PC sales stink, but hope for bottom remains

The first quarter for the PC market was ugly, but analysts still maintain that a bottom may be in place.

First, the stats:

- IDC said global PC shipments fell 11.5 percent in the first quarter to 60.6 million units. Shipments were hurt in quarter due to Windows 10 uptake in the enterprise. Windows 10 is mostly in pilot phase. Toss in weak consumer demand, global economic uncertainty and competition and PCs were thumped.

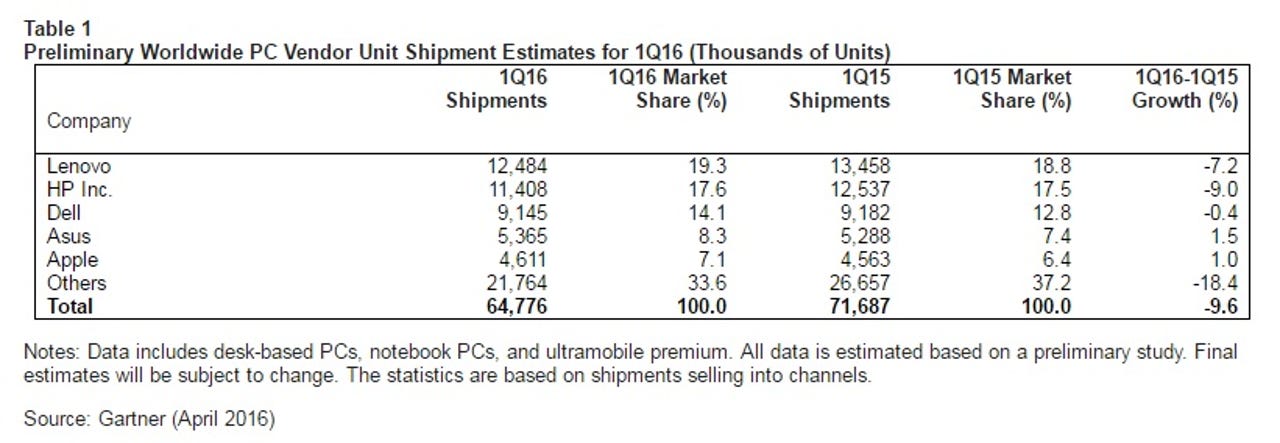

- Gartner put PC shipments at 64.8 million in the first quarter, down 9.6 percent from a year ago. PCs are a no-show in the emerging markets.

- Dell is the No. 1 PC vendor in the U.S., according to both IDC and Gartner. Lenovo moved to protect margins in China and lost share, but gained ground in the U.S.

- IDC has Apple growth falling 2.1 percent, but gaining share to 7.4 percent of the market globally.

Add it up and the PC market is either toast or making a bottom. A pair of Credit Suisse analysts are taking the optimistic side of the argument. Credit Suisse analyst Thompson Wu said that the PC market is "showing signs of a bottom."

Wu said:

We believe IDC PC data and our conversations with the supply chain indicate trends we outlined in April PC outlook report are still on track. 2Q16 remains the seasonal slowest quarter; we forecast flattish sequential units. We also forecast mild quarter over quarter growth in the Taiwan PC manufacturers; 1.5% by notebooks and flattish in desktop.

We expect 3Q16 PC shipments to outpace seasonality; driven by mild channel restocking before reverting back to seasonality in 4Q16. Overall, these sequential changes reach 7% decline in 2016.

The bet for Wu is that the rebound for the PC industry comes in the third quarter. Corporate replacements and virtual reality upgrades will stabilize the market.

On the Microsoft front--Gartner said Windows 10 hasn't spurred PC upgrades--Credit Suisse analyst Philip Winslow said the software giant could see some weakness, but its operating system uptake should improve. Winslow said that Windows pricing should improve, enterprise PC upgrades will help margins and an inventory glut is now being worked off.

Fortunately for Microsoft, it isn't tethered to the PC market nearly as much as it used to be. Microsoft is about the cloud subscriptions, Azure and enterprise applications.