Google and Salesforce.com: still not a done deal

In all the excitement around the Google and Salesforce.com tie up, an email turned up from Sridhar Vembu, Zoho's CEO. He claims that Salesforce.com is operating a 1990's business model and that the partnership will end in tears.

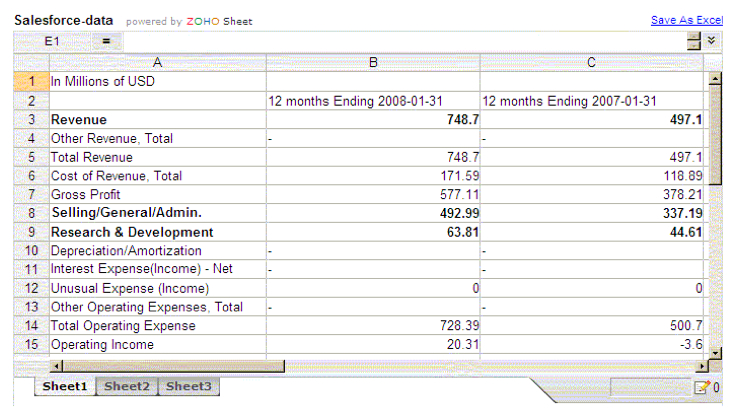

Why should this matter? Salesforce.com has clearly put a lot of effort into integrating Google, is providing assurance and has done a commendable job of making it easy for Salesforce.com users to pick up on Google Apps. Vembu argues that Salesforce.com's business model reeks of 1990's bloat. Check the ratio of R&D to sales and you get the picture:

For every dollar of fee, 66 cents is spent on selling, general and administration. Salesforce.com is operating a push model where Google operates a (largely) pull model.

This is a discussion the Irregulars have had over many months. While we generally applaud what Salesforce.com has achieved, their future strategy to make it into the large enterprises is dependent on an entrenchd and cost heavy model. Many of my colleagues see little alternative, despite what Phil Wainewright thinks about the pervasive nature of application adoption. During the live webcast, Dave Girouard, general manager of Google Enterprise acknowledged that getting Fortune 1000 companies to go Google's way follows a pattern with which those of us in enterprise land are very familiar: "They go slower."

That won't preclude smaller companies from taking the Salesforce.com and Google bait but that brings them in direct competition with the Zoho's of this world. "We're not going away any time soon, and we're not in the mood to be acquired" says Raju Vegesna, a Zoho evangelist. Others are circling as well. As one of many emerging examples, InfoStreet's StreetSmart, a suite of Web-based applications that includes portal access, file sharing, shared calendaring, scheduling, tasks, email and CRM is reporting success at Concierge Colorado and Hospital Concierge of America. InfoStreet is pricing at $10/user/month, way under Salesforce.com.

It worries me more that Eric Schmidt, Google's CEO seems to think the two companies have a real shot at defining the next iteraton of applications computing. As reported by Dan Farber:

"We now what it takes to build this next generation of services," he said. "You need a company with values," he said, citing the social responsibility leadership of salesforce.com. Importantly, he said, salesforce.com figured out the model for making money selling services from the cloud. "That model is the defining model of new computing cloud age," he said, and it is "a 20 or 30 or 40 year vision."

"Although the two companies are working in the same space in different ways, the models are getting closer and closer. The clouds are beginning to merge," Schmidt said. Google has even changed its tag line to reflect its investment in applications, from search and ads to search, ads and apps.

Are they? In contrasting Salesforce.com's approach to that of Google. Vembu reminded me that in 2006, Benioff halted a Zoho/Salesforce.com integration because of the competitive position that Zoho CRM occupies:

Google is our principal competitor, yet neither their team nor ours had any issue at all integrating - it was obvious to us this is the right thing to do for customers. The Google Gears folks bent over backwards to make sure the playing field was level, and we got access to information and support to do the integration right. That is openness.

In other words, it's not in Salesforce.com's DNA to partner unless there is zero competitive threat (which sounds horribly familiar) whereas Google has a much more open stance. Can two companies with such different approaches genuinely make it together? I'm not convinved.

All of which leads me to conclude that today's announcement is largely a market building exercise based upon the noise the two companies can generate with plenty of speculation left to argue whether Salesforce.com survives as an independent operation.

For what this really means at the enterprise level however, Forrester's Rob Koplowitz provides the sharpest analysis I've seen so far:

...there are folks gunning for this emerging opportunity. Microsoft, Oracle and SAP all have on-line CRM offerings. IBM and Microsoft are moving into on-line collaboration. These are not necessarily folks you want coming after you. The disruption that can and will be caused by cloud computing is a potential source of risk and opportunity for every major player in the industry...

...It looks like a sea change is coming and Salesforce.com is sitting smack in the middle of it. The big players are moving quickly and aggressively which could ultimately spoil the best laid plans and aspirations of Salesforce.com. They like to squeeze little guys with good technology and markets. The problem here is that an acquisition of Saleforce.com by any of the major players represents a huge threat to all of the other players. So, squeezing could end up driving them and their assets into the hands of the enemy.

As I've said before, the world and his dog may look at this announcement with starry eyes, foretell the death of Microsoft and others as they whiff what they think is blood on the enterprise floor. They're mistaken if they think it will be that easy, painless or happen any time soon. There are way too many ifs and buts to declare this game over, despite the obvious validation for cloud computing.