Morgan Stanley sees bright future for mobile Web, credits Apple for changing game

A report released by Morgan Stanley this week goes into great detail - to the tune of 424 pages and 659 accompanying slides - about the state of the Mobile Internet.

In a nutshell, the mobile Internet is the future - and Morgan Stanley sees it surpassing the PC as the primary way of accessing online information within five years.

That makes sense. The barriers of entry for mobile Internet adoption are relatively low, compared to the costs of a PC a decade ago. Competitive pricing for mobile Web access - as well as increased speeds - has exposed the mobile Web to a growing number of users. Smartphones have made it easy for them to navigate the mobile Web and engagement in social sites such as Facebook and Twitter has given them a reason to access the mobile Web.

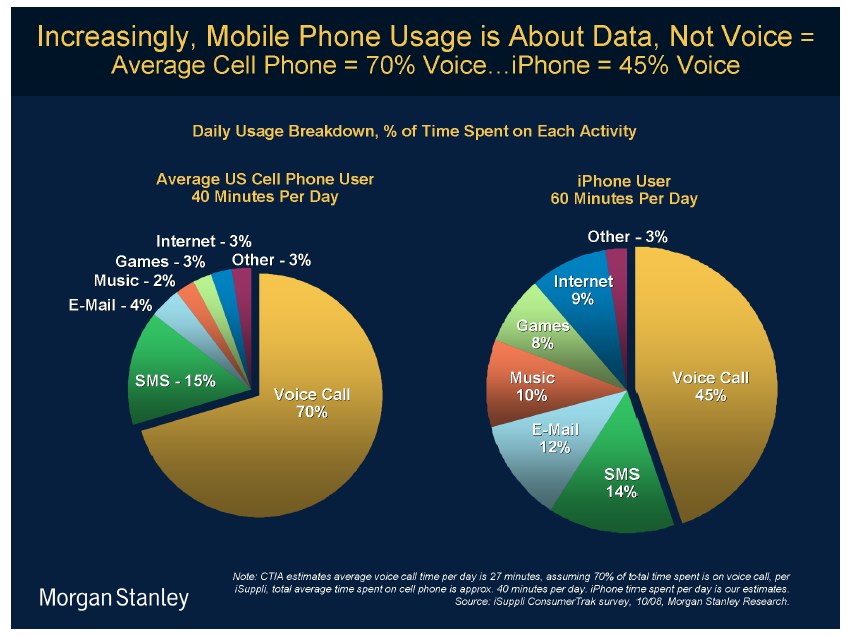

The report's authors give a lot of credit to Apple for changing the mobile Web game. That's largely deserved - Apple brought rise the idea of apps, most of which are still the "mobile Web" even though they don't run in a browser. Apple also introduced a user interface that was attractive to the masses. And it sent a wake-up call - via AT&T's failures - to the carriers, essentially telling them that they were going to have to up their games if they wanted to keep up with the innovation found within the devices.

More importantly, it put some fire into the competitive landscape. Apple and its iPhone is definitely the one to beat but that's not to say that it can't be beaten at its own game. So far, Google is showing the most potential with its Android OS strategy, which involves partnering with multiple carriers and multiple device manufacturers. And that's got companies like Palm, Research in Motion, Microsoft and others rethinking their strategies, offerings and pricing. When that happens, consumers get better deals and are more inclined to adopt new technologies.

The report is pretty massive but you can read it online if you're so inclined. As part of its summary, Morgan Stanley highlights the eight themes it tackles. They are:

- Wealth Creation / Destruction Is Material in New Computing Cycles – History shows that massive technology changes typically shift dynamics between incumbents / attackers, creating winners / losers. A handful of incumbents (like Apple, Google, Amazon.com, and Skype) appear especially well positioned for the mobile Internet, the fifth new cycle of the last half century.

- Mobile Ramping Faster than Desktop Internet Did and Will Be Bigger Than Most Think – As five key trends converge (3G, social networking, video, VOIP, and awesome mobile devices), the explosive Apple iPhone / iTouch ramp shows why usage of mobile devices on IP-based networks should surprise to the upside for years to come. As 3G adoption hits inflection points in many markets, consumers are flocking to a broad range of IP-based usage models over powerful mobile Internet-enabled devices. We predict that smartphones will out-ship the global notebook + netbook market in 2010E and out-ship the global PC market (notebook + netbook + desktop) by 2012E.

- Apple Leading in Mobile Innovation + Impact, for Now – Depth of App Ecosystems, User Experience, and Pricing Will Likely Determine Long-Term Winners – Near term, Apple is driving the platform change to mobile computing and leading in user experience. Its mobile ecosystem (iPhone + iTouch + iTunes + accessories + services) market share and impact should surprise on the upside for at least the next 1-2 years. Longer term, Google Android’s open operating system (combined with clever device manufacturers), emerging markets competition, and carrier limitations may pose challenges to Apple’s market share upside. RIM may maintain the enterprise lead, thanks to its installed base, but the long-term outlook is challenging.

- Game-Changing Communications / Commerce Platforms (Social Networking + Mobile) Emerging Very Rapidly – Improvements in social networking and mobile computing platforms (led by Facebook + Apple ecosystems) are fundamentally changing how people communicate with each other and how developers, advertisers, and vendors can reach consumers. Mobile devices are evolving as remote controls for continually expanding types of real-time, cloud-based services – including emerging location-based services – creating opportunities and dislocations, empowering consumers in unprecedented and transformative ways.

- Japan Mobile and the Desktop Internet: Roadmaps for Growth and Monetization – Mobile Internet development in Japan and desktop Internet business models provide significant runways for monetizing the mobile Internet through online commerce, paid services, and advertising; data access likely will continue to lose relative revenue share in the mobile Internet ecosystem.

- Massive Data Growth Driving Carrier / Equipment Transitions – Global mobile IP traffic is likely to grow 66x by 2013E (with 130% CAGR), per Cisco. Increasing 3G / smartphone penetration and emerging usage models (such as video / audio streaming) will stress carrier wireless networks. Carriers may be able to address the surge via capacity upgrades and offloading to Wi-Fi. Tiered data pricing (speed, quantity) will likely be critical to long-term revenue growth.

- Compelling Opportunities in Emerging Markets – Emerging markets have enormous potential for mobile Internet user growth, owing to low fixed-line telephone / broadband penetration + already vibrant mobile value-added services. We expect 3G inflection points to be 2-3 years away, depending on the individual markets.

- Regulators Can Help Advance Mobile Internet Evolution… Or Slow It – Inherent conflicts between the wants / needs of consumers and those of incumbent TMT providers are creating challenges for regulators.