Business

Oracle vs. Rimini Street nears finale, but third party maintenance blueprint far from set

You'd think that the Oracle vs. Rimini Street lawsuit would set a solid blueprint for third party enterprise software maintenance. Think again.

The Oracle vs. Rimini Street trial over copyright infringement and third party support and maintenance techniques will head to closing arguments Tuesday, but don't expect the legal showdown to clarify the rules of engagement.

Oracle's legal battle against the much smaller Rimini was five years in the making and arguments conclude this week in a federal courtroom in Las Vegas. After two weeks of Oracle presentations and witnesses and a week of Rimini's defense, the closing arguments kick off Tuesday. From there, the trial goes to the jury with Rimini's future possibly in the balance.

Regardless of the outcome of the trial, the battle over third party support is far from over. For customers eyeing third party enterprise software support, the rules of engagement may remain unclear.

For Rimini, a ruling in favor of Oracle, which is seeking nearly $250 million in damages, would be a major hit. But here's the catch: The trial wasn't about the legality of third party support. Maintenance and support are a cash cow for Oracle and SAP and players like Rimini are a big threat.

Karen Dunn, a partner at Boies, Schiller & Flexner and co-lead counsel for Oracle, said the trial isn't about third party maintenance but blatant copyright infringement. "This is about one company, Rimini, that did an extraordinary amount of copying and lied about and interfered with customers," said Dunn.

Oracle had already won a few key rulings before the jury trial. For instance, Judge Larry R. Hicks found that Rimini violated Oracle copyrights for two products. The trial revolves around whether Rimini violated copyrights for two other products and what damages should be paid. Seth Ravin, CEO of Rimini Street, was a frequent topic with Oracle portraying him as a cheater and using its TomorrowNow lawsuit with SAP as historical evidence.

As background, Ravin was a co-founder of TomorrowNow, which was acquired by SAP. Oracle won $1.3 billion in damages from SAP over copyright infringement, but that sum was cut to $272 million on appeal. Ravin moved on to launch Rimini Street. Rimini's counsel portrayed Ravin as a hero and advocate for customers. Here's Rimini's response to Oracle:

Rimini Street and Oracle are fierce global competitors. Despite Oracle's rhetoric, Rimini Street and Oracle actually agree there is no dispute that third-party support for enterprise software is permitted for Oracle licensees to purchase and for Rimini Street to offer.

We disagree with Oracle's characterization of our long-running, good-faith dispute over software license terms as applied to support processes formerly used by Rimini Street. Once Rimini Street had the benefit of a judicial interpretation of the license terms in 2014, we stopped all processes challenged by Oracle in this case and completed our transition to an all-remote support model. We are in court to resolve our remaining disputes in this case.

It's safe to say whatever happens there will be an appeal. Oracle is seeking $245.9 million in damages based on customers that defected to Rimini. Rimini countered that damages should be more like $10 million based on the value of the licenses. Oracle argued that customers would have stayed with the company for support. Rimini noted that Oracle loses about 5 percent of its support and maintenance customers each year. These customers are either in transition to another vendor, decide to support the software themselves or headed to the cloud.

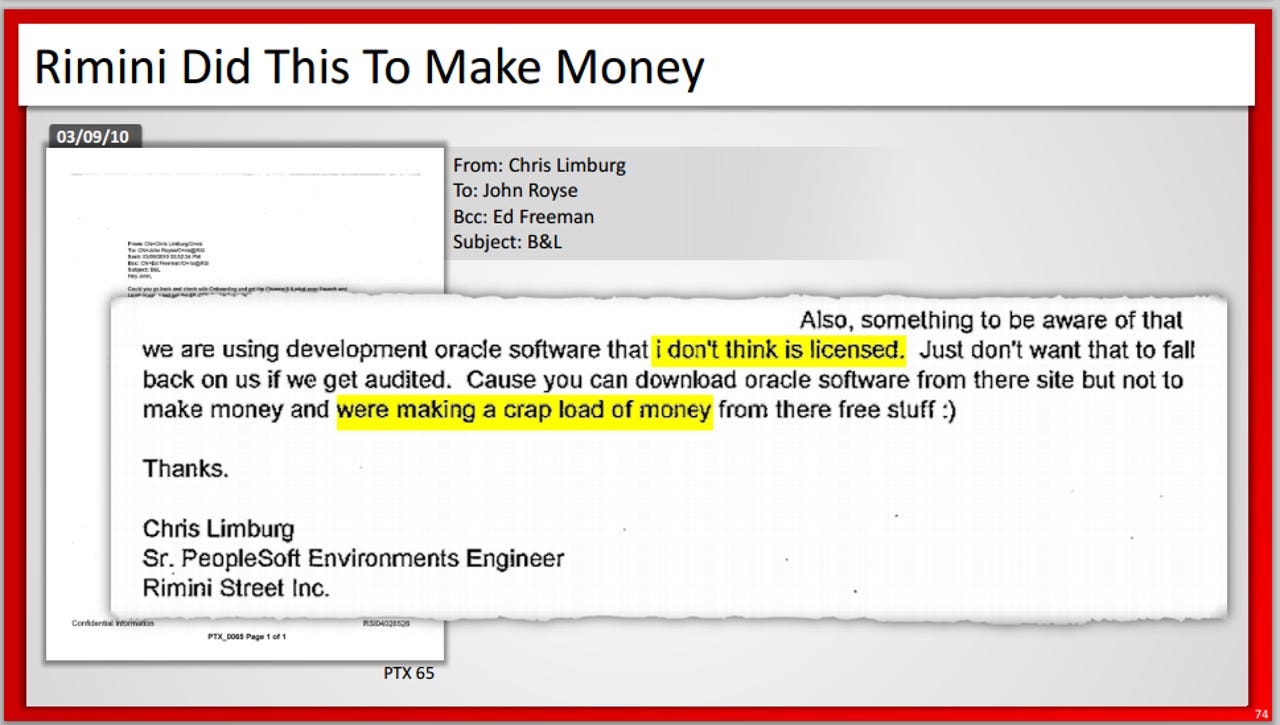

In other words, Rimini's point is that at best it gets about 12 percent of that 5 percent that would leave Oracle anyway. Rimini cited customers such as Bausch & Lomb and Birdville ISD as testifying that they wouldn't have stayed with Oracle anyway. Oracle argued that Rimini outright lied to customers about its process and use of its intellectual property. If Rimini customers, knew that the company was automating downloads, storing support libraries and infringing on copyrights it wouldn't have any customers, argued Oracle.

Patrick Walravens, an analyst at JMP Securities, which is also an underwriter for the Rimini IPO, outlines why this trial matters. Rest assured that the trial is about the money as well as the copyright infringement.

The stakes are high for this trial. Third-party support threatens Oracle's $19B/year maintenance revenue stream, which represents the highest margin part of its business. Oracle seeks an outcome, in our opinion, that crushes Rimini Street with damages and deters others from adopting the third-party support business model. Rimini seeks an outcome that minimizes damages for past copyright violations, but, at the same time, validates the legality of third-party support - when it is done the right way. Rimini argues the damages should be no more than $10M. A Rimini victory could provide a "how to" guide for third-party support, accelerate Rimini Street's growth, attract other players to the space, and compound the threat to Oracle's maintenance stream.

Depending on how the trial goes it's possible that some groundwork will be laid for either Rimini Street to spawn an industry of third party support companies. Nevertheless, the key points in the case won't be totally clarified even when the trial concludes. Here's a look at a few key issues:

The third party maintenance provider can't access a client's applications and documentation on its own servers. Rimini already changed its practices over a previous ruling. This chart from Rimini's opening argument shows how:

Bill Isaacson, the other co-lead counsel for Oracle from Boies, Schiller & Flexner, noted that Rimini's practice outlined in the trial is part of another lawsuit in discovery. In a nutshell, there's already an Oracle vs. Rimini sequel in the works. Rimini's remote access point wasn't admissible in court. "That's what Rimini says it is doing, but there's no evidence it is actually happening," said Isaacson. "That's a separate issue."

Terms used in licensing agreements for legacy software are vague when it comes to third party support. In the Oracle vs. Rimini trial, the definition of facilities was an issue in previous PeopleSoft agreements. The licensing agreement indicated that the software was allowed to be used in a customer's facility. In the cloud age, good luck defining a facility. If Rimini hosts code does that count as an outside facility? Apparently so. Now Rimini provides support via VPN. What about a laptop that's out of state with a development platform on the drive?

Given that many legacy enterprise software deals were inked years ago, there will inevitably be terms that can become an issue in third party support deals. In other words, copyright is going to be a persistent issue.

Third party support isn't in question, but... Rimini lawyers have argued that the Oracle trial is really a licensing disagreement. Oracle's lawyers argue that the case is about copyright infringement. All of that said, Oracle's strategy appears to be to aggressively defend any possible copyright issue to freeze third party providers and their customers, said analysts like Walravens. That view isn't uncommon, but does reflect a reality that Rimini may be in court against Oracle repeatedly.

Customized software muddies the water. Rimini provides support for customized ERP applications and argued that updates from Oracle aren't reused by the company because it has to build its own rewrites. Oracle argued that Rimini re-used its intellectual property. Any clarification from the trail on the re-use vs. re-build issue will provide a path forward.

Dunn said that Rimini's argument that it was rebuilding instead of reusing is merely a way "to justify its illegal conduct."

The customized software issue will be worth monitoring in future third party support disputes. Rimini argues that it creates its own value over Oracle's base. Oracle maintains that the base is still its intellectual property. Given the amount of customized enterprise software you can see how this issue isn't going away any time soon.

So what has a trial really proved? After reading dozens of documents from the trial and talking to both sides on and off record here are a few thoughts:

This Oracle vs. Rimini lawsuit will have encores and sequels. Perhaps the only thing preventing a groundswell of third party support providers from following Rimini into the market is the Oracle lawsuit threat. Oracle will likely play a game of legal Whac-A-Mole. A customer will have to weigh staying power of the third party support provider, cost savings and ongoing lawsuits. Customers will have to be indemnified to even ponder third party support.

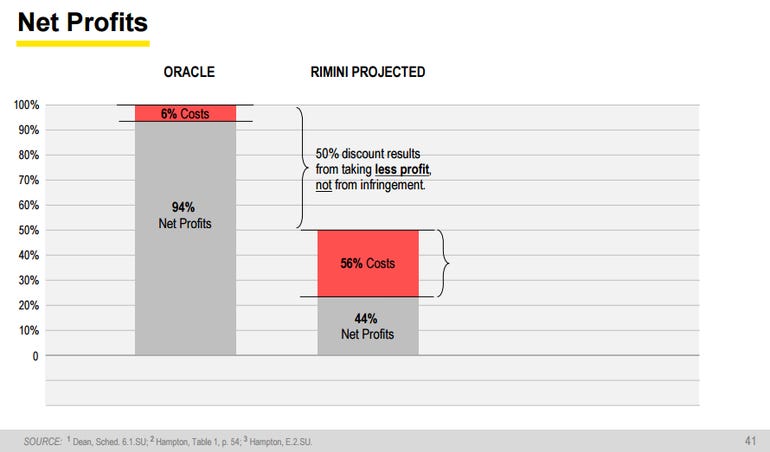

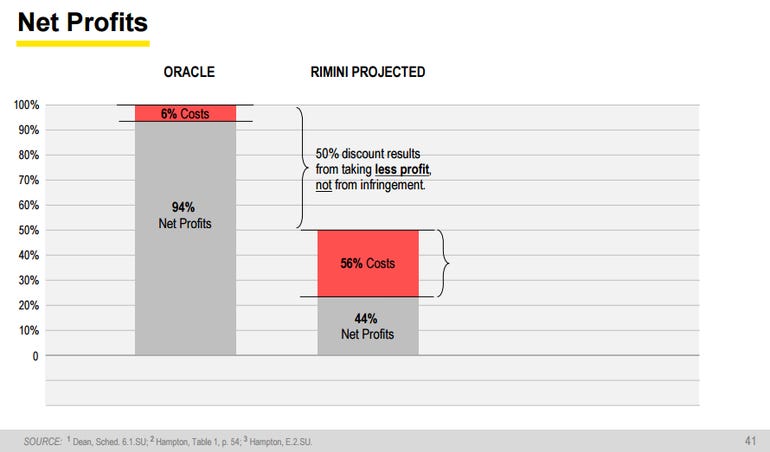

The trial is all about the money. While Oracle vs. Google over Android got a lot more press, over time the Rimini suit will equate to more money. Oracle and SAP garner hefty profits from support and maintenance and that revenue stream is largely funding investment in cloud and other new delivery models to offset stagnant at best new licensing revenue. Here's what Rimini presented the jury when it tried to portray Oracle as a company holding customers over a profit barrel. Oracle maintained that copyright protection and profits drive innovation.

Should there be a chilling effect on third party maintenance Oracle will win (or at least buy time) even if it's awarded just a fraction of the damages it seeks. Frankly, it's hard for me to see a scenario where there won't be a chilling effect of some sort.

Then again the third party maintenance genie is out of the bottle. It's unlikely that Rimini will be put out of business by Oracle's copyright suit. As a result, the groundwork for future defense of third party maintenance will be set. I think it's quite possible to slow third party maintenance momentum, but it won't be stopped. If anything, third party maintenance will be viewed as a bridge to cloud-first models. Rimini's threat in the future won't be Oracle or SAP, but a bunch of upstarts willing to take a lower profit margin.

ZDNet's Monday Morning Opener is our opening salvo for the week in tech. As a global site, this editorial publishes on Monday at 8am AEST in Sydney, Australia, which is 6pm Eastern Time on Sunday in the US. It is written by a member of ZDNet's global editorial board, which is comprised of our lead editors across Asia, Australia, Europe, and the US.

Previously on the Monday Morning Opener:

- Could the FTC prevent Google taking much-needed control of Android?

- The death of this revolution has been greatly exaggerated

- Apple's iPhone: Looking at its past and present to predict its future

- Intel's next frontier: Powering robots

- An extended winter looming for OEMs

- When robots eliminate jobs, humans will find better things to do

- Microsoft and mobile: Searching for a way forward

- Who will have the courage to build the future again?

- Apple Watch: Now the hard work really begins

- BlackBerry has nothing to lose, so why not try out Android?