Juniper, Polycom, Broadcom paint mixed tech picture

Networking gear maker Juniper’s first quarter was better than expected, but the outlook was light. The company’s earnings---along with Polycom and Broadcom---presented a mixed technology picture.

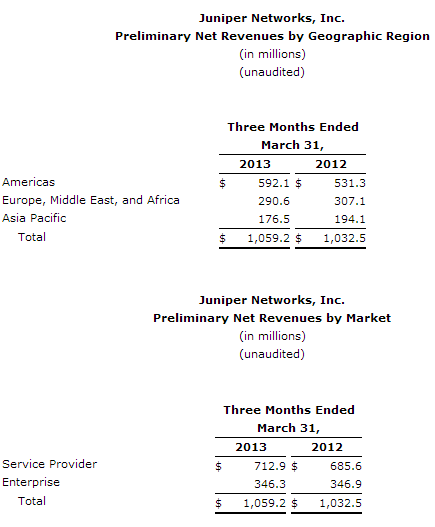

Juniper Networks reported first quarter earnings of $91 million, or 18 cents a share, on revenue of $1.06 billion, up 3 percent from a year ago. The earnings tally includes a 5 cents a share tax benefit, 2 cents a share litigation charge and penny a share restructuring charge. Non-GAAP earnings for the first quarter were 24 cents a share.

Wall Street was looking for first quarter earnings of 21 cents a share on revenue of $1.06 billion.

As for the outlook, Juniper projected second quarter revenue between $1.07 billion and $1.1 billion with non-GAAP earnings of 22 cents a share and 26 cents a share.

Wall Street was expecting Juniper to report second quarter earnings of 27 cents a share on revenue of $1.11 billion.

Juniper noted that it continues to expect enterprise spending to be week with U.S. service providers spending well with improved demand in EMEA.

Among other key tech results:

Polycom reported first quarter earnings of $3 million, or a penny a share, on revenue of $339 million, down 2 percent from a year ago. Non-GAAP earnings were 13 cents a share in the first quarter.

Wall Street was looking for first quarter earnings of 11 cents a share on revenue of $336.3 million.

The company said that its revenue growth in unified communication personal devices was 8 percent in the first quarter with 10 percent growth in services. Fifty one percent of revenue was in the Americas followed by 26 percent in EMEA and 23 percent in Asia Pacific.

Broadcom reported a strong first quarter that handily topped expectations due to mobile chip demand.

The company reported first quarter earnings of $191 million, or 33 cents a share, on revenue of $2.01 billion, up 10 percent from a year ago. Non-GAAP earnings were 65 cents a share.

Wall Street was expecting first quarter earnings of 56 cents a share on revenue of $1.91 billion.