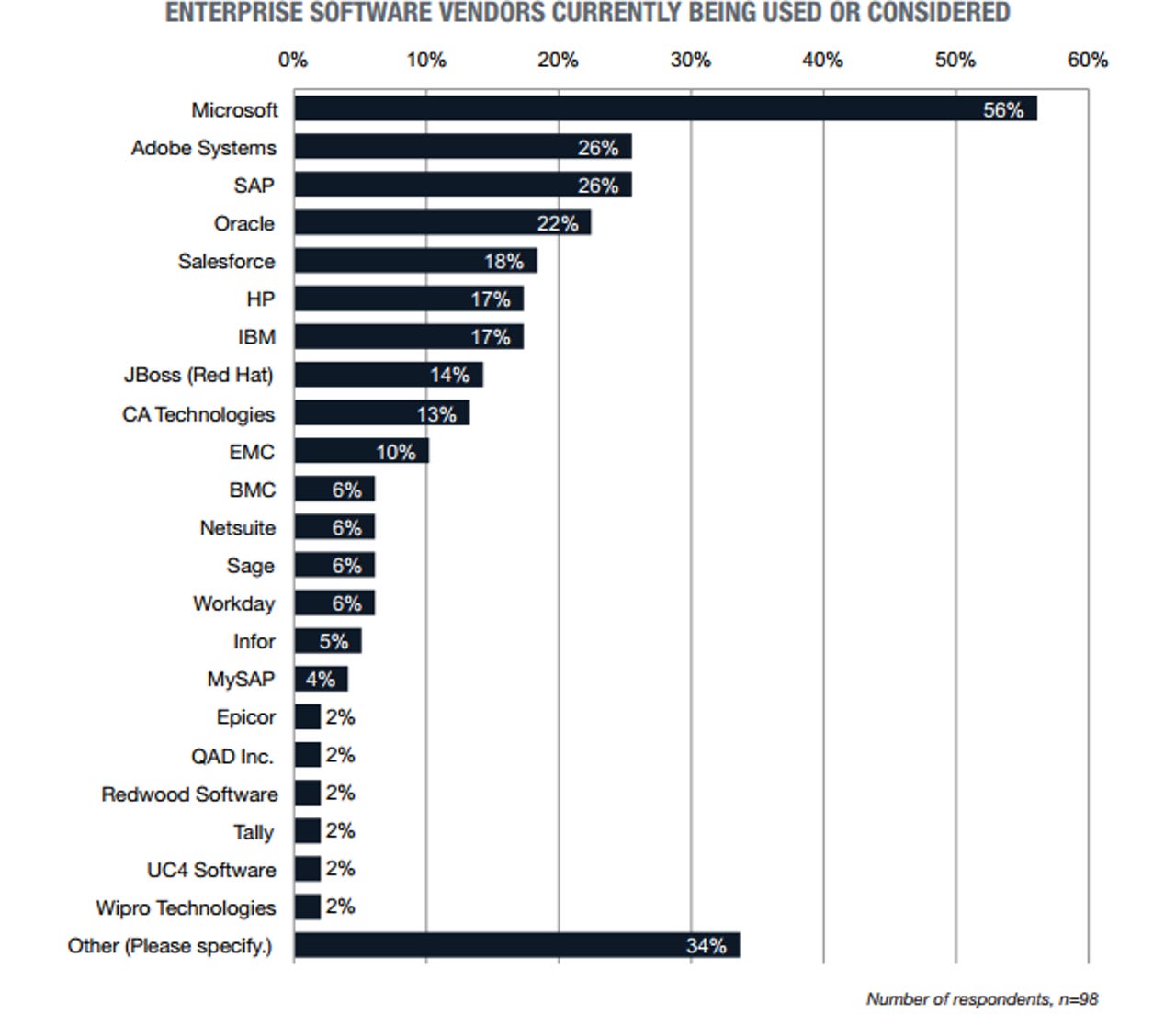

Here's a quick look at the prime enterprise software vendors surfaced in our TechPro Research survey.

Now let's take a deeper dive;

Microsoft takes a lot of hits for Windows 8 and its mobile strategy, but the company's enterprise division is humming. In fact, Microsoft may be one of the better positioned enterprise software vendors in the stack. The company has moved to the cloud in good measure, has a strong installed base and is showing double-digit growth for Windows Server, Lync, SharePoint and Exchange. Commercial "other" revenue---largely comprised of cloud offering such as Office 365 and Microsoft Azure---was up 31 percent in the most recent quarter to $1.9 billion.

Adobe is another company that is well positioned. Why? Adobe has the most complete marketing cloud stack in a field filled with much larger rivals. Adobe has been continuously ahead of the curve and acquired key parts of its marketing cloud well before giants like Oracle started gobbling up players. Adobe has also managed to transition to the cloud model and away from licensing better than most. In many respects, Adobe's transition to the cloud showed other enterprise software vendors they could too. More: Is Adobe a marketing player now? | Adobe bolsters Marketing Cloud, launches core services, iBeacon support

SAP is moving aggressively to a cloud computing and subscription model and touting its HANA in-memory database as an analytic foundation of everything it does. The company acquired SuccessFactors and Ariba to become a cloud player and has programs to transition customers from on-premise software to services. SAP is also focusing more on user interface in what amounts to a welcome change. However, SAP's largest challenge is shedding a reputation as a monolithic player that's losing deals to the likes of Workday and Salesforce. Overall, SAP has a lot to work with, but the technology direction may be in flux since Vishal Sikka, the company's tech and development head, recently left. More: SAP's Sikka steps down, company reshuffles executive board

Oracle and SAP have similar challenges. Oracle has also gotten cloud religion and has followed an aggressive acquisition plan to create a comprehensive marketing cloud and human capital management offerings. Oracle also has its Fusion applications and is enamored with selling hardware and integrated systems. The goal for Oracle is to offer the best stack, convince customers to standardize on it and then collect maintenance fees. Will cloud-first customers go with Oracle though? Workday, SAP and Salesforce remain formidable threats to Oracle's business, but new product cycles for applications, cloud services and its entrenched database are on deck. As usual, Oracle remains very aggressive, equates to a selling machine and can't be counted out. More: Oracle's cloud blitz: Are there term limits on enterprise tech giants?

Salesforce is officially in the big leagues of enterprise software and its Salesforce1 platform is promising. The company gets mobile, gets trends and can take consumer technologies such as Amazon's Mayday button approach and turn them into business tools. The company is expected to deliver $5.3 billion in revenue for the fiscal year ending Jan. 30, 2015. Salesforce has developed and acquired a lot of moving cloud parts and appears to be focused on selling it aggressively to enterprises. One thing to watch is Salesforce's ability to innovate as it grows. More: Salesforce launches Service SOS, an enterprise version of Amazon's Mayday button

HP was a bit of a surprise turning up as one of the most used vendors in our survey. HP's software mostly runs in the background of data centers, but the company is increasingly embracing open source technologies such as OpenStack. HP is also embracing the cloud, but big data---notably its Vertica unit---may be driving future growth. More: HP, enterprise giants fill up OpenStack bandwagon

IBM has a vast software as a service lineup and is moving its applications to its SoftLayer infrastructure as a service play for easier consumption. Big Blue is also a dominant middleware player and has a big business intelligence and analytics installed base via its Cognos applications. IBM's software unit in the first quarter reported revenue growth of 2 percent to $5.7 billion. Middleware represented $3.7 billion of that total software sales sum. Our survey highlight's IBM's big software challenge---JBoss, an open source middleware stack owned by Red Hat---was right behind Big Blue in our stack. More: IBM 'as a service' cloud pieces fall into place

As for the challengers, NetSuite, Workday and Infor were all in the same cluster of enterprise application favorites. Not surprisingly, all of them are gunning for Oracle and SAP. Infor is notable because it can attack SAP and Oracle in the cloud and on premises. One other key indicator of the software landscape is that "other" happens to be a popular enterprise application choice and would be the No. 2 vendor. Tech Pro Research noted:

There were more than 20 distinct vendors cited under "Other" — including companies like Citrix, SugarCRM, and Intuit's Quickbooks, as well as a number of responses such as proprietary software, internally developed, and self-employed person.

ZDNet's Monday Morning Opener is our opening salvo for the week in tech. As a global site, this editorial publishes on Monday at 8am AEST in Sydney, Australia, which is 6pm Eastern Time on Sunday in the US. It is written by a member of ZDNet's global editorial board, which is comprised of our lead editors across Asia, Australia, Europe, and the US.

Previously on Monday Morning Opener

- Windows XP: Microsoft can't wash its hands of the security problem so easily

- Core Infrastructure Initiative just first step in open source funding

- Microservers and the hurry-up-and-wait conundrum

- Heartboned: Why Google needs to reclaim Android updates

- Mapping out the next half a century of computing

- The end of Windows XP is also the end of everything we thought we knew about computing

- Microsoft's Build powwow: Our wish list

- The Internet tsunami: 8 big insights on what it disrupts next

- Tablets: Not mobile enough or productive enough for many professionals

- Wanted: A Flipboard approach for the enterprise

- Smartphone innovation is dead: Here are four ways to breathe life into it again