Is an IBM purchase of Red Hat inevitable?

Despite a bevy of questions---looming competition from Oracle, takeover rumors and a weak economy---Red Hat appears to be humming along, according to Jeffries analyst Katherine Egbert. But in the long run, Red Hat will have to be subsumed into a large company---most likely IBM.

In a research note, Egbert touches on the short-term and long-term prognosis for Red Hat. In the short run, she notes that there's solid demand for Red Hat Enterprise Linux and Jboss in a down economy. Meanwhile, sales to the government---Red Hat has just beefed up its sales force to sell to Washington D.C.---are expected to get a stimulus boost.

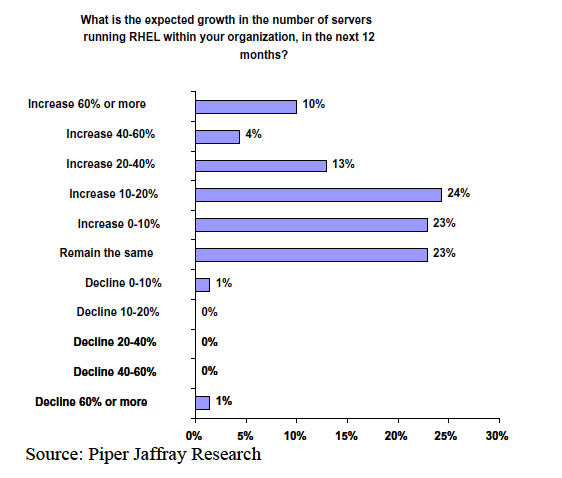

Egbert's take echoes research by Piper Jaffray analyst Mark Murphy. Murphy surveyed 70 Red Hat customers and generally found that the company is gaining wallet share.

Here's the money slide from Murphy:

Simply put, Red Hat is looking strong. Wall Street is expecting the company to report earnings of 14 cents a share on revenue of $171.7 when its fiscal first quarter closes at the end of May. But there are a few moving parts. The biggest one is Oracle's acquisition of Sun Microsystems. Will Oracle continue to support Red Hat products?

Egbert writes:

While Oracle's CEO has said publicly that he will continue the company's support of Red Hat Enterprise Linux (RHEL), there is a sense within Red Hat that an increased focus on Open Solaris over RHEL is inevitable, as Oracle seeks to protect the declining Solaris maintenance stream. We estimate that 1/3 of Red Hat's new business comes from Unix-to-Linux migrations, much of this from Solaris-to-Linux. The danger to Red Hat is that Oracle will offer customers attractive terms to stay on Solaris, potentially even paying them or offering discounts not to migrate.

If that scenario plays out Red Hat will increasingly be caught in the land of giants with Oracle on one end and Microsoft on the other.

That reality points to a Red Hat takeover at some point, argues Egbert. She adds:

We believe it's inevitable that Red Hat will be subsumed into a larger entity, probably IBM, given the strategic importance of RHEL with the data center. Here's our reasoning:

To date, much of Red Hat's success has come because the software is relatively inexpensive, Unix applications port easily to Linux, and because Red Hat is not Microsoft i.e. they are not a large, integrated vendor that can lure customers in with low pricing but exploit their pricing power once the customer becomes dependent on the software. Most customers view Red Hat Enterprise Linux as a way to break free of large vendor lock in and the high economic toll it extracts.

However, with Oracle buying Sun Red Hat now has 2 giant competitors, both of whom have virtually unlimited pricing power. We believe it will be increasingly difficult for Red Hat to compete over a sustained period as a small, standalone, independent vendor against the upcoming entry of Oracle, who could offer cheap hardware/software bundles, steep discounts to stay on or migrate to Open Solaris, or even pay customers to not use RHEL as they seek to stabilize the Solaris maintenance stream. Therefore, with Red Hat's choice-based value proposition potentially pre-empted by a data center land grab among 2 giants, it seems to us that Red Hat needs a partner. A large partner. Someone with pricing power, C-level relationships, and a significant enough presence in the data center to combat the Oracle/Microsoft threat. IBM fits the bill.

Indeed, IBM could totally offset the threats to Red Hat from Microsoft and Oracle. A deal would make sense because:

- IBM could bundle RHEL;

- Jboss would complement Websphere;

- IBM could leverage Red hat developers;

- IBM would get and operating system and virtualization tools to play in all layers of infrastructure.

- The IT game is increasingly becoming a matter of dueling hardware and software stacks. Red Hat would provide IBM with more software ammo.