More MP3 player market data says Microsoft's Zune won't be shaving my head at CES

So far, I haven't heard back from Microsoft president Robbie Bach about my open challenge to him. In case you missed it, I caught a story where he said that Microsoft would be ranked #2 in the portable digital media player (PDMP) market by the time this year's holidays were done and said I would shave my head on the stage of Bach's choice if Microsoft hit that mark. But Bach would have to reciprocate by shaving his own head if Microsoft doesn't hit that mark.

Microsoft, with it's hard drive-based Zunes is currently ranked #4 in the overall PDMP market (includes both hard drive and flash memory-based devices) with 3 percent of the market behind Creative (ranked 3rd with 4 percent) and Sandisk (ranked 2nd with 10 percent). To move into second place, it Microsoft must pass Sandisk. Yesterday, I made a mistake in my math. I said that at a bare minimum, Microsoft much reach 7.1 percent marketshare by stealing 4.1 percent of the market that Sandisk has (causing Microsoft at 7.1, to edge-out Sandisk at 6.9 percent). But 10 minus 4.1 does not equal 6.9. The corrected math is actually a bit more favorable to Microsoft. To pass Sandisk, Sandisk must sacrifice at least 3.55 percentage points, all of which Microsoft must take for itself, thereby putting Microsoft at 6.55 percent and Sandisk at 6.45 percent. Bear in mind that this assumes that other options and/or competitors (eg: the new crop of phones like the iPhone that would cause someone not to want a dedicated PDMP) don't end up taking away any percentage points that are in play.

Even so, the big question is whether or not, based on the new Zune PDMPs that Microsoft announced earlier this week, can Microsoft actually achieve Bach's goals (especially since the last PDMP marketshare data to come from the NDP Group showed Sandisk's share improving).

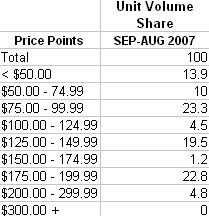

Putting Microsoft's Zunes in the context of this chart is tricky since, at $149, the lowest priced Zune sits right on the cusp of two price bands. But let's start with the more-favorable-to-Microsoft math by looking at the number of buyers below the $125-$149.99 band, and the number that are in the next highest band or above. 51.7 percent of PDMPs sold cost less than $125. If this trend is projectable into the holiday season (which I'm guessing it is because so few people budget $149 or more for each gift they buy), I'm feeling very good about the hair on my head. I don't know what percentage of Sandisk's sales are in the <$125 range (I've been looking for this data but didn't have an official answer by the time I published this). But even if it's a healthy minority of Sandisk's sales (more than likely, it's the majority), it would be pretty much impossible for Microsoft to overtake Sandisk as #2 since it has nothing to offer those buyers.

For example, let's say 40 percent of Sandisk's 10 percent overall share of the market were in the <$125 range. In other words, whereas more than half the market is buying in the <$125 range, less than half of Sandisk's sales are in that same range. This is a guess that gives Microsoft the benefit of the doubt. If the data so far is projectable and since Microsoft has no way of selling into the same market where Sandisk scores 40 percent of its sales, then 4 of Sandisk's 10 percentage points are safe from Microsoft. Therefore, all Sandisk has to do is keep 2.51 out of the remaining 6 percentage points to keep Microsoft from taking over the #2 two slot. At 6.51 percent share (the 4 untouchable points + the 2.51 out of the 6 remaining points), Sandisk will have relinquished 3.49 points to Microsoft putting Microsoft at a 6.49 percent share. That would solidly place Microsoft in the #3 spot ahead of Creative but still behind #2 Sandisk at 6.51 percent.

If more than 40 percent of Sandisk's sales are in the <$125 price range where Microsoft has nothing to offer 51.7 percent of the PDMP buyers, then the situation worsens for Microsoft. For example, if 50 percent of Sandisk's sales are in the <$125 price range (meaning that, with its least expensive player at $149, Microsoft has nothing to offer 5 of the 10 market percentage points that Sandisk sells to), then all Sandisk has to do is retain 1.51 of it's remaining 5 percentage points to keep ahead of Microsoft. Moving one more notch, if 60 percent of Sandisk's sales are in the <$125 range where Microsoft has nothing to offer, all Sandisk must do is keep .51 of it's 4 remaining percentage points in order to preserve its #2 position.

<Update>The NPD Group has sent me the data I was looking for. 70 percent of Sandisk's sales of PDMPs are of units priced under $100 (a $50 or more price differential from Microsoft's least expensive Zune). So, let's rerun the math. Wait a minute. There's no math to do. If 70 percent of Sandisk's 10 points of market share are in the <$100 range where Microsoft has nothing even close to offer those buyers, the game is pretty much over. Even if Microsoft was able to take the remaining 3 points away from Sandisk (hold that thought, I explain why it won't in a sec), that would only bring Microsoft's total market share to 6 percent which is less than the 7 percent market share that Sandisk commands with offerings for which Microsoft will have no competition (based on existing announcements). Now, here's why it won't be able to get the other 3 percent.

According to NPD Group's Ross Rubin, "most of the rest [of Sandisk's PDMP sales] are in the $100-$150 range." In other words, with Microsoft's least expensive Zune costing $149, Microsoft has nothing to compete with almost the rest of Sandisk's sales (except for the buyers that are right on the top boundary). So, almost all of Sandisk's command of 10 percent of the PDMP market is based on sales of units for which Microsoft doesn't have anything comparably priced.</Update>

This of course is all theoretical and there are other factors. For example, what if Microsoft gets some of Creative's, Sandisk's, and/or Apple's percentage points. Could those be enough to pass Sandisk? Or, what if Microsoft acquires Sandisk or Creative? (chances are, the transaction wouldn't close by the holidays, but I guess anything is possible). In that case, I'd void the challenge because the challenge is all about whether, with the Zunes that were announced, can Microsoft climb into the #2 spot.

With nothing to offer 51.7 percent of the buyers (and probably more since Microsoft's least expensive player comes in at the very very top end of a price band that covers 19.5 percent of the units sold) , it'll will take an act of God for Microsoft to make it into the #2 spot. Of course, ever since the day of the Windows 95 launch when the normally gray Northwestern skies over Microsoft's campus looked exactly like the box that Windows 95 came in (as well as the wallpaper that Win95's desktop defaulted to), I've often wondered if someone at Microsoft has that sort of pull. For my hair's sake, I hope they don't.