How low can Telstra go?

The recurring argument over the debate of the proposed split of Telstra into two divisions is whether it'll be bad news for shareholders. Anyone with Telstra shares is already accustomed to losing money, of course. Trading over the $5 mark five years ago, the company is now struggling to stay above $3. The uncertainty of the company's future is hardly helping, but it's unlikely that a split of Telstra into a wholesale and a retail division will have much impact on shareholder value.

Telstra's share price has, for a long time, been influenced by one single factor. It's a former monopoly, still commanding 90 per cent of the industry profit. Deregulation was always going to mean a reduced market share for Telstra, thanks to competition and the inevitable focus from the industry regulator. Anyone who bought shares expecting a rosy future went in with their eyes closed.

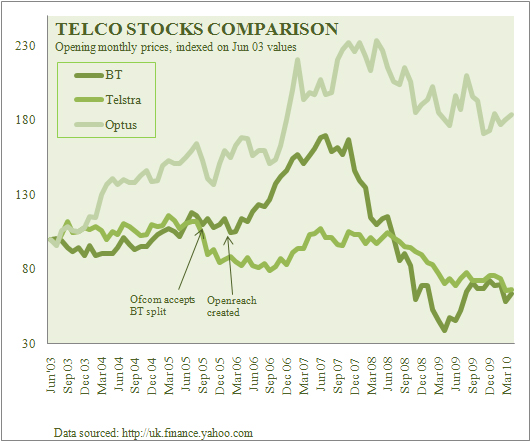

BT, the UK's incumbent telco, has seen shares fall 35 per cent over the last seven years, about the same as Telstra over that period. The difference is, over that time, BT has had separation foisted on it. So would Telstra have fallen even further if it had been split in two as well? I doubt it. While the competitive climate is bad news for incumbents, forced to operate efficiently, it's good news for challengers. Optus has climbed 84 per cent since June 2003.

Telco stocks(Credit: Phil Dobbie/finance.yahoo.com)

The party line from BT has always been that the split was good news for the company because it enabled them to provide wholesale services to a broader range of customers. In the 18 months that followed the creation of their functionally separated Openreach wholesale division the share price rose more than 50 per cent, admittedly in a very bullish market. What followed though, was a catastrophic fall from a high of 332 pence down to 77 pence in less than two years.

To me the long-term trend is the key. Irrespective of what the regulator chucks at it, an incumbent telco is an incumbent telco. I suggest any future outcomes, in whatever form they come, are already factored in to the selling price. Expect bad news and you're never disappointed. So the damage is already done and a continued downward slide in Telstra shares is highly unlikely.

Unless...

There is one caveat. While the threat is to split Telstra in two, the endgame for the government is for the telco to sell its networks assets to the NBN Co, which is charged with building the new National Broadband Network. If Telstra gets a good price, that's great news for shareholders. If it holds out and the deal falls through, the government might push ahead regardless. That means Telstra has a massive wholesale competitor, across the country. That could hit shares hard, but it's the sort of ruthless tactic that could also bring down a government. Rudd backed down on climate change, is he really willing to fight any harder on this one?