Square launches Market; leaps into e-commerce

It's safe to say that few knew just what Twitter co-founder Jack Dorsey was on to when he launched Square, the San Francisco-based mobile payments company that is slowly but surely upending the way businesses accept payments for goods and services.

With the company's Register product, which allows for payment using a smartphone or tablet computer, I've paid for cab fares in Orlando and popsicles in Philadelphia. I haven't used the company's Wallet product yet, but I've paid for things using a QR code on my smartphone before, so it's really just a matter of time.

Not content with digitizing the in-person payment process, the startup announced on Tuesday its third product, Market, which gives small businesses an aesthetically pleasing web platform for selling their wares.

"Shop online from neighborhood businesses all over the country," its website proclaims, "anytime, anywhere."

This is, of course, one of the Internet's promises, fulfilled: an online store to reach potential customers around the world.

For many years, though, small business had to grapple with registering a domain and setting up a website and maintaining it and all of the technical trouble that went with it. Small business owners had to make choices they weren't familiar with. They had to perform tasks that were far outside of their core competency. Many companies have tried to address this market—Microsoft's Office Live for Small Business comes to mind—but those efforts were broader in scope, to encompass businesses that had information to convey or goods to sell. And they still had to navigate building a website.

Square, true to its mission to simplify solutions to Apple-esque ends, is offering a marketplace that's strictly for selling goods—but also entirely mobile-native, from both the consumer's (shopping) and business owner's (management) standpoint. It essentially extends Square's reach beyond the physical point-of-sale, so that a business can be a Square customer regardless of the channel through which an order is made: in person, over the web, by mobile device. This unified approach makes sense for a small business that wants to focus on cultivating customers but not on the actual exchange of payment, and certainly positions Square to benefit as more and more commerce moves away from cash and toward clicks. (Or finger taps, as it were.)

It also pits Square directly against Amazon and its less elegant but far more etablished Marketplace.

There's no cost to set up or maintain a website in Market; Square is only interested in the money your business generates, and will take 2.75 percent of each sale for the privilege. (In comparison, Amazon charges $1 per sale for less than 40 goods per month and $40/mo. for more.) Critics of Square's other services say this charge is steep; others contend that the simplicity is well worth the price, and far less than what it would cost a small business to set up more traditional means of payment.

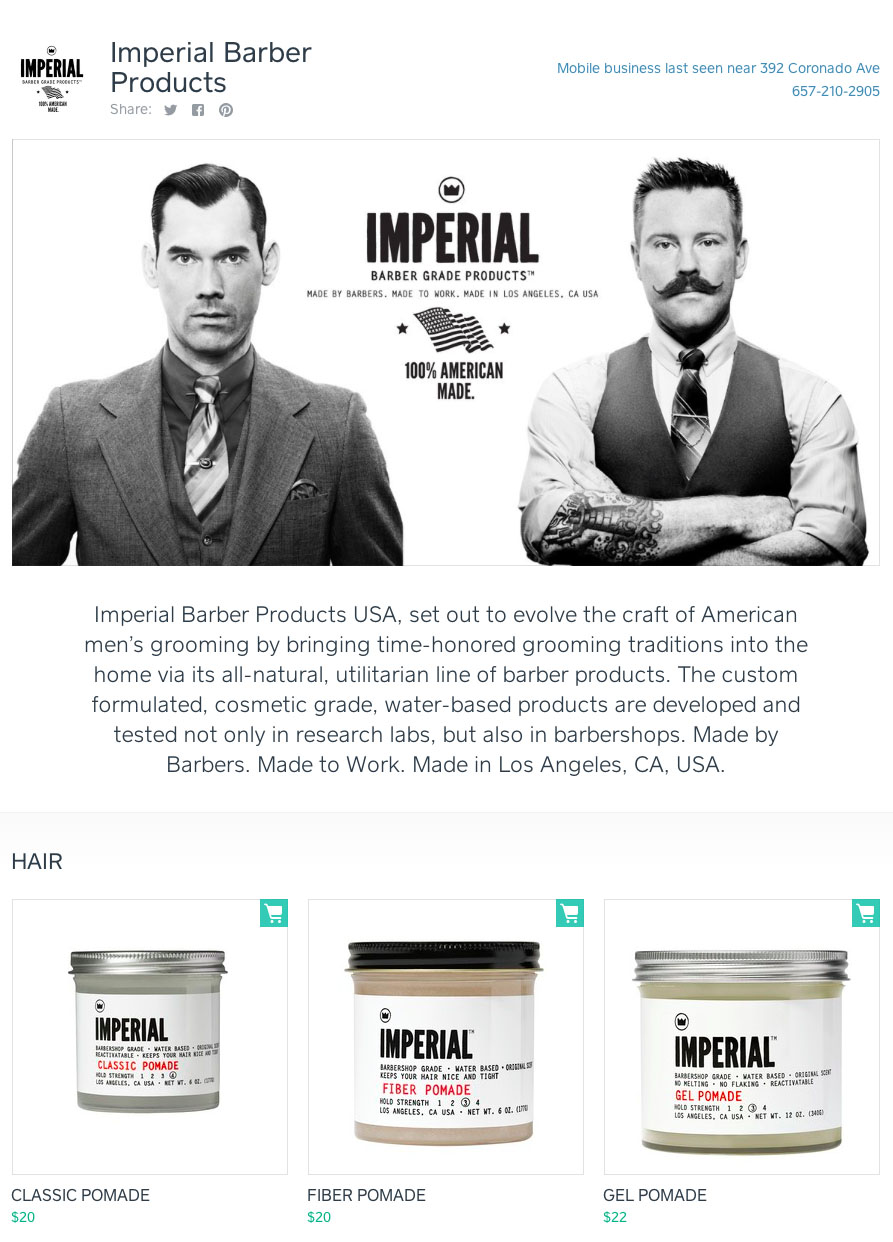

For now, Market is filled with the type of stores and products Square most wants to be affiliated with: vintage finds, picture-perfect pastries, personal grooming products with a sense of heritage, premium coffee—from small stores in hip and resurgent towns such as Oakland, Brooklyn, Austin, Seattle, Portland and St. Louis.

The company clearly has an image to uphold, though it's unclear just how many consumers will buy a $14 bag of coffee beans with a $9 shipping charge from a store they've never been to before. Still, the platform is there. There is money on the table.