Salesforce.com: Pondering the next 10 years

Salesforce.com turns 10 Monday and in the last decade it has cemented its standing as a leading enterprise software vendor and leader of the software as a service and cloud computing charge. However, the next 10 years may be much more interesting.

Salesforce.com, officially launched in a San Francisco apartment March 16, 1999, finds itself at an inflection point. The company is posting solid financial results, saw fourth quarter sales jump 34 percent from a year ago and continues to poach customers who are sick of high maintenance costs. And the company is the first of its ilk to hit the $1 billion revenue mark.

The big question: Where does the company go from here? It has developed Force.com a platform for on-demand applications and a marketplace for software, but is largely a SaaS customer relationship management software firm (its ticker is "CRM"). Salesforce.com is increasingly targeting large enterprises---the playground of Oracle and SAP, two companies with a lot more sales resources. Here's a look at my five top unresolved issues for Salesforce.com in the years ahead:

Can Salesforce.com continue to grow at its current pace?

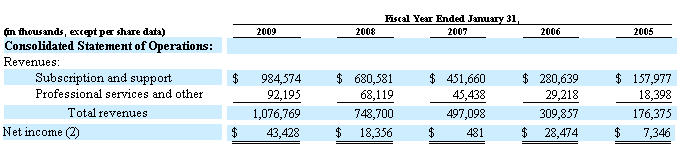

Here's a look at the company's financial results going back to 2005:As you can see the company has been growing at a rapid clip and it is projecting fiscal 2010 revenue of $1.3 billion to $1.33 billion. But it remains to be seen whether that pace can continue. Ultimately, the laws of large numbers catch up with companies. And while Salesforce.com isn't to the point where the growth figures will slow too much, the trip to $5 billion in revenue will require different techniques. The company currently has about 55,400 customers worldwide.

Salesforce.com's regulatory filings tell the tale (albeit in a boilerplate fashion):

Our recent revenue growth rates may not be sustainable and may decline in the future. We believe that period-to-period comparisons of our revenues, operating results and cash flows may not be meaningful and should not be relied upon as an indication of future performance.

In addition, SaaS purchases are becoming more scrutinized. In fact, some enterprises have determined that SaaS wasn't the way to go, according to a Forrester report.

Also see: SMBs to Salesforce: We want more SaaS

Does Salesforce.com need to develop a suite?

To date, Salesforce.com's success can largely be attributed to focusing on commodity software markets that lend themselves well to the on-demand model. The primary example of one of those commodity software markets is CRM. Salesforce.com has tried to expand its service via AppExchange, a marketplace for cloud computing apps that run on the company's Force.com platform.However, it's unclear whether that will be enough to build out a full enterprise suite.

A Forrester report recently highlighted bevy of enterprise software categories moving toward an on-demand model. Forrester handicapped what categories would be successful under the SaaS model.

Clearly Web conferencing and CRM are leading in adoption and growth. That's the good news. The bad news is that these two categories are the closest to hitting equilibrium and their eventual decline. The challenge for Salesforce.com is finding that new category before on-demand CRM growth slows.

Simply put, Salesforce.com needs to find a few new software categories. Does it need a suite? Forrester's data is mixed on the subject.

Human resources, collaboration and IT management have a high degree of success under the SaaS model. But ERP and supply chain management only has a moderate degree of success under SaaS, according to Forrester. Meanwhile, business intelligence---arguably the most important category in enterprise software---has a low chance of SaaS success.

Add it up and it's possible that Salesforce.com goes for the suite much like NetSuite has, but a far better option would be to develop HR, collaboration and IT management apps.

Here are the leading players via Forrester in each category where Salesforce.com could tap into new growth:

- Human resources: ADP, Plateau, SuccessFactors, SumTotal, Ultimate Software. Takeaway: Could be fertile ground for Salesforce.com to buy or build software.

- Collaboration: Atlassian, Cisco (WebEx), Daptiv, Google, IBM (LotusLive Engage), Microsoft (SharePoint). Takeaway: A very crowded space and few companies Salesforce.com could acquire.

- IT management: HP, Service-now. Takeaway: A possibility for Salesforce.com, but large players--HP and IBM--may wind up dominating.

In any case, Salesforce.com's mission will be to build new areas beyond CRM.

It's hard to box the big boys

One of the larger issues for Salesforce.com in the next few years will be competing with established rivals, notably Oracle and SAP, with more resources.Salesforce.com CEO Marc Benioff noted that the company was poaching customers from its largest rivals. On its last earnings conference call, Benioff said:

In face offs with Oracle, Microsoft, and SAP, customers moved to the cloud in record numbers in FY ‘09.

Meanwhile, Oracle Larry Ellison also has Salesforce.com in its sights. In December, Ellison said:

When we compete head-to-head with Salesforce we win more deals then we lose and that’s new in the last couple of quarters.

Toss in SAP and its BusinessByDesign SaaS effort and you have a multi-front war. The problem for Salesforce.com: This war is fought on the sales front lines and Benioff's army is outnumbered by a wide margin. Salesforce.com has 3,566 employees as of Jan. 31 and plans to expand sales and marketing activities. Oracle has 86,657 employees and SAP has 51,536.

Indeed, Oracle and SAP (all resources) dwarf Salesforce.com. In fact, Salesforce.com would be a fine subsidiary of either enterprise software giant.

Also see: Salesforce.com: High maintenance costs are pushing customers to us

SaaS vs. cloud computing platform

Salesforce.com may be able to avoid a lot of the Oracle and SAP pyrotechnics if it can position itself as a cloud computing platform. There was a not-so-subtle change during Salesforce.com's last fiscal year" It began referring to itself as a cloud computing company instead of an on-demand software outfit.See Feb. 25's earnings report:

Salesforce.com Announces Record Fiscal Fourth Quarter Results

First Enterprise Cloud Computing Company to Achieve Fiscal Year Revenue of One Billion Dollars

And the report from Feb. 27, 2008:

Salesforce.com Announces Record Fiscal Fourth Quarter Results

First Ever On-Demand Software Company to Exceed $850 Million Annual Revenue Run Rate

Salesforce.com's messaging points to the future, but in the present it's an on-demand software company. In its annual report, Salesforce.com acknowledges that "substantially all of our subscription and support revenue comes from subscriptions to our core CRM application services."

How that balance changes may dictate how the next decade goes for the company. The problem is that many other companies---Amazon, Google and Microsoft to name a few---are positioning themselves as cloud platform companies. Salesforce.com said in its annual report:

We believe that as enterprise software application and platform vendors shift more of their focus to cloud computing, they will be a greater competitive threat.

The other wild-card is enterprise demand for cloud computing. According to Forrester, only 5 percent of large enterprises have deployed cloud computing applications.

It's no wonder that Benioff is welcoming Microsoft to the cloud: The Windows giant could validate the movement.

Salesforce.com: A fine subsidiary of...

Given all the moving parts associated with pondering the next 10 years for Salesforce.com, we'd be remiss if we didn't ponder the company as a takeover target.Google could be a candidate to acquire Salesforce.com. The two companies are long-time partners and Salesforce.com could give Google some enterprise credibility.

Other potential buyers could also emerge, but Oracle would be among the most obvious choices to acquire Salesforce.com. Just the fact that Ellison mentioned Salesforce.com so much on the company's December conference call may indicate interest. He used to beat up BEA too---right before buying it.

Meanwhile, both Benioff and Ellison share a passion: They both like to give SAP hell. If you coupled Oracle's Siebel on-demand unit with Salesforce.com, you'd have the SaaS CRM market locked up to serve as a hedge to Ellison's more lucrative on-premise software business. At the very least, it wouldn't hurt to own your biggest threat.

So happy 10th birthday Salesforce.com. Now get back to work. Your next 10 years are going to be quite eventful.