PwC report: Tech IPOs poised for comeback

2013 could be a much better year for initial public offerings in the technology industry, based on a new report from Pricewaterhousecoopers.

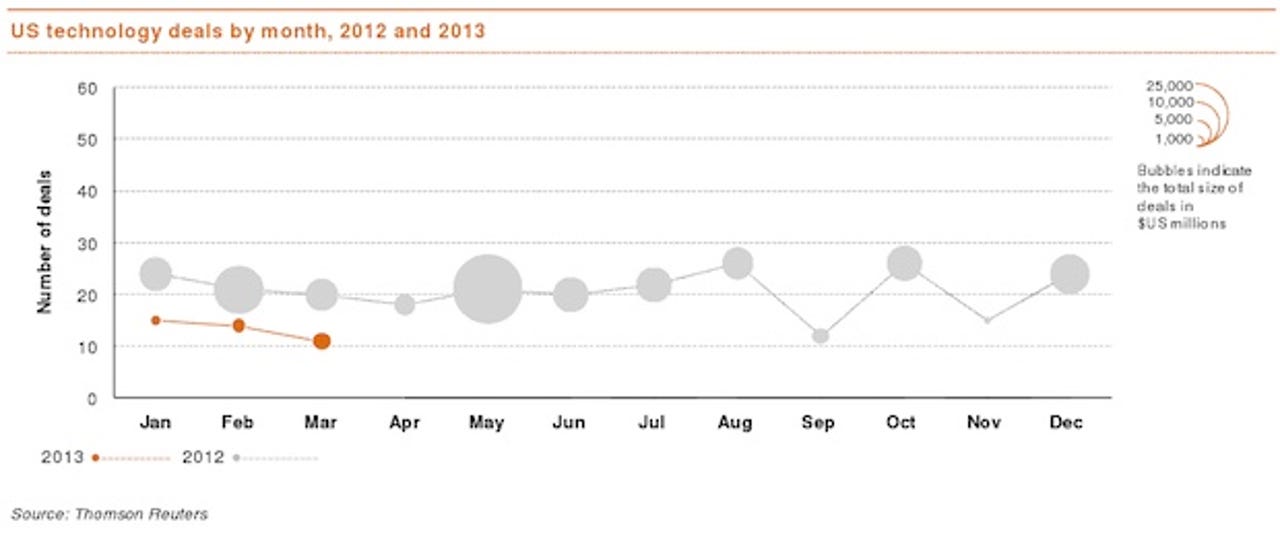

In its Q1 2013 Technology M&A Insights study, PwC found that tech M&As actually dropped abruptly to a 4-year low last quarter.

Nevertheless, they maintained a positive outlook for more robust deal activity ahead as political and economic uncertainties subside.

Despite some maelstroms surrounding consumer tech IPOs such as Facebook and Zynga, PwC analysts predicted better public debuts for tech companies this year.

Here's why:

As the markets rose, so too did the prospects for technology initial public offerings (IPOs), signalling that investors may have finally shaken off the jitters generated by Facebook's post-IPO 2012 performance. Seven technology IPOs were placed in the first quarter of 2013 with total proceeds of just under $1 billion, still below the volume and value of IPOs in the fourth quarter of 2012 but a strong start to the year. More importantly, these new listings registered a one-day average return of 27%, the highest of any industry. With new registrations increasing 41% in the first quarter, along with improved returns and high public filing activity late in the quarter, the technology industry may well be poised for a more active IPO market as the year progresses.

Based on last year's track record, enterprise software companies still seem to be a safe bet.

For example, Workday, which went public on the New York Stock Exchange in October, debuted at $28 per share -- already higher than previous expectations -- closing out the first day at roughly $50 per share.

More recently, Marin Software stampeded out of the gates with a smashing debut, jumping by at least 37 percent to $19.11 per share within the first few hours of trading.

Other key themes highlighted in the report include a rise among software mergers, which comprised of 53 percent of deal volume in the quarter.

Analysts also tracked record levels of cash on hand and high equity values, which they indicated point toward confidence in a rebound for tech deals in the quarters ahead.

Chart via Pricewaterhousecoopers