IBM's Q4: Every core unit saw revenue declines

IBM reported mixed fourth quarter results that highlighted the company's challenges developing emerging businesses such as cloud and Watson fast enough to offset the slowdown in other units. Meanwhile, the company cut its 2015 outlook.

Big Blue reported fourth quarter earnings of $5.5 billion, or $5.54 a share, on revenue of $24.1 billion, down 12 percent for a year ago. IBM noted that the revenue decline was in part explained by divested businesses and currency fluctuations. Excluding those issues sales would have been down 2 percent from a year ago in the fourth quarter. Non-GAAP fourth quarter earnings for IBM were $5.81 a share. For 2014, IBM reported earnings of $15.8 billion, or $15.59 a share, on revenue of $92.8 billion.

Wall Street was expecting IBM to report fourth quarter earnings of $5.41 a share excluding charges on revenue of $24.77 billion.

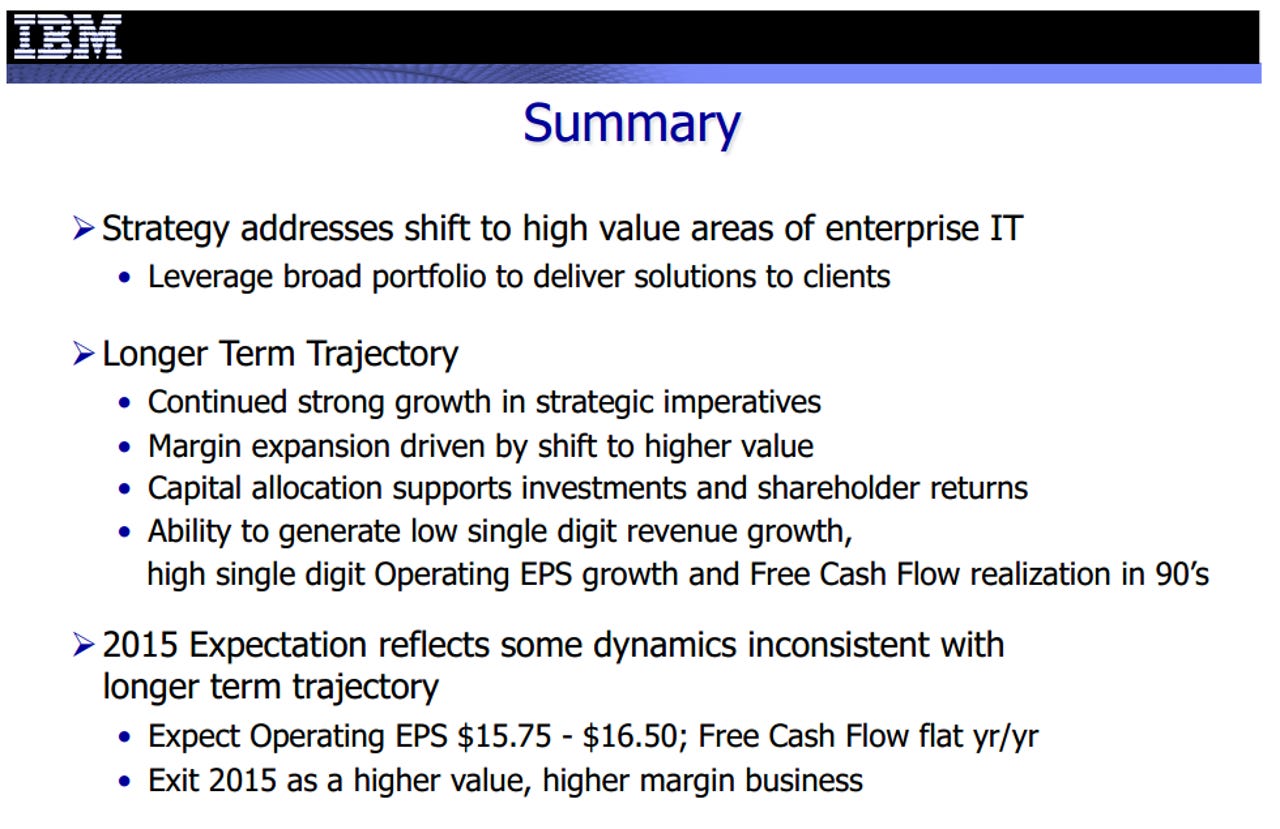

For 2015, IBM said that it expects operating earnings of $15.75 a share to $16.50 a share with flat free cash flow. The company said that "some dynamics are inconsistent with longer term trajectory." Analysts were expecting 2015 earnings of $16.53 excluding charges.

IBM's fourth quarter results put to bed a challenging 2014 that included the creation of the Watson business unit, the sale of its commodity server business to Lenovo, a partnership with Apple in the enterprise and the build out of its cloud services. IBM's results revolved around continuing operations.

Nevertheless, every IBM unit showed revenue declines in the fourth quarter.

Previously:Apple, IBM roll out first wave of mobile apps for business | Inside the Apple-IBM deal: How will it work, and what to expect | IBM, Apple forge enterprise app pact: Watson, meet iPad | Will Apple bring developers to IBM's Watson ecosystem?

For 2015, IBM's plan is to grow its business in areas like mobile, analytics, e-commerce, cloud services and cognitive computing. IBM's challenge is to grow those businesses fast enough to offset weak hardware sales and slow growing services. The company recently launched a new mainframe that should at least help hardware revenue.

On the bright side, IBM said that its cloud revenue for 2014 was up 60 percent to $7 billion with analytics up 7 percent to nearly $17 billion.

However, those strategic areas, which now account for 27 percent of IBM's sales, can't offset the company's core businesses and struggle in the emerging markets.

Consistent with previous quarters, IBM's hardware business was the biggest sore spot.

Other key points via CFO Martin Schroeter on IBM's conference call:

- In 2014, IBM spent 6 percent of revenue on R&D.

- Four of five largest China banking clients increased mainframe capacity in the fourth quarter.

- The Apple partnership is "off to a great start."

- He said IBM plans capital spending to increase of more than $500 million compared to a year ago, "as we continue to build out our cloud platform (and) invest in software."

Going into the results, analysts were primarily interested in the 2015 outlook and whether IBM could set reasonable expectations. Janney Capital Markets analyst Joseph Foresi said in a research note:

IBM is a large organization ("tanker"), meaning it may take awhile before a shift in its business shows in results. The company has been taking the right steps by shedding lower quality businesses and investing in growth.