Swipely payment platform adds CRM, analytics

Payment services company Swipely is launching an extensive update to its platform that adds deeper customer relationship management (CRM) and near real-time analytics into sales trends.

"It is difficult for small businesses to understand the core nuances, but we can help them derive better insight into anyone who plays with a credit card," said Angus Davis, founder and CEO of the company, which is based in Providence, RI.

Here are some of the specific things included in the "Winter '13" release:

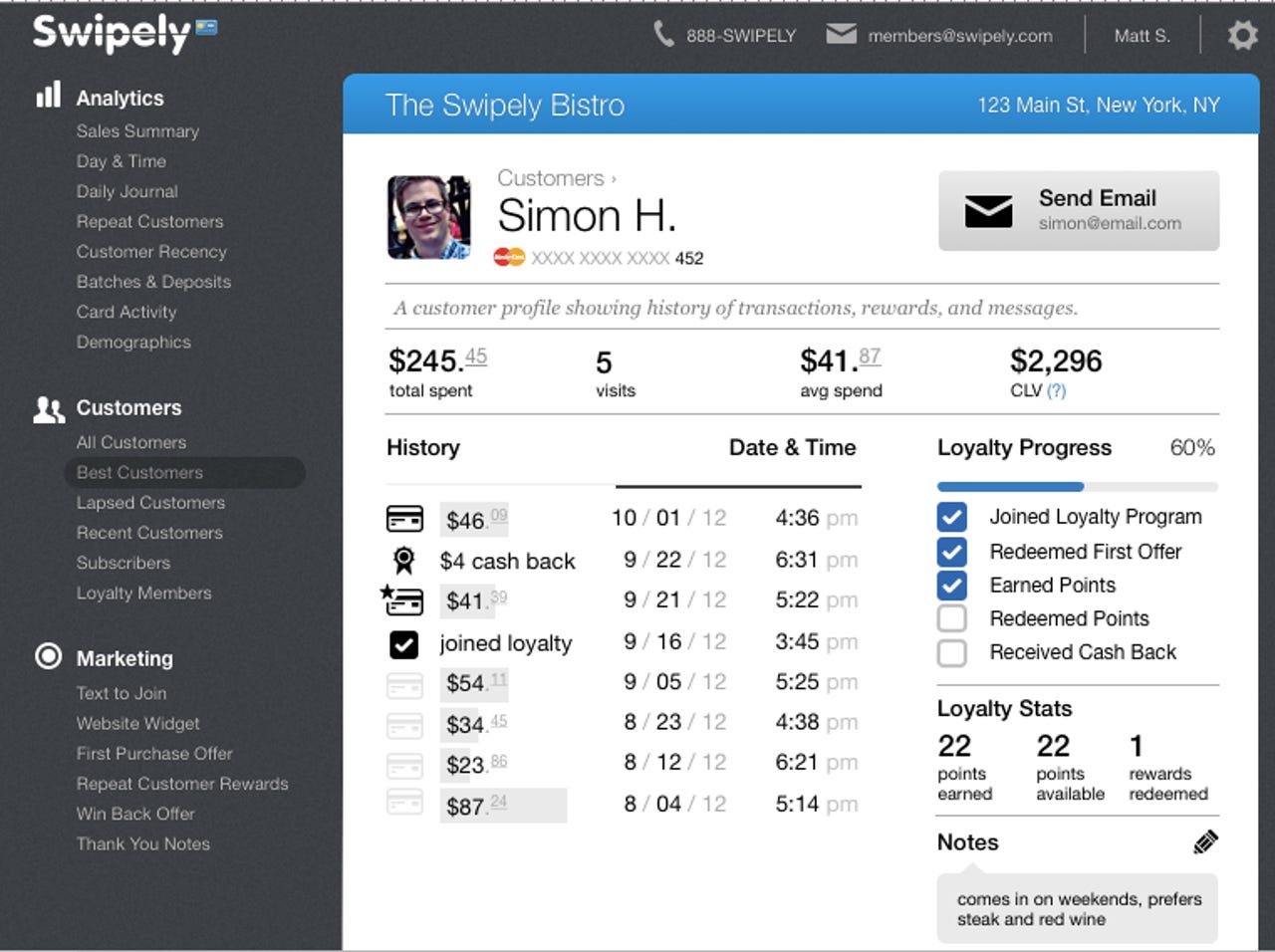

CRM – The service builds a profile for customers over time, helping merchants understand how a person is spending money, how frequently she or he visits, along with the time of day. This information enables owners to build promotions or offers that can be specific to that person. (The screen capture below shows the Customer Profile dashboard.)

Hourly Analytics – You can think of this as a "heat map" into sales trends on an hour by hour, near real time basis. This sort of data can help a store owner or manager determine whether it's worth adding a promotion spontaneously – for example, if the weather is really cold or warm, or whether certain items are selling well while others are not. (An example of the analytics is shown in the second screen shot below.)

Next-day Settlements – Swipely is, after all, a payments service first and foremost. So the company has updated how accounts are settled, moving to a next-day settlement schedule rather than the 30-day terms often associated with merchant accounts. It even does this with American Express, with which it has a new relationship. This feature can help improve cash flow by nearly $5,000 on average, according to Swipely's materials.

The upgrade is available immediately to existing Swipely customers – it currently manages about $250 million in sales on annual basis. The typical small retailer, restaurant or merchant using the service handles about $30,000 in monthly credit card sales.

The company dodges direct questions about pricing, but Davis said Swipely will match a small business's existing terms with merchant services processing companies. Based on the form you have to fill out to get pricing information, that probably depends on your company's average monthly credit-card sales volume and average transaction amount.