Intel rides data center demand to strong Q3

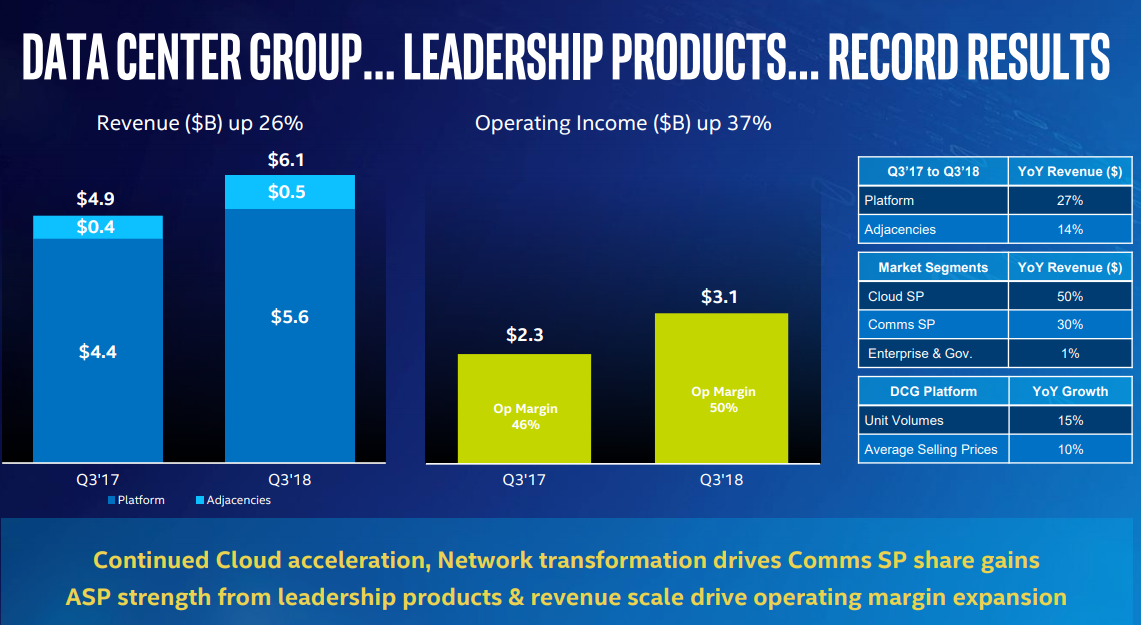

Intel's third quarter results were better-than-expected as its data center group delivered record revenue that was up 26 percent from a year ago.

The chip giant reported net income of $6.4 billion, or $1.38 a share, on revenue of $19.2 billion, up 19 percent from a year ago. Non-GAAP earnings were $1.40 a share.

Wall Street was expecting Intel to report third quarter non-GAAP earnings of $1.15 a share on revenue of $18.4 billion.

Intel's results come a day after AMD's third quarter revenue and outlook disappointed. In addition, Intel has been struggling with manufacturing issues and meeting demand.

Nevertheless, Intel's ability to provide infrastructure to cloud providers is carrying the team even as the company's PC processor division fared well.

Indeed, Intel's so-called data centric businesses revenue gains. For instance, Intel's memory business saw sales up 21 percent from a year ago. The Internet of things unit saw revenue grow 8 percent in the third quarter to $919 million.

CFO and interim CEO Bob Swan said the company remains focused. The company's plan is to cut operating expenses and funnel the funds in part into research and development. On a conference call, Swan said:

We are growing share in a larger TAM, driving operating leverage while increasing our R&D investments and delivering attractive capital returns. Our thesis is that the massive growth of data worldwide will increase demand for the analysis, storage and sharing of data.

On the PC processor front, Intel saw third quarter revenue of $10.2 billion, up 16 percent from a year ago. Notebook chip sales were up 13 percent from a year ago with desktop revenue up 9 percent.

For the fourth quarter, Intel projected revenue of about $19 billion with non-GAAP earnings of $1.22 a share. That outlook was better than what Wall Street was expecting. Swan said:

Our full year revenue outlook is now more than $6 billion higher than our January forecast, and we have supply to support this revised guidance, thanks to outstanding responsiveness from our factory teams. We are focused on doing everything possible not to constrain our customers' growth. We've increased our CapEx by $1.5 billion since January to a record $15.5 billion.

We've repositioned some 10-nanometer capacity to 14-nanometer, and we're making progress with our 10-nanometer process technology. Supply is tight as at that entry-level of the PC market and in our IoTG business. Within our CPU product lines, we're prioritizing the production of our Xeon and Core processors so that we and our customers can serve the high performance segment of the market. Our biggest challenge in Q4 will be meeting any additional PC and IoTG demand beyond our guidance, and we do expect fourth quarter upside from here will be limited.

Here's the outlook: