NetSuite shares plummet day after report of "impressive" growth

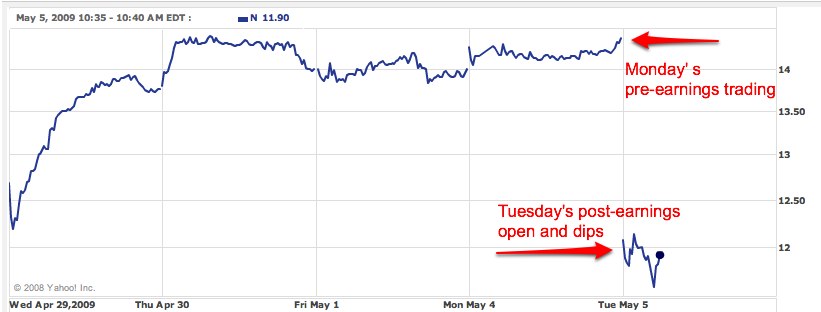

Shares of NetSuite, which reported first quarter results yesterday, is taking a beating on Wall Street today, with shares plummeting nearly 20 percent in regular trading, despite the "impressive" growth that the CEO referenced in his earnings statement.

First quarter revenue was up 22 percent for the quarter but analysts today are downgrading the stock. Piper Jaffray, for example, writes in a note to investors:

With the approaching competitive entry of industry giant SAP into NetSuite's core market, and a likelihood of single-digit revenue growth in 2H:09, the current premium valuation on NetSuite shares is unwarranted, in our opinion.

The Piper Jaffray note also references a weak Q1, noting that revenue - despite being up - missed Wall Street's estimates and further notes that cash flow was weak and "customer adds plummeted 40 percent" from a year ago. In addition, the guidance for Q2 and the fiscal year were weak - both in revenue and EPS.

In a note to investors, Wedbush analysts wrote:

We remain neutral on NetSuite shares as revenue growth is expected to decelerate materially throughout 2009 stemming from issues associated with the global recession, as well as purchasing delays from larger customers looking to preserve capital. While Q1 results were roughly in line with expectations, the degree to which NetSuite management expects their business to decelerate over the next few quarters is much lower than we believe investors were anticipating.

And in a separate note, JMP Securities analysts note that, while they were disappointed with the performance for the quarter, they "like NetSuite long term." The analysts wrote:

The stock traded down in the after-market, and we would recommend buying on a dip because, at a fundamental level, we think NetSuite may be the best positioned name in our universe. NetSuite has the strongest on demand ERP product, is well capitalized, and continues to expand its lead over the competition, in our opinion.