HP's Hurd: 'Business is stabilizing'; Units (except for services) still take revenue hit

Updated: Hewlett-Packard CEO Mark Hurd said Tuesday that "business is stabilizing" and the company will be an early beneficiary of an economic turnaround. The company also raised its fourth quarter earnings target.

As expected, HP's quarter was a mixed bag (statement, preview). The company delivered better than expected non-GAAP results, but some units suffered major revenue hits.

On a conference call, Hurd noted that "business is stabilizing." Hurd added that he was pleased with the company's "execution in a tough market." He said HP was strong in China and has seen an economic rebound there, but hasn't seen the same bounce in the U.S. Hurd wasn't about to call a bottom and seemed to indicate that the current level of demand would continue for the rest of the year.

HP reported a non-GAAP third quarter earnings of 91 cents a share on revenue of $27.5 billion, down 2 percent from a year ago. Wall Street was expecting earnings of 90 cents a share on revenue of $27.2 billion. Net income was 67 cents a share, down from 80 cents a share a year ago.

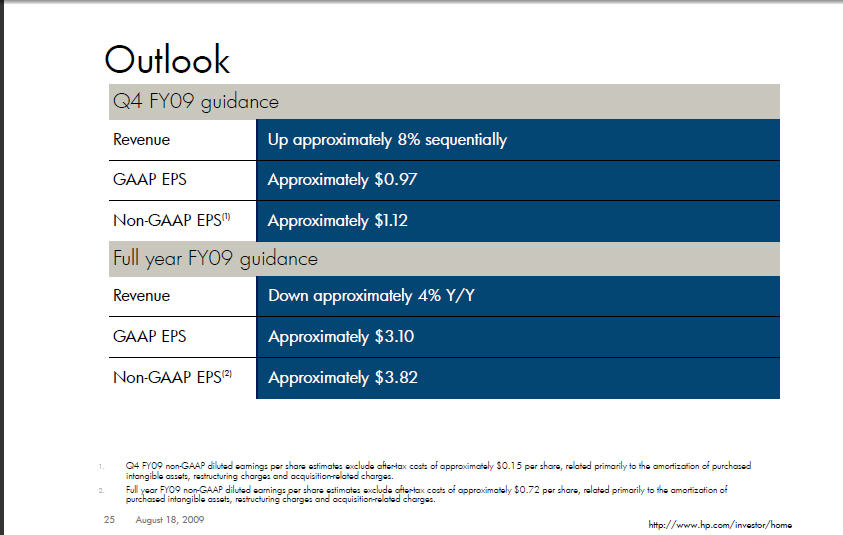

As for the outlook, HP projected fourth quarter revenue up 8 percent from the third quarter. Non-GAAP earnings are expected to be $1.12 a share. Wall Street was expecting $1.07 a share on revenue of $29.8 billion. For fiscal 2009, HP's guidance was in line with expectations.

HP has managed the downturn well via cost cutting, but some analysts have questioned whether the company can become a growth story again.

The company's quarter didn't provide any definitive answers even though Hurd noted that the HP will "will continue to outperform when conditions improve." Hurd's comments about demand echoed those from other tech companies.

HP's flagship business these days is its services unit, which has been bulked up via the acquisition of EDS. HP's third quarter services revenue was $8.5 billion, up 93 percent from a year ago. Operating profit was $1.3 billion, or 15.2 percent of revenue. HP said its EDS integration was tracking ahead of plan.

Hurd also indicated that HP can get more savings out of the EDS deal and moves that can position the services unit will for the future. Meanwhile, the company will focus more on winning deals going forward.

Other units had a much tougher quarter. Consider:

- HP's enterprise hardware business took a hit in the third quarter. Enterprise storage and server revenue fell 23 percent in the third quarter to $3.7 billion. Storage revenue fell 21 percent and industry standard sales dropped 21 percent. Blade revenue fell 14 percent. HP said its third quarter operating profit was $356 million, down from $544 million a year ago.

- The closely watched PC business saw revenue fall 18 percent to $8.4 billion. Notebook revenue fell 10 percent and desktop sales fell 26 percent. Commercial revenue fell 22 percent and consumer sales dropped 13 percent. Operating profit was $386 million, down from $587 million a year ago.

- HP's software business, which used to be a fast-growing unit, saw sales fall 22 percent to $847 million. Operating profit was $153 million, an improvement from $135 million a year ago.

- And finally HP's imaging and printing unit saw revenue fall 20 percent to $5.7 billion. Supplies revenue fell 13 percent and printer units fell 23 percent in the third quarter. The business remains a cash cow, however. HP said operating profit was $960 million, compared to $1 billion a year ago. Those earnings are impressive given revenue fell 20 percent.

Here's a look at my notes on the quarter (click to enlarge):