Symantec snags $500 million Silver Lake investment amid turnaround effort

Private equity firm Silver Lake will invest $500 million in security vendor Symantec, which will use the money to buy back shares and issue a $4 dividend to shareholders.

For Symantec, the Silver Lake investment was seen as a vote of confidence in the company's turnaround plans. Symantec said it will increase its buyback and shareholder return program to $5.5 billion. Symantec will also raise its dividends after the share of its Veritas storage unit.

Silver Lake managing partner Ken Hao will join the Symantec board.

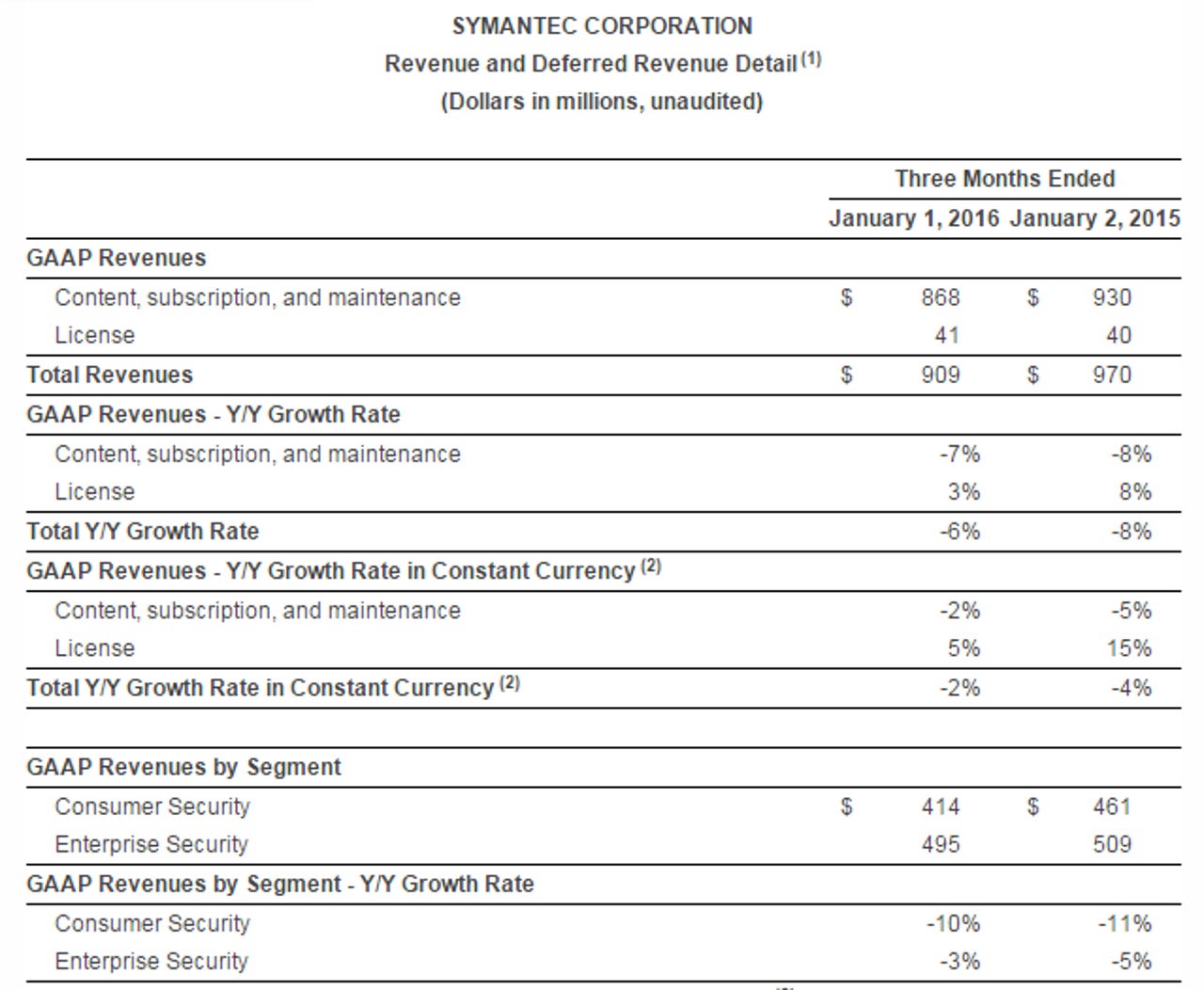

As for earnings, Symantec reported fiscal third quarter earnings of $170 million, or 25 cents a share, on revenue of $909 million, down 6 percent from a year ago. Non-GAAP earnings for Symantec were 26 cents a share.

Wall Street was looking for non-GAAP earnings of 24 cents a share on revenue of $905.8 million.

Symantec projected fiscal fourth quarter revenue of $885 million to $915 million with non-GAAP earnings between 24 cents a share and 27 cents a share. Wall Street was looking for earnings of 25 cents a share on revenue of $901.7 million.

The company said it expects its enterprise security business to continue to grow through the next fiscal year. Symantec is also aiming to save $400 million in costs by the end of fiscal 2018.