Business

Software revenue chugs along; Microsoft remains top dog

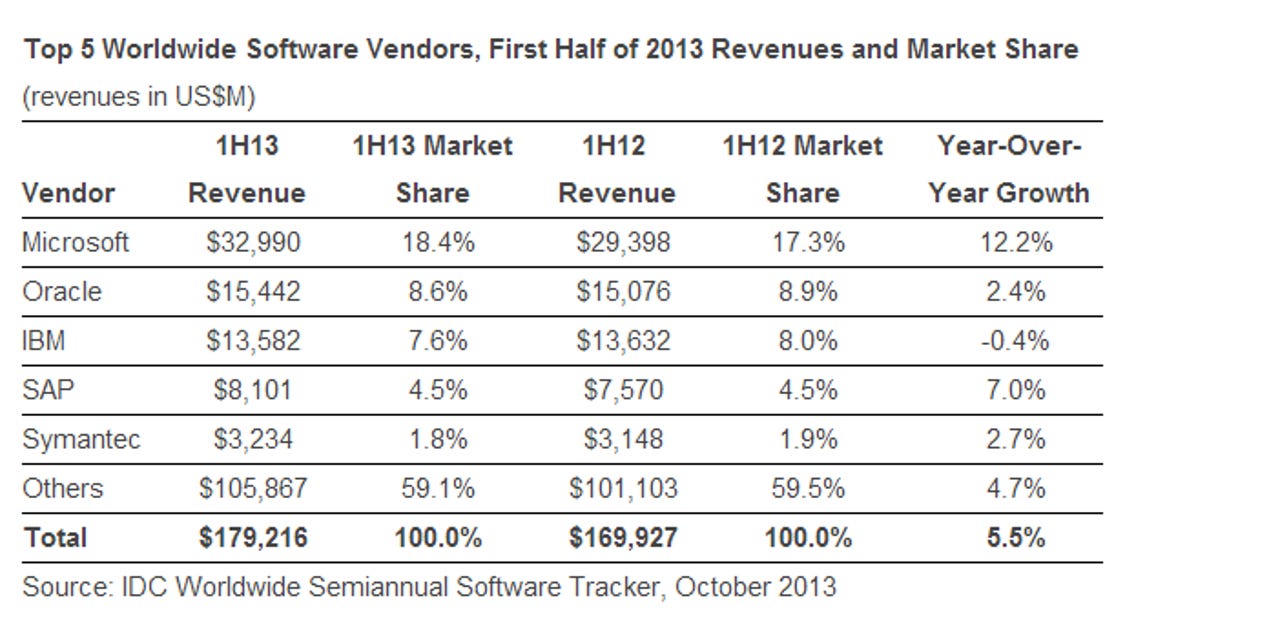

Microsoft is showing the best growth and remains the No. 1 software vendor. Oracle is No. 2 followed by IBM and SAP.

The global software market grew at a 5.5 percent clip in the first half of 2013 as big data, analytics and collaboration tools delivered sales surges, according to IDC data.

IDC expects software sales to grow for several more years at the current pace. As far as the standings go, Microsoft is showing the best growth and remains the No. 1 software vendor. Oracle is No. 2 followed by IBM and SAP.

The Evolution of Enterprise Software

One key point to note is that "others" still have the most market share at nearly 60 percent as companies such as Salesforce, NetSuite, Workday and a gaggle of others chase down the giants.

Among the key moving parts:

- The applications market grew at a 5.8 percent rate due to collaboration software. Enterprise social network software sales grew 28.3 percent in the first half from a year ago.

- Microsoft had 14.9 percent market share in the applications market largely due to content and collaboration applications.

- Intuit was a top 5 vendor in the applications market behind SAP, Oracle, IBM and Microsoft.

- Applications development and deployment accounted for 23.4 percent of total software revenue in the first half of 2013. The category had growth of 5.1 percent in the first half.

- Relational database management system sales grew 7 percent in the first half relative to a year ago. Oracle led the Applications development and deployment category with 23.1 percent market share.

- System infrastructure software showed growth of 5.1 percent in the first half. Microsoft led the category with 30.1 percent market share followed by IBM, Symantec, EMC and VMware.

- Latin America software sales jumped 8.6 percent in the first half followed by the U.S. at 7.9 percent. Western Europe software sales were up 5.1 percent and Asia/Pacific excluding Japan jumped 6.6 percent.