Pay-by-selfie, pay-by-fingerprint: Coming your way soon after MasterCard's Dutch experiment

MasterCard ran its main Identity Check app pilot scheme for pay-by-selfie and pay-by-fingerprint in the Netherlands.

.

MasterCard is rolling out its new mobile payment verification services, pay-by-selfie and pay-by-fingerprint, this year in Canada, the US, and the UK.

The company hopes to simplify the online shopping experience for MasterCard holders at a time when retailers are beginning to complicate it with extra security measures at checkout.

Retailers in the US and the UK are implementing security checks, such as 3D Secure and Verified by Visa, during the online checkout process. But the checks may obstruct the shopping experience, which can translate into lost sales.

In the UK, 18 percent of online shoppers abandoned their baskets due to "excessive payment security checks" in 2012. And in the US, companies lost $118bn in potential sales in 2015 due to "false positives", transactions that are wrongly declined because financial institutions incorrectly associate them with fraud.

The pay-by-selfie and pay-by-fingerprint concepts propose a simpler alternative to these security steps at checkout. Called biometric authentication, a banking customer's photo or fingerprint could replace these cumbersome checks.

The Apple Pay platform on iOS already gives iPhone and iPad owners the option to authenticate payments with a fingerprint at select online retailers and stores.

On Android devices that have built-in fingerprint sensors, such as Samsung's smartphones and tablets, users can use Android Pay or Samsung Pay to make payments with fingerprint authentication. All these platforms already work with MasterCard credit cards.

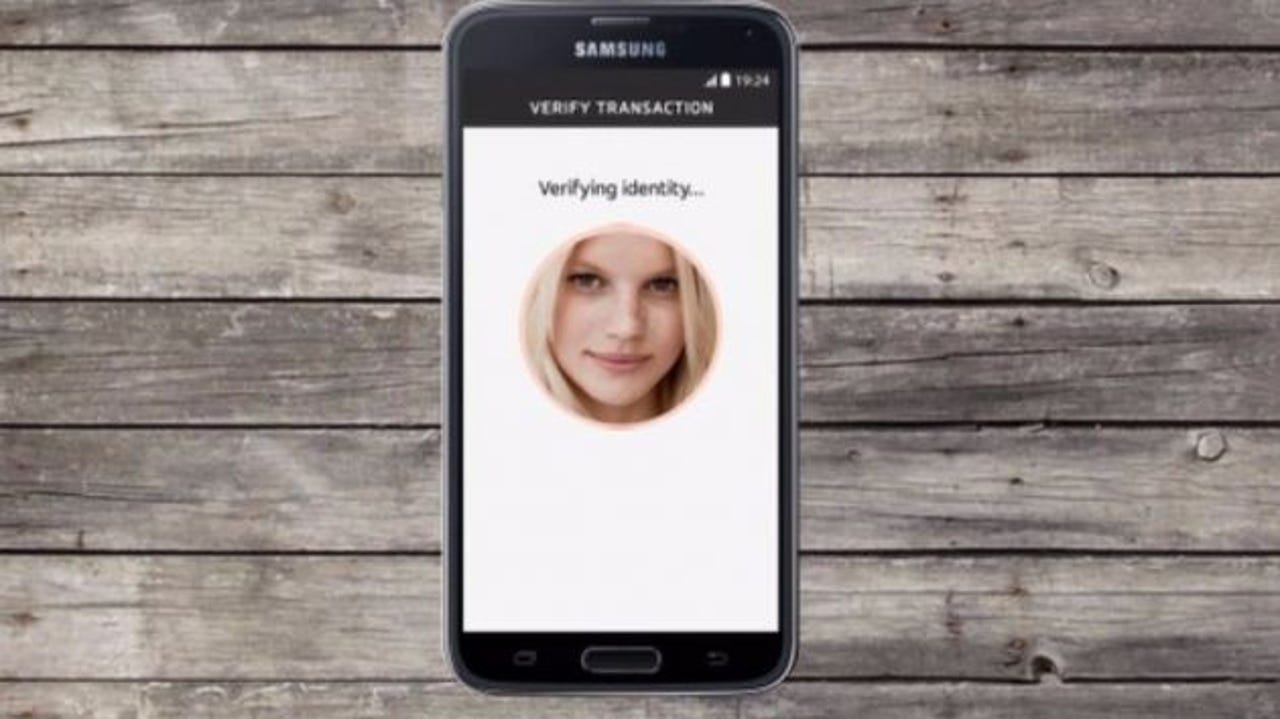

MasterCard's new platform, called the Indentity Check app, gives its cardholders the option to pay with a selfie, as an alternative to the fingerprint. MasterCard holders at participating financial institutions can install MasterCard's the Identity Check app on their mobile devices, but it will only work for online purchases, not at physical retailers.

Late last year, MasterCard ran concurrent pilots in the Netherlands and the US. Over three months, 750 ABN Amro Bank customers in the Netherlands and 240 employees of California-based First Tech Federal Credit Union participated over two months. Participants could choose between using selfie or fingerprint authentication.

Combined data from both pilots show that 92 percent of all participants thought Identity Check was more convenient than typing in passwords, and 83 percent believed it was more secure.

Overall, 93 percent said fingerprint authentication was convenient, and 71 percent rated facial recognition as convenient.

Since most of the participants came from the Dutch pilot, MasterCard's test data represents the Dutch consumer more than it does the US one. But Dutch consumers have characteristic banking habits that don't match those of North American or UK consumers. So how much does this data tell us that Instant Check will succeed in North America and the UK?

"Security is as much of an issue in the Netherlands as it is in the UK and in the US as well," says Ajay Bhalla, president of enterprise security solutions at MasterCard.

Still, the Dutch participants in the pilot were already burdened with more complicated authentication checks than average North American or UK consumers are.

Dutch ABN Amro customers generally need to use a bank-issued electronic card reader device as part of a payment authentication process, even when shopping online at home. Any process that eliminates the need to use this device would be a welcome improvement for these consumers.

Meanwhile, consumers in North America and the UK shop online relatively easily. Most retailers in the US and the UK implement little or no security checks at checkout, apart from asking for a three-digit security code.

Online users often store their credit-card information on the retailer's website, which streamlines the checkout process even further.

Even so, Bhalla says online fraud will become more of a threat in the US and the UK as physical payment channels become more secure, mainly due to the growing use of EMV chips in payment cards. Retailers are asking for more digital security, he says.