Salesforce.com: High maintenance costs are pushing customers to us

Salesforce.com delivered strong fourth quarter results that put CEO Marc Benioff in a more chatty mood than usual. The big takeaway: Salesforce.com is using high maintenance costs from big vendors like Oracle and SAP to its advantage.

First, the financial figures. Salesforce.com reported fourth quarter earnings of $13.7 million, or 11 cents a share, on revenue of $289.6 million, up 34 percent from a year ago. Wall Street was expecting earnings of 7 cents a share.

International sales were 28 percent of Salesforce.com's total. But more importantly deferred revenue rose $124 million from the third quarter to $594 million. Much of that boost is seasonal though as the company expects deferred revenue to fall in the first quarter.

Salesforce.com also provided a fiscal 2010 outlook that was solid (conference call transcript). The company is projecting annual revenue of $1.3 billion to $1.33 billion and earnings of 54 cents a share to 55 cents a share. Wall Street was expecting earnings of 50 cents a share. For the first quarter, Salesforce.com projected earnings between 10 cents a share and 11 cents a share on revenue of about $304 million to $305 million.

Now that Salesforce.com has officially hit the $1 billion revenue mark the fun really begins. The $1 billion mark for software companies is either just a hurdle to clear on the way to becoming a much larger company or an area where former fast-growing firms stagnate.

Indeed, Salesforce.com executives did note that invoicing patterns are being closely watched even though customers haven't altered behavior in the downturn. And Salesforce.com will now have to begin monitoring customer attrition. For now, attrition rates at Salesforce.com are less than 1 percent, but that's likely to increase in fiscal 2010, according to the company.

Nevertheless, Benioff highlighted a few key points on the earnings conference call.

Maintenance costs are a boon for Salesforce.com. Benioff said:

We added roughly 3,600 net customers during the fourth quarter to bring our total net paying customer count to more than 55,400. That's an increase of roughly 14,000 customers for the year, more customers than we added in our first six years of business.

These new customer additions are key to our growth strategy not only because they result in new business today, but because of their growth potential in the future. There's a common theme in the deals we won in the fourth quarter. Customers are taking a hard look at the maintenance payments that they're making to enterprise software companies and replacing those stagnant legacy technology costs with predictable scalable subscriptions in constant built-in innovation of cloud computing.

Whether it's our Salesforce CRM sales, customer services and support, or Force.com platform, customers are choosing the low cost, low risk, and fast results of cloud computing over expensive hardware, software, and data centers that burn through precious capital and yet rarely produce the promised returns. In face offs with Oracle, Microsoft, and SAP, customers moved to the cloud in record numbers in FY '09.

SAP and Oracle are the big targets for Salesforce.com (and the feeling is mutual). Benioff said he poached Oracle customers CMC, Canon, Corporate Executive Board, DeVry, Equinox, Axiom and beat Larry Ellison and the gang with CRM wins at Cigna Health, Epson and Williams Scotsman. Regarding SAP, Benioff said Salesforce won deals at Baker Hughes, AREVA, the Brady Corporation and Lennox International. Now rest assured Oracle and SAP have their wins against Salesforce.com too, but the message is clear. Benioff is pitching maintenance costs as a way to go SaaS.

Applications on the Force.com platform passed the 100,000 mark.

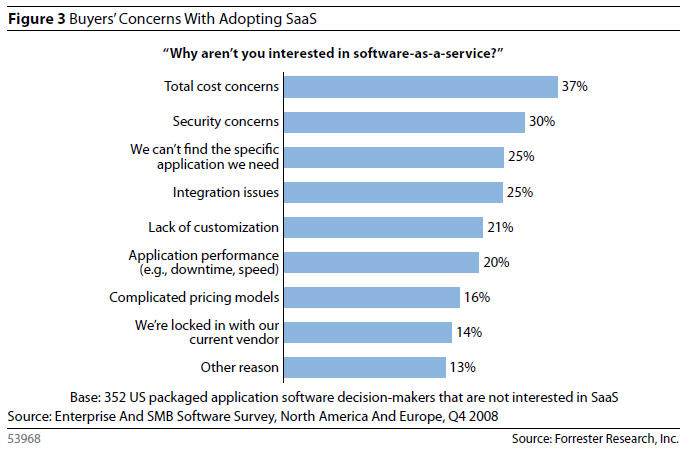

There is a bit of a disconnect here though. Salesforce.com is pitching lower costs for its services yet potential customers are worried about total cost of ownership and lock-in. You can get locked into a cloud as well as legacy software. Here's a look at Forrester Research's recent survey on SaaS:

Can Salesforce.com allay those worries and hit another billion or so in sales?