Mobile in the Middle East: Can Nokia hang on as top dog in the region?

The United Arab Emirates (UAE) has one of the most active mobile markets in the world.

According to the country's Telecommunications Regulatory Authority (TRA), the UAE hit 200 percent penetration for mobile devices as far back as 2009, while research compiled last year by Statista (using data from Google's Our Mobile Planet survey) reported that the UAE had the highest level of smartphone penetration anywhere in the world.

Although figures for smartphone usage vary, new figures from the TRA demonstrate how the local market is dominated by Apple and Samsung, with the iPhone 5 being the UAE's most commonly used smartphone model in the first quarter of the year.

However, over half (50.2 percent) of all mobile handsets — both smartphones and feature phones — registered on UAE networks are manufactured by Nokia. The brand's popularity in the country is in line with wider regional trends: researchers IDC, for example, found late last year that 45.2 percent of all mobile phones sold in the MENA (Middle East and North Africa) region were Nokia devices.

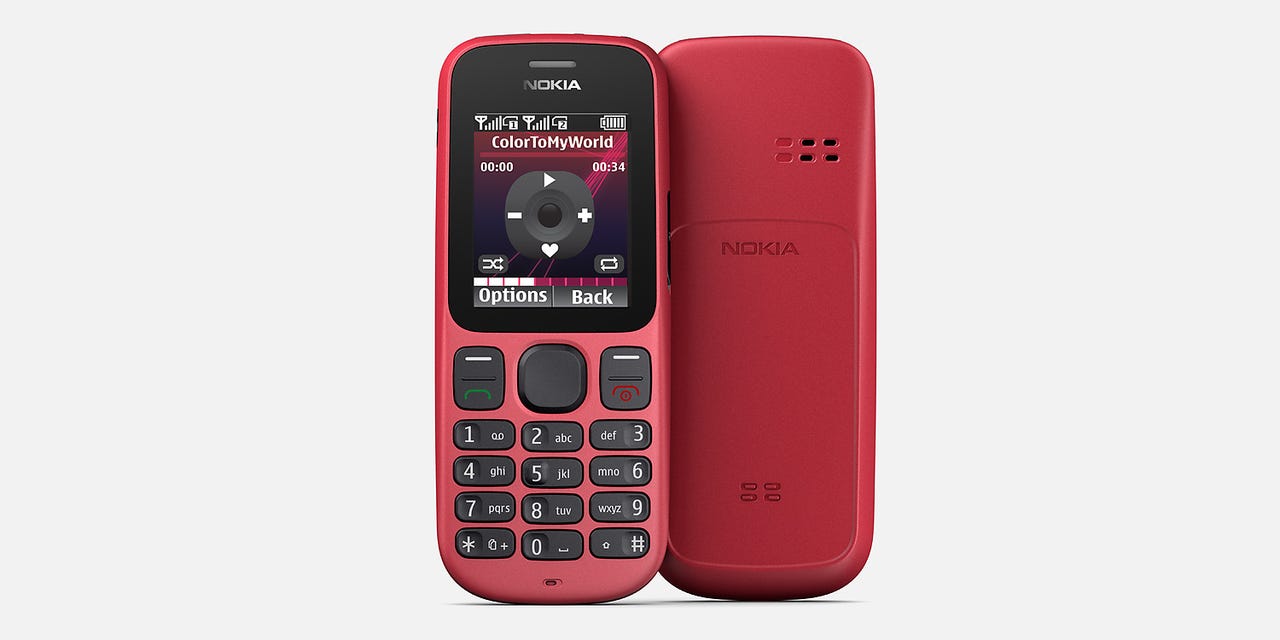

Within the UAE, the Nokia 101/1010 is the country's most popular phone, while other models such as the 1280/1282, E5 and the X1 all enjoy greater levels of ownership than more high-profile devices such as the Samsung Galaxy S3, Galaxy Note, or the older iPhone 4 and 4S.

Nonetheless, although Nokia continues to dominate the UAE, the TRA notes that the handset maker's market share "has been declining over time", with Samsung (19.3 percent) and Apple (9.1 percent) both growing their market share over the past year.

And despite the dominance of Nokia handsets and feature phones in particular, there are fewer visits to Nokia's Asha app store than iTunes, Samsung Apps, and BlackBerry World, reflecting the challenge of continuing to build revenue from non full-fat smartphones.

Nokia's gradual decline in the UAE is also mirrored by BlackBerry's. Although 8.2 percent of all devices on the TRA's networks are BlackBerry devices, the first quarter of this year saw the Canadian smartphone manufacturer pushed for the first time into fourth place, as Apple became the third most popular handset maker in the UAE.

The only good news for BlackBerry is that LG and HTC are still some way behind, with just 0.9 percent and 0.7 percent of the market respectively, meaning BlackBerry is likely to stay in fourth place for some time.

Finally, a new report into Qatar's ICT landscape (published by the ministry for whom I work) reflects the continued growth of device ownership in one of the UAE's neighbours, particularly in terms of mobile devices.

"For the mainstream population, ownership of ICT devices such as mobile phones and laptops has grown significantly. In 2013, a household in Qatar had approximately nine mobile phones, on average, compared to nearly four in 2012," the authors note.

Alongside this, the penetration of laptops also increased from 83 percent in 2012 to 93 percent in 2013, while takeup of tablets tripled over the same time period, from 10 percent in 2012 to29 percent in 2013.

Findings from Ericsson ConsumerLab also benchmarked Qatar against other markets, and revealed that penetration of laptops, smartphones, and tablets is considerably higher in Qatar than in more mature ICT economies such as Sweden and Singapore, as well as nearby countries such as UAE and Saudi Arabia.

In both Qatar and UAE, the high level of device ownership and connectivity have the potential to support government efforts to grow their digital economies and increase use of online services. However, as the report recognises: "There is still much room for improvement when it comes to the sort of advanced usage that will drive future innovation and economic success."

As a result, we're going to continue to see more government-driven efforts to increase ICT skills and knowledge, address online security concerns and increase awareness of egovernment opportunities. High take-up levels of technology means that to some extent, they're already halfway there.