Service & Reliability Survey 2010: introduction

If you've ever ended up on the wrong end of a disastrous IT purchasing decision you'll appreciate the importance of the research phase in the buying cycle. Matching product specifications to your requirements, reading independent reviews, quizzing sales people — all of these are important steps. Another valuable information source is the collective after-sales experience of fellow technology buyers. That information isn't easy to collate, though: you could trawl vendor forums, and anywhere else online where buyers vent their feelings, but it's a laborious process.

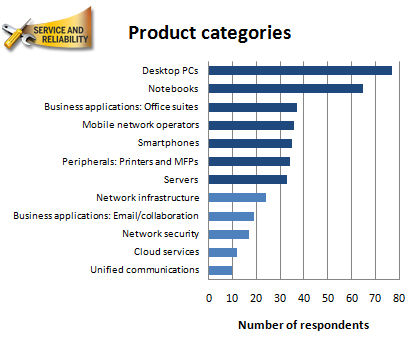

That's why we've conducted ZDNet UK's first Service and Reliability Survey, which quizzed our readers between October 2009 and January 2010 about their experiences with products in 11 categories (see details below). We asked which vendors they bought from, what tended to go wrong with the products, how the vendors rated in terms of product reliability and technical support, and — the key indicator of satisfaction — whether they'd be happy to purchase from their current vendor(s) again. We also took a sounding on the importance our readers attached to vendors' environmental policies — which includes clean manufacturing techniques, low power consumption and efficient recycling.

We hope you find the results helpful. If you feel the responses in some categories are on the sparse side, you know what to do the next time we ask for survey participation!

Survey vital statistics

We received contributions from 112 readers in total, who provided information on 11 product categories: desktop PCs, notebooks, smartphones, mobile network operators, servers, network infrastructure, peripherals, business applications, unified communications, network security and cloud services. Seven of these categories received data from more than 30 respondents:

'IT & Technology' is the most prevalent industry sector in the survey, by some distance, although there's an impressive spread of activities represented:

Our respondents reside on networks of all sizes; most are small to medium-sized, although a few are very large indeed (>10,000 users):

Forecasts for spending on technology over the next 12 months have a similar shape to the network size chart, as you might expect. Although 35 percent of respondents expect to spend less than £10,000 in the upcoming year, 12 percent plan on investing more than £10 million on their networks:

Most of our respondents participate in multiple stages of the IT buying cycle, although 20 report that they are 'not involved' at all. It's noticeable that the 'techie' tasks — evaluating, influencing and specifying IT purchases — rank higher than more 'clerical' ones like approving budgets and making the final decision: