Google's quarter falls short of expectations; Social networking not monetizing well

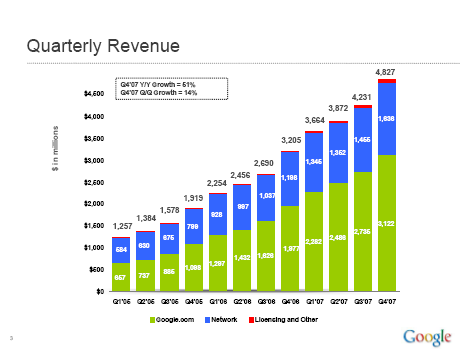

Google on Thursday reported fourth quarter net income of $1.21 billion, or $3.79 a share, on revenue of $4.83 billion, up 51 percent from a year ago. Excluding charges Google reported earnings of $4.43 a share. All of those figures missed Wall Street estimates.

According to Thomson Financial, Google was expected to report a fourth quarter profit of $4.44 a share on revenue of $3.45 billion. That revenue estimate excludes traffic acquisition costs. Excluding TAC Google had revenue of $3.39 billion, which was also shy of estimates.

Google shares were last trading at $512 in after hours trading. On a conference call with analysts CEO Eric Schmidt said he was pleased with the quarter and optimistic about 2008. Overall, Google said it wasn't seeing any major economic problems. Officials argued that a downturn would push customers to advertising techniques with good ROI (think text ads).

There were a few product nuggets on the conference call.

- CFO George Reyes said social networking advertising is not monetizing as expected. When questioned further Sergey Brin, president of technology, said: "We don't talk about individual partners or anything like that." Brin noted some things were tried that didn't pan out. While Brin won't talk about partners it's fairly obvious that MySpace is an issue. Google is obligated to pay at least $900 million in minimum revenue guarantees to MySpace through 2010. Later, the question was revisited again. He noted that Google also has Orkut and other social networking partners. "We have an incredible amount of this inventory," said Brin. "I don't think we have the killer best way to monetize social networks yet. We have had a lot of experiments (and some disappointments)."

- Google is tracking iPhone usage closely. The company said that usage of Google services on iPhone have doubled a month after the search giant launched optimized apps for the Apple's phone.

- Google can't answer any questions about the 700 Mhz wireless auction by the FCC. Google couldn't talk about WiMax either.

- Brin said new infrastructure was launched for Gmail. "This new infrastructure has made development easier and improved performance," said Brin.

- Brin added that YouTube has had strong growth and touted the political debate partnership with CNN.

- Google also signed a Google Apps deal with Genentech and Brin said the company is making headway with enterprise customers. Most of growth in licensing was due to the acquisition of Postini.

Among the notable figures (revenue figures include TAC) from Google's earnings report:

- Google ended the fourth quarter with 16,805 employees, up from 15,916 at the end of the third quarter. Reyes said the new hires in the quarter were mostly engineers and sales and marketing.

- Operating income for the fourth quarter was $1.44 billion.

- Google sites revenue was $3.12 billion in the fourth quarter, or 65 percent of total revenue. Google's partner sites through AdSense generated revenue of $1.64 billion.

- International revenue was $2.32 billion, or 48 percent of revenue during the fourth quarter. In the same quarter a year ago Google international revenue was 44 percent of total revenue. The weak dollar padded Google's international revenue. Schmidt talked up international opportunities. He noted that Google has a global team to execute a "global-local" strategy.

- TAC is increasing. TAC was 30 percent of revenue in the fourth quarter, up from 29 percent in the third quarter.

- Expenses were held in check (for Google). Google said "other cost of revenues," or data center expenses, credit card charges and content acquisition costs came in at $516 million, or 11 percent of revenue in the fourth quarter. That's up from 10 percent of revenue in the third quarter. Operating expense in the fourth quarter remained at 30 percent of revenue, on par with the third quarter.

- Google had $14.2 billion in cash and equivalents at the end of 2007.

- For 2007, Google reported revenue of $16.6 billion and net income of $4.2 billion, or $13.29 a share. In 2006, Google reported revenue of $10.6 billion with net income of $3.07 billion, or $9.94 a share.

- R&D spending for 2007 was $2.2 billion, up from $1.3 billion in 2006.