Google's acquisition strategy should think small (and mobile)

When it comes to Google's acquisition strategy the search giant may be better off playing small ball.

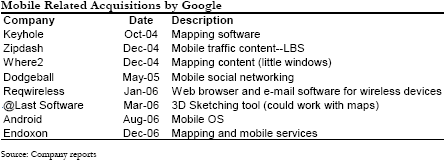

Sure Google's purchase of dMarc and YouTube are significant deals that get a lot of attention--lately as potential busts in the making. But how about Google's smaller deals like the acquisitions of Keyhole, Zipdash, Reqwireless and Android? And let's not forget the 2004 purchase of Picasa and the 2005 acquisition of Urchin Software (Google Analytics).

Perusing this list of Google's acquisition history (note it may not be complete) reveals a lot of purchases that wound up in Google's products. Without Keyhole and Where2, both purchased in 2004, you wouldn't have Google Earth or Google Maps. Meanwhile, most of these deals had financial terms that were undisclosed. Translation: They were so inexpensive that it wasn't material.

It's easy to focus on the dMarc struggles, the YouTube lawsuit and offline ventures, but to see where Google is really heading you may want to focus on the smaller deals. And Google's acquisitions are pointing to the mobile market.

This point was driven home in a Thomas Weisel research note penned by analyst Christa Quarles. Her note focused on Google's mobile search opportunity, but one of her graphics (below) caught my eye.

Aside from Keynote do any of those deals ring a bell? Probably not since most observers have been yapping incessantly about YouTube. Add those acquisitions up though and you get a picture of Google's mobile plans.

In the long run, the chances are pretty good that those companies mentioned above will deliver bigger returns.

And that brings us to Quarles' main point: Google's best opportunity is in the mobile market. Her argument boils down to this: Google's text ads are well suited to the mobile market; the market is still in flux; and Google's Web users are likely to use the company's software on the road. Yahoo is shaping up to be a major competitor, but if Quarles is right mobile market share may mirror search market share.

Quarles argues that Google would be better suited by focusing on the mobile search and information market while just partnering on offline (radio and TV) ad sales. For instance, it may be more profitable to own more of the mobile advertising space, which is supposed to be a $13.9 billion market by 2011 according to eMarketer, than be an agent in the massive TV advertising market.

"We believe mobile internet advertising should develop faster than PC internet ads, however, precisely because we already have a precedent and the expansion should be much more global in nature. In addition, should Google achieve similar dominance in mobile that it has achieved in PC-based online advertising (we estimate 45% of every online ad dollar will go through Google’s system in 2008), the contribution to revenues could be meaningful. Getting even 10% of the mobile advertising market in 2011 would make mobile a larger contributor (on a net revenue basis) than Google’s entire affiliate business today."

In addition, Google Maps has given the company a nice entry into the mobile and local markets (thank the Where2 acquisition).

Quarles notes that Google won't have it easy in the mobile space. After all, Yahoo has focused on making mobile search easier (see gallery).

"We do believe that Yahoo! Go Mobile has done a terrific job of bundling its local content offerings in an easy to use package (complete with widgets and other neat features). It is our estimation that Yahoo! believes consumers have not yet set their mobile preference, giving the company a chance to regain market share of search on the mobile device. We believe that “tried and true” Google PC searchers are likely to become Google mobile searchers, however, although there is always room for market share shifts on the edges."

Quarles also touches on the Google Phone rumors. She doubts that Google will get into the handset market, but may become a mobile virtual network operator or offer a Google ad-subsidized phone plan. The economics are difficult unless Google charges, but it could work. Another option: Google could use WiMax to bypass wireless carriers.

"We could envision a world in which Google is able to bypass the carriers altogether to create an ad supported mobile network where its content (i.e., local search, maps, etc.) serves as the “portal” for consumers to move on to the mobile web. We believe Google’s Wi-Fi partnership with Earthlink was a test to help the company better understand a move in this direction."

How will we know if Quarles' theory about Google's mobile intentions is on target? Follow the acquisitions--preferably the small ones. More acquisitions like the August 2006 purchase of mobile OS maker Android may give a glimpse of the future.