PitchBook and Morningstar integrate data, facilitate AI-driven investing

Getting data on the financial markets is nothing new. Wall Street has thrived on data, whether it be focused on market activity, securities processing or portfolio performance management. Some financial companies are really technology companies; Bloomberg, L.P. is a case in point.

Public-private hybrid

Data on private equity markets is a bit harder to come by, though. But PitchBook Data, a Seattle company founded in 2007, specializes in it, and that's probably why Morningstar bought the company in December, 2016 . That's not a lot of time to integrate data sets and platforms, but today PitchBook is announcing a new milestone in that pursuit. For the first time, the PitchBook Platform is offering both PitchBook's own data on the private markets and some of its parent's data on the public markets.

PitchBook says the added data, which covers more than 44,000 publicly traded companies worldwide, includes coverage of up to 900 new data points and 170 calculations. And Frannie Besztery, CFA, and head of data at Morningstar said "This is a shining example of how the acquisition is providing considerable benefits to PitchBook customers and is helping to strengthen both PitchBook and Morningstar's data and technology offerings to all investors."

There's (not just) an app for that

PitchBook is touting that it will now be providing 300 percent more data in PitchBook Desktop, in addition to PitchBook Mobile and the PitchBook Excel plugin.

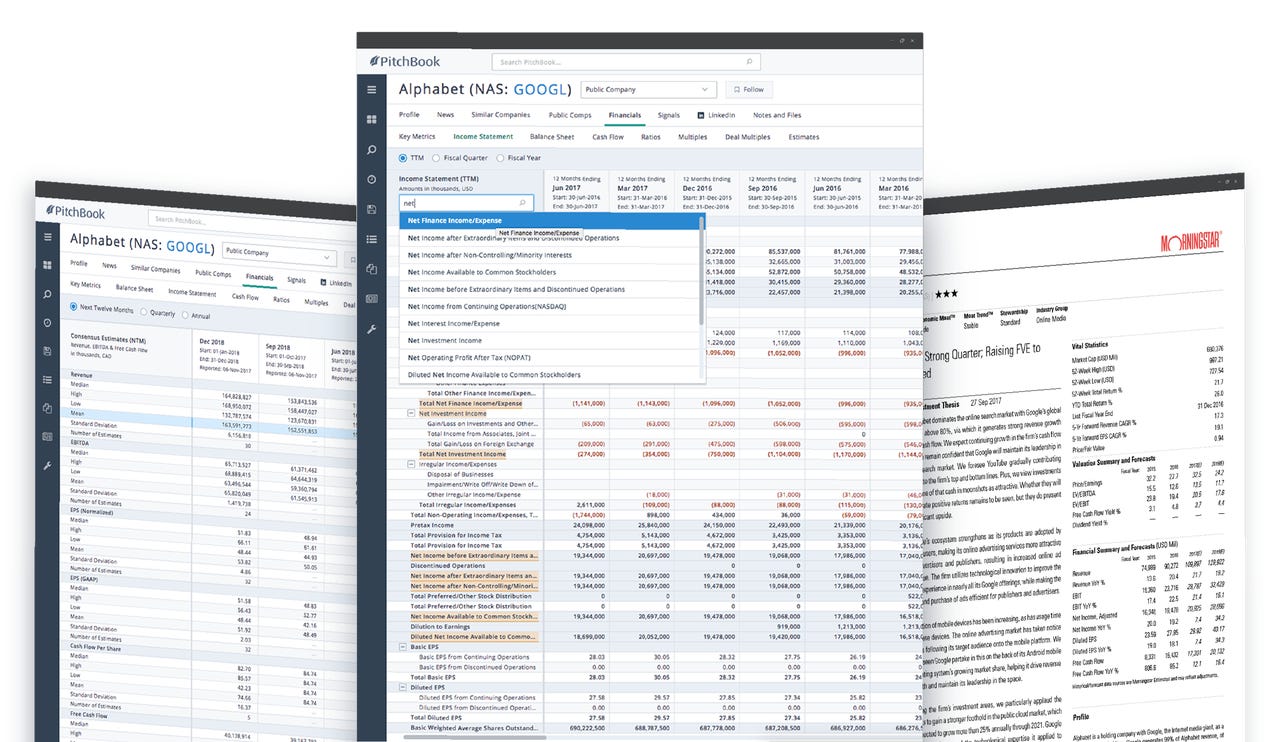

A Morningstar report, alongside PitchBook's user interface

But there's a bit more here than might at first meet the eye. Because in addition to its desktop, mobile and Excel front-ends, PitchBook also makes its data available via raw data feeds and API. And when you combine that fact with the the basic value proposition of using public data to benchmark private equity investment, this could be a data scientist's dream.

Think about companies like Betterment and Wealthfront. Their business models are premised around algorithmic investment strategies. That's got some serious cool-factor all by itself, but since it's based on publicly available market data, it is, in a sense, straightforward. But what those companies can do for individual investors in the public market PitchBook can at least start to do for venture capitalists and private equity investors.

Predictive outcome

What's more, the combination of public and private data creates the potential for predictive analytics come into play. If the performance of a private company can be evaluated via models built form the data of companies that have already IPO'd, then investors may be able to predict a company's success while to help them with investment decision making.

This isn't just a theory either; PitchBook's PR department told me that "investment and corporate development professionals are utilizing our data to create predictive models and trends across a market or industry, which allows them to make the best investment decisions possible."

And I would hazard a guess that for companies already invested in, such models could be used to monitor a portfolio company's performance and even suggest course corrections for better outcomes.

New normal

This isn't the type of news I would normally cover. But my gut tells me change there is afoot. Data analytics has impact on a growing number off fields and areas of specialization. And a growing number of industries and companies are having a greater impact on analytics, as those companies become data-driven and data-producing.

Data analytics, machine learning, and the tools used in pursuit of both will become increasingly relevant to conducting business, even when the business itself is focused on things other than analytics itself.