HP's second quarter on target; Big units take revenue lumps; Headcount cuts ahead

Updated: Hewlett-Packard's fiscal second quarter results were in line with estimates courtesy of cost cutting but the company's main divisions---printing, personal systems and storage and servers---all took heavy revenue hits. HP also noted that it will cut an additional 2 percent of its workforce over the next 12 months.

The company on Tuesday reported second quarter net income of $1.7 billion, or 70 cents a share, 17 percent from a year ago (statement). Revenue of $27.4 billion was down 3 percent from a year ago. On a non-GAAP basis, HP's earnings were 86 cents a share, on par with Wall Street estimates.

HP's outlook for the third quarter was also roughly on target with expectations. The company projected third quarter revenue to be flat or down 2 percent from the second quarter. Non-GAAP earnings were projected to be 88 cents a share to 90 cents a share, compared to estimates of 89 cents a share. Including charges, HP projected earnings of 64 cents a share to 68 cents a share for the quarter.

For the year, HP is projecting revenue to decline 4 to 5 percent from the prior year. Fiscal 2009 earnings will be $3.76 a share to $3.88 a share on a non-GAAP basis. Wall Street was expecting $3.71 a share. Fully loaded, HP is projecting fiscal 2009 earnings of $3.02 a share to $3.16 a share.

On a conference call with analysts, CEO Mark Hurd said HP executed well, managed inventory tightly and improved the EDS services pipeline. But he stopped short of calling a bottom in the economy. "I'm not ready to call (the market) better. It's sort of steady as she goes," said Hurd. "It's roughly going to be the same the remainder of the year."

In the meantime, Hurd will focus on costs. Hurd also touted "transformations" across all units to "change the expense profile" of the company. Indeed, Hurd said HP found an additional $500 million in savings just based on real estate related to the EDS deal. Those savings will kick in during 2012 to bring total savings from the EDS deal to $3 billion. "We like our chances when the rebound occurs," said Hurd.

He added that he was confident that HP would emerge from the current economic malaise to be stronger and talked up efforts like Matrix, which Hurd described as a cloud computing infrastructure in a box.

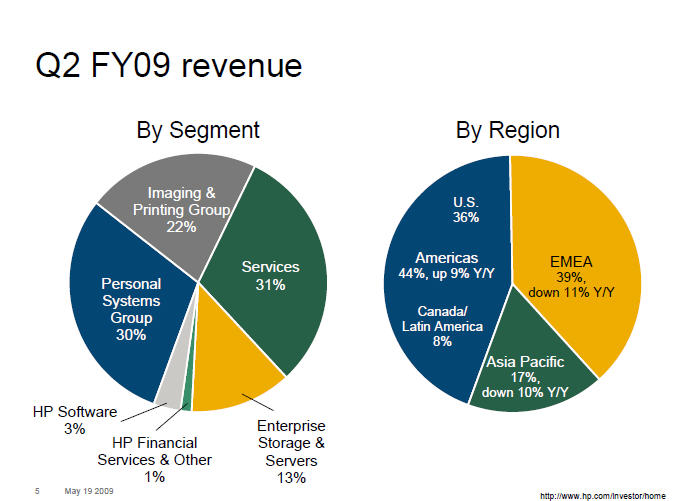

But the real story here is HP's business units, which continue to get whacked. Consider:

- Enterprise storage and server revenue was down 28 percent to $3.5 billion in the quarter. Operating income was $250 million, down from $655 million a year ago.

- Personal systems revenue fell 19 percent to $8.2 billion as notebook revenue fell 13 percent and desktop sales fell 24 percent. Operating profit was $374 million, down from $544 million a year ago.

- Imaging and printing revenue fell 23 percent to $5.9 billion as consumers cut back on supplies. Operating profit was $1.1 billion, down from $1.2 billion a year ago. Hurd said that HP will look to gain market share in the third quarter. He noted some stock outages with printing hardware.

- Software revenue was down 15 percent to $880 million. Operating profit was $157 million, an improvement compared to $104 million a year ago.

- Services revenue surged 99 percent to $8.5 billion, but that's because of the EDS purchase. Operating profit was $1.2 billion. HP said the EDS integration is "tracking ahead of plan."