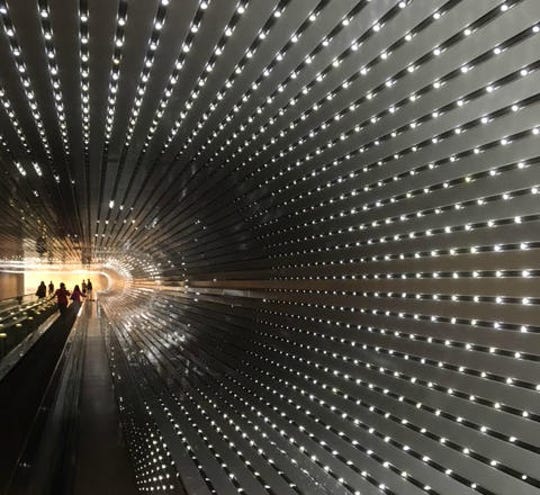

Some corporate tech spending disappears into black hole, survey shows

More than eight percent of corporate revenues (8.2% to be exact) is spent on information technology. The top three items receiving these funds include digital transformation, cybersecurity and cloud first or cloud migrations. However, due to lack of transparency and organizational inertia, a good portion of funding gets lost in a black hole.

These are some of the findings of a recent survey of executives by Flexera, which tracked IT spending patterns. More than half of respondents, 56 percent, say they expect to increase IT spend over the next year.

A lot of IT spending -- between 12 percent and 30 percent -- is wasted, the survey shows. "For a company with a $250 million IT budget, that can be as much as $75 million down the drain," the survey's authors estimate. Visibility into these spending soft spots is a challenge, cited by 61 percent of executives. In citing what they consider significant challenges to managing IT spend, 43 percent say they have too many manual processes, 38 percent say it's avoiding waste and 31 percent say it's understanding the cost of delivered services. Adding to the challenge is the fact that 26 percent of technology spending takes place outside of IT, in business units.

Along with eight percent of revenues, IT headcount represents nearly 14 percent of the workforce, the survey shows.

Greater visibility into various segments of IT spending is the key, but it's often difficult to achieve. The top three challenges in gaining visibility of IT spend are reporting on spend by IT business service (61 percent), collecting IT spend data (43 percent) and reporting on IT spend by application (38 percent).

The leading cloud technology or services providers cited in the survey include Microsoft, VMware, SAP, ServiceNow, AWS and Oracle. Close to two-thirds of executives, 65 percent, expect to increase their use of AWS in the next year, while 30 percent expect to decrease their use of Oracle in the next year.

Forty-three percent of respondents report their largest spend is with Microsoft, while 13 percent cited SAP and 10 percent cited AWS. Of the large vendors that offer on-premises software, SaaS and public cloud IaaS and PaaS solutions, Microsoft is the on-premises vendor with the largest adoption of SaaS (39 percent) and public cloud (25 percent).

In addition, although nearly half of respondents say their organizations are mature in maintaining software license compliance, less than one-fourth say they're mature in optimizing software license spend, identifying shadow IT and identifying wasted IT spend

The survey also shows cloud spend has surpassed on-premises software spend, with 22 percent going for on premises software and 25 percent for cloud, with seven percent for software as a service (SaaS), and 18 percent for IaaS and PaaS combined. Close to one-third, 32 percent, of workloads are already in the cloud, across SaaS, IaaS and PaaS, and cloud workloads are expected to increase to 43 percent in the next year