Nutmeg, a Mint.com for investing, lands $5.3 million in funding

American startup Mint.com revolutionized the way individuals managed their money across multiple accounts through a cloud-based platform. With a bird's eye view to personal finance and an easy-to-use interface that was miles ahead of those offered by banks and other financial institutions, It gained a devoted following. Then Intuit took note and acquired the company.

What Mint did for individual finance in North America, U.K.-based Nutmeg wants to do for individual investing in its home country.

The big question: Would you rather pay a person or an algorithm to manage your investments? A bank, or a web service?

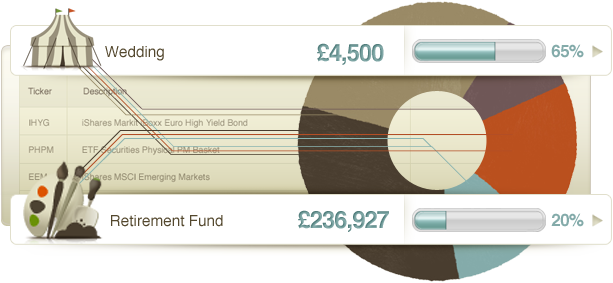

In both cases, Nutmeg hopes it's the latter. The company combines that desire with a hand-holding, visually rich user interface to effectively take the numbers -- or specifically, the eyes-glazed-over effect you get starting at them -- out of investing.

(And yes, I'm aware that Mint has an investments section. But it only tracks your investments made elsewhere. Furthermore, Mint is not yet available in the U.K.)

The company has received an additional £3.4 million (or approx. $5.3 million) in anticipation of the public launch of its service this summer, which will only be available in Britain. The additional funds come from venture capital firm Pentech Ventures, Silicon Valley investor Tim Draper, European investor Klaus Hommels and Armada Investment Group chairman Daniel Aegerter.

The problem with investing today? It's a wonk's game. If you like diving into the details, there's no greater thrill than poring over the minutiae of financial documents. But many people who own investments do not share that passion -- yet everyone cares about how those investments turn out.

More than 9 million people in the U.K. own shares, whether directly or through mutual funds, according to the U.K. Shareholders' Association. Nutmeg wants to crack some of that market through a low barrier for entry -- you can create a portfolio with a sum as low as £1,000, or through monthly contributions of £100 -- and that lovely interface.

The idea is to give more transparency to your investments. Instead of forking it over to a human manager (possibly expensive, possibly opaque) or doing it yourself (possibly a hassle), Nutmeg wants you to give it to them -- but you can look over their shoulder and comment, somewhat like a tech-savvy high net worth individual.

Nutmeg charges an annual management fee of up to 1 percent (including VAT), depending on the overall value of the portfolio. (Why? Because it's a discretionary investment manager, actually making the transactions for you.) It doesn't charge exit fees, and you can remove your money at any time.

The company is prepped for rapid adoption, pushing a points-based loyalty scheme that rewards active, referral-happy users with lower fees. Though Nutmeg is aiming for the individual, it's not hard to see its services be of interest to a company's human resources department -- after all, why not offer this as an option for employees' retirement accounts? Still, we'll see how the Brits take to it when it launches in the coming months.