'Insourcing' predicted to throttle Indian IT services revenues

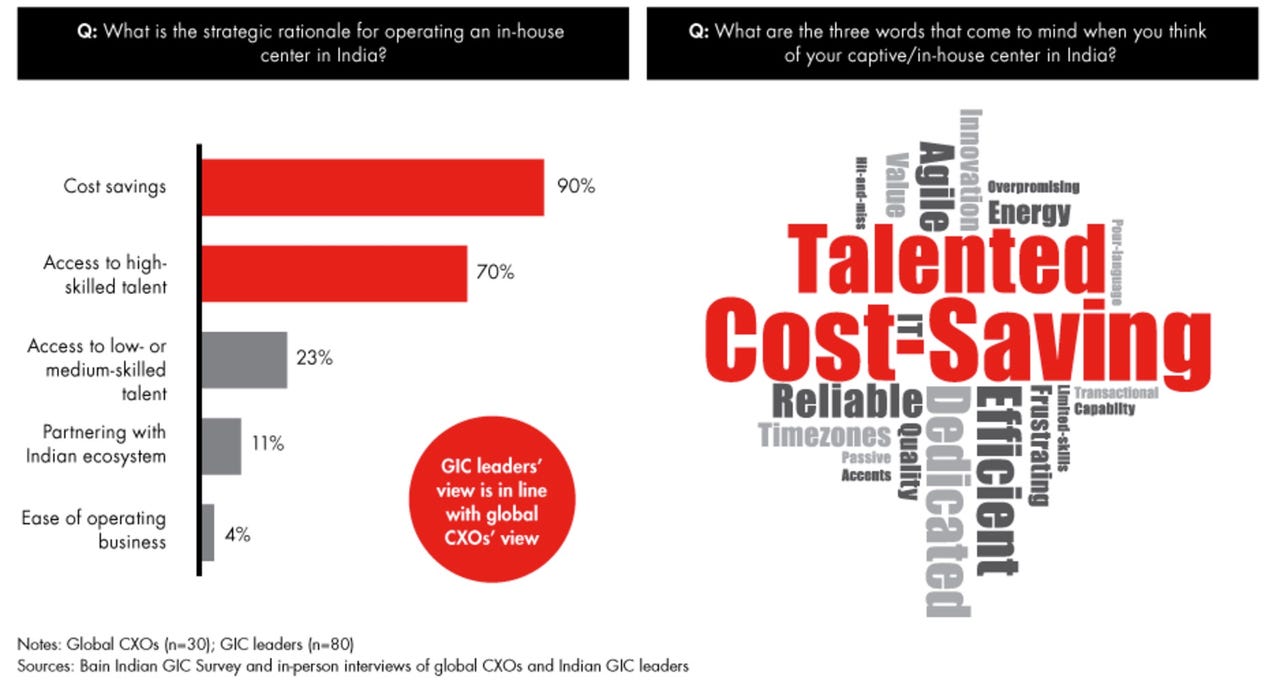

Cost savings and access to high-skilled talent have been the biggest reasons for rapid growth of Indian GICs. (Image: Bain)

Indian technology has come full circle.

In 1997, General Electric started its first captive in-house technology center in India with the aim of becoming the company's business process back-office servicing GE's far-flung global sprawl. This offspring, Genpact, was engineered to not only make the parent company more efficient, it would bring in substantial cost savings was the theory.

The model was so successful that it not only went onto spawn an entire industry called BPO (Business Process Outsourcing) filled with imitators, but Genpact would eventually cleave itself apart from GE to become a thriving, standalone company catering to corporates across the world.

BPO is still big business in India, but it was quickly eclipsed by the larger and sexier IT services boom that started in the early 2000s, which burnished India's reputation for outsourced work.

Ironically, today it is the BPO business that is booming once again, while the IT services business -- represented by global luminaries such as Infosys, TCS, and Wipro -- are getting pummeled by the cloud, which has severely commoditized bread-and-butter IT businesses such as infrastructure maintenance.

This resurgence called 'insourcing' is once again being spearheaded by global outsourcing clients looking to turn inward for their technology needs via Global In-house Centres (GICs). According to consulting outfit Bain, they already apparently number over 1,100 firms, employ 800,000 individuals, and collectively rake in $23 billion in revenue.

"The India IT industry is facing structural headwinds from having higher exposure to slower-growing legacy segments as spending shifts towards newer areas like Digital (social, mobile, analytics, cloud, security and IoT)," says a recent Nomura research report "Insourcing: Next big worry for India IT."

Revenues fromGICs growing at a 12.4-percent rate have easily outstripped the top four IT outfits growing at a 9.3-percent average over the last five years, and considering Indian ITs considerable challenges and the recent implosion of revenue growth amongst this cohort, this trend is only likely to increase.

One important reason for this development appears to be changing CXO priorities, according to Bain. IT is continuing to free itself from the shackles of on-site engineers. They are no longer the masters of a client company's technology domain and requirements. Today, technology needs to be agile, instantly responsive, and often democratic.

Read also: Ex-CEO Nilekani appointed chairman in desperate attempt to stabilize Infosys | Right to privacy fundamental but not absolute: Supreme Court of India | Google Consulting could be Indian IT's new, great threat in its own backyard

The need to be flexible means that erstwhile client companies prefer to have more control over work done and are better able to tack on new innovations and tech solutions that often emerge at lightning speed and need to get tested for their resiliency and efficacy. Outsourcers can sometimes delay this process.

Lower costs have been the bedrock of outsourcing, but Bain suggests that higher employee costs for a GIC will be possibly offset by mark-ups that outsourcing firms tend to charge for comparable work. Global CXOs in the Bain's survey say that they expect Indian GICs to substantially ramp up the scale and scope of work handled by them over time.

Nomura's report seems to agree with this conclusion, observing that 27 percent of US-based 'global 2000' companies already have a GIC in India, but in five years that number will touch 50 percent.

Hardly the best news for Indian IT struggling to get back into the game.

PREVIOUS AND RELATED COVERAGE

Infosys steps up US hiring as more top talent flees

These twin developments may just be a key trend to watch across the Indian IT services landscape in the coming years.

Why IoT could be the savior Indian IT desperately needs

The skills required for IoT implementation are those that Indian IT services companies have in abundance. But they need to be able to make bold moves and seize opportunities in the space, which may be difficult considering their track record.