Mitel's bets $1.96 billion on Polycom as joint company aims to fend off cloud rivals

Mitel said it is acquiring unified communications and collaboration company Polycom in a deal valued at about $1.96 billion, but the combined outfit will still face challenges from cloud-based competitors.

The combined companies will have annual revenue of about $2.5 billion. Polycom will keep its brand.

As for the financials, Polycom shareholders will get $3.12 in cash and 1.31 Mitel common shares. That sum equates to $13.68 a share for Polycom shareholders, or a 22 percent premium.

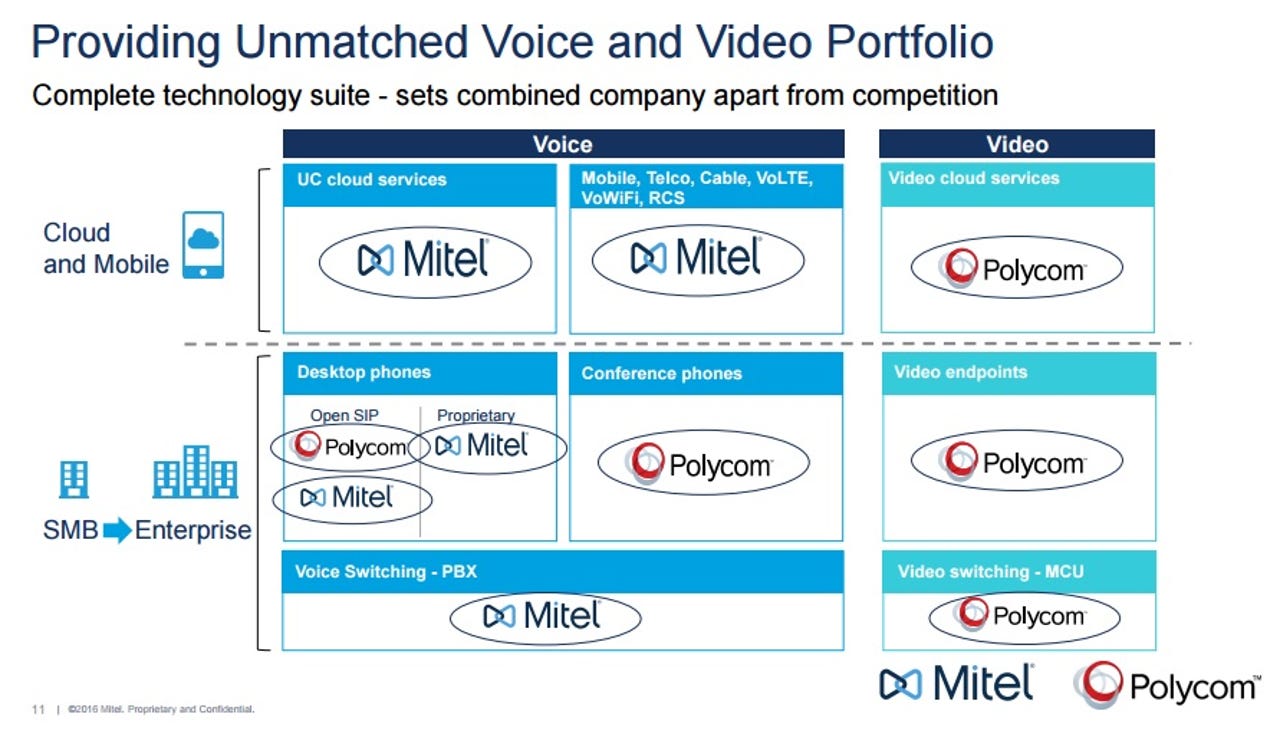

The game plan is to focus on communications and collaboration. Mitel brings global communications knowhow and Polycom brings video conferencing and collaboration tools. The combined company will be able to better compete with rival Cisco.

According to Mitel, the company will be able to provide cloud communications, IP/PBX extensions in Europe, conference phones, video conferencing and audio installations.

Analysts were mixed on Mitel's plan. Mitel said its first quarter sales will be $270 million to $280 million and that range fell short of estimates. Mitel has missed three of its last five quarters. Polycom has also had mixed results ahead of product transitions.

Wells Fargo analyst Jess Lubert said:

We suspect Mitel may struggle to achieve the $160 million in targeted cost synergies given the limited overlap between the two businesses, the potential to see dis-synergies should Polycom's voice partners be hesitant to work with a competitor like Mitel, and macro concerns that may continue to place pressures on legacy voice and video infrastructure players, such as Mitel and Polycom, which are being disrupted by low cost software and cloud based alternatives.

Indeed, the video conferencing and enterprise phone market have been under pressure from the likes of everything from Cisco's WebEx to low-cost alternatives such as Google and Skype.

Mitel will be the parent company with Polycom being a brand under it. Mitel CEO Richard McBee will run the combined company and Steve Spooner, CFO of Mitel, will keep that roll. The combined company will have about 7,700 employees.

McBee said on a conference call that he expects many Polycom executives will stay on. "We are creating a highly competitive company with truly global scale, a strong capital structure, and upon closing, will count among its most strategic relationships, one of the largest and broadest-reaching companies in our industry today," said McBee.