Innovation

Google's fourth quarter misses mark

In what was supposed to be a strong quarter, Google's fourth quarter results missed the mark. But the quarter also included multiple moving parts such as real estate purchases.

Google's fourth quarter fell short of expectations across the board in what was expected to be strong results due to holiday ad sales. However, Google had multiple moving parts.

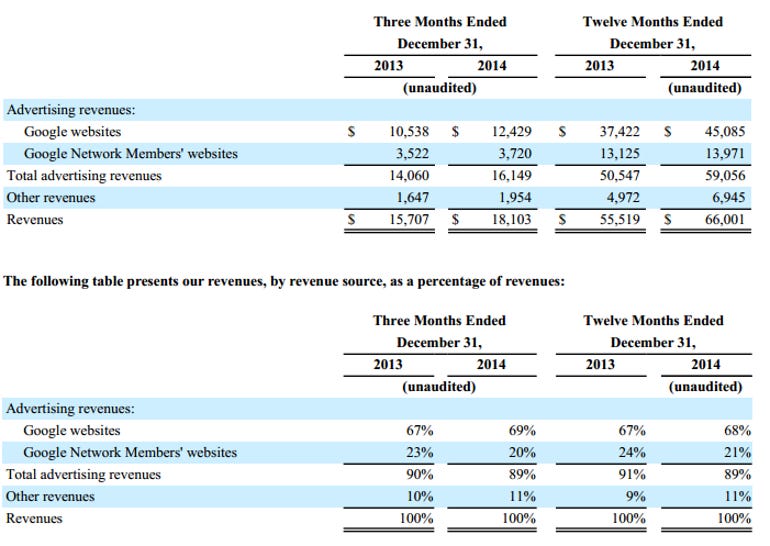

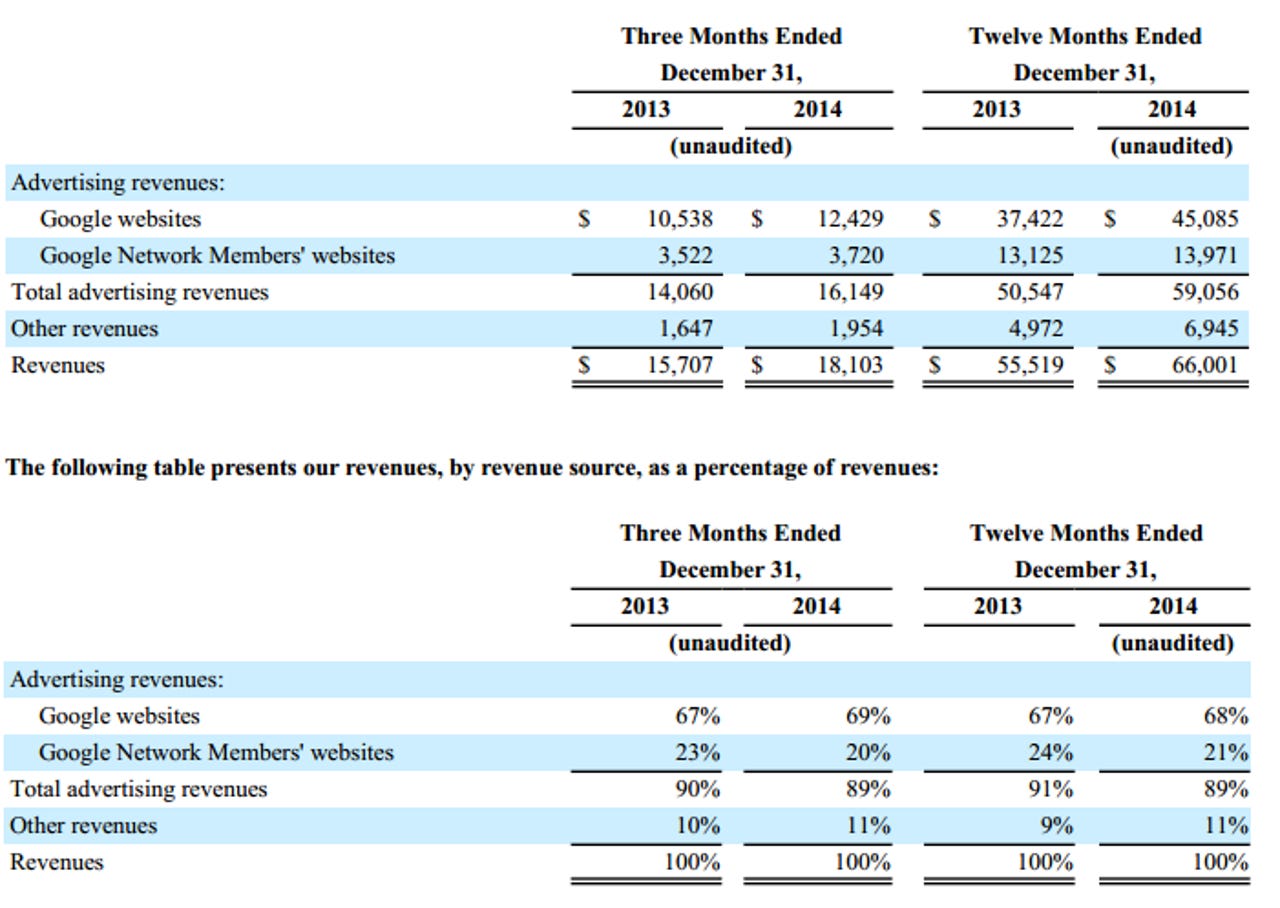

The company reported fourth quarter earnings of $4.76 billion, or $6.91 a share ($6.88 non-GAAP), on revenue of $18.1 billion. Excluding traffic acquisition costs, Google's revenue was $14.5 billion.

Wall Street was expecting Google to report non-GAAP earnings of $7.08 a share on revenue of $14.61 billion.

Analysts were expecting a strong quarter.

For 2014, Google reported earnings of $14.44 billion, or $21.27 a share, on revenue of $66 billion including traffic acquisition costs. Sales were up 19 percent from a year ago.

Also: Google nears saturation point: Will incremental marketing dollars go elsewhere?

Key figures to note include:

- Google spent $9.83 billion on R&D in 2014, up from $7.14 billion in 2013.

- Google's sites revenue was 69 percent of the total. Network revenue was 20 percent of sales.

- Revenue from outside the U.S. were 56 percent of total sales.

- The company said it took a revenue hit of $541 million in the fourth quarter due to a strong dollar.

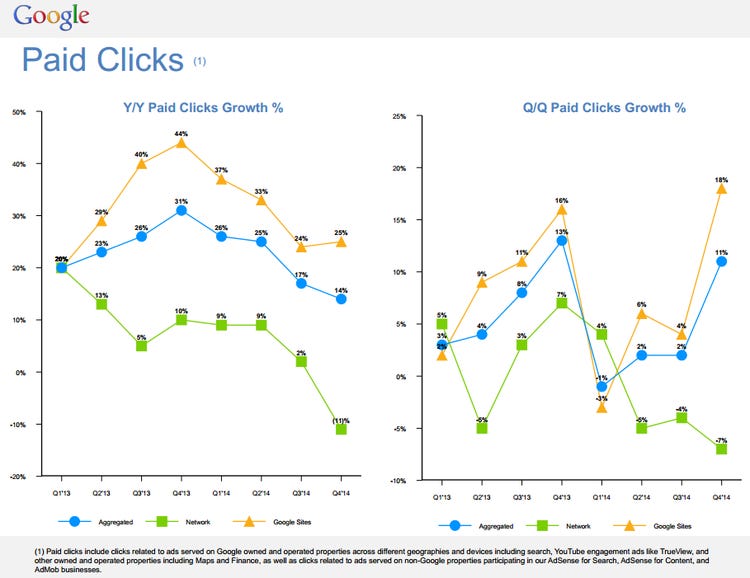

- Average cost per click fell 3 percent in the fourth quarter compared to a year ago. Cost per click on Google sites fell 8 percent in the fourth quarter compared to a year ago.

- Costs related to data centers, content, hardware and revenue share with mobile partners was 18 percent of revenue in the fourth quarter, down from 19 percent a year ago.

- Google employed 53,600 at the end of the quarter.

- Cash and equivalents was $64.4 billion as of Dec. 31.

Google CFO Patrick Pichette said the fourth quarter included some "noisy" data. The moving parts included a strong U.S. dollar in addition to the following:

- "The Nexus 6 was very well received as the new phone we had real issues and unable to secure sufficient inventory to meet the demand we had forecasted," said Pichette. That shortage hurt other revenue.

- The company bought real estate in the fourth quarter. "CapEx for the quarter was $3.6 billion. And this quarter most of the CapEx was spent on related to facilities, production equipment, and data center construction in that order," said Pichette. "We have been opportunistic about acquiring space in real estate where we need to really pressure and accommodate for future growth. To that end our facilities expenditure included just over $900 million of real estate investments during the quarter, of which $585 million was relate R&D to the acquisition of our property in Redwood City that we disclosed."

- Google had ongoing "cleanup efforts" with its AdSense business.

- Google took a writedown on select real estate assets as well as compensation charges.