IBM's earnings better than expected on software, services; Hardware revenue thumped

IBM on Monday reported net income of $2.3 billion, or $1.70 a share, on revenue of $21.7 billion, down 11 percent from a year ago largely due to currency fluctuations. The upshot: Cost cutting helped IBM hurdle Wall Street estimates despite lighter than expected revenue.

Wall Street was expecting first quarter earnings of $1.66 a share on revenue of $22.5 billion. More importantly, IBM delivered a solid 2009 outlook, reiterating its previous guidance. Big Blue said that it expects to report 2009 earnings of at least $9.20 a share. For 2009, IBM is projected to earn $9.03 a share on revenue of $97.4 billion, according to Thomson Reuters.

In a statement, IBM CEO Sam Palmisano said that the company's portfolio of software and services is helping the company weather the downturn relatively well.

On a conference call, IBM CFO Mark Loughridge credited the company's services and software portfolio for being able to weather a downturn. In fact, IBM did well in the quarter even though its hardware business was thumped (results). "All of our profit came from software, services and financing," said Loughridge, who added that IBM can alter its services based on what customers need to weather the downturn. He cited IBM’s recent business analytics launch as an example.

The big takeaway was that Loughridge said that he was more confident that IBM will hit its earnings target of at least $9.20 a share for 2009 than he was last quarter.

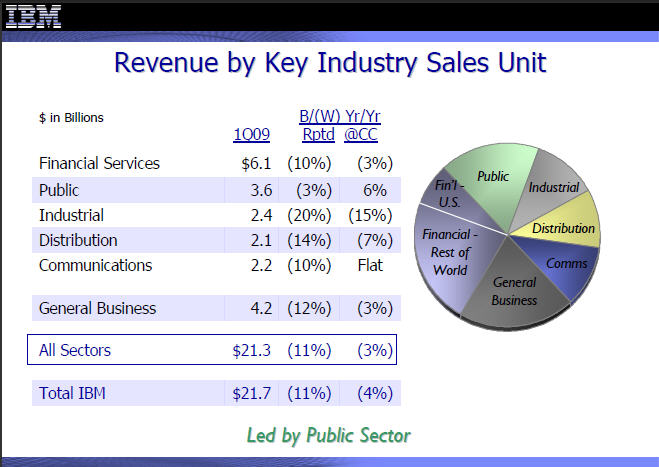

Meanwhile, IBM's government business fared well in the quarter, but little else did. Loughridge also added that IBM will continue to cut costs to better match revenue.

Union: IBM layoffs accelerating as employees vent

Under the hood was a mixed bag for IBM. Currency fluctuations hampered IBM's results, but the systems and technology unit (servers, storage and the like) was whacked. Even accounting for currency fluctuations IBM's systems unit fell 18 percent.

And digging deeper on IBM's problem area you'll find systems across the board from servers to storage to retail systems taking a hit.

Here's a look at how IBM's product lines fared:

By the numbers:

- Revenue in the Americas was $9.3 billion in the quarter, down 7 percent from a year ago. Europe revenue at $7.2 billion was down 18 percent and Asia Pacific revenue fell 6 percent to $4.8 billion.

- Software revenue was down 6 percent to $4.5 billion.

- Total global services revenue fell 10 percent to $8.8 billion. Technology and business services both fell by 10 percent in the quarter. IBM signed services contracts totaling $12.5 billion, flat with a year ago. Long-term deals were up 14 percent, but short-term contract signings fell 14 percent.

- Sales, general and administrative expenses fell 6 percent to $5.3 billion.

- And global financing revenue fell 9 percent in the first quarter. Also note that IBM is reserving more funds to account for potential losses for its financing deals.