T-Mobile adds 1.8 million customers in Q1, becomes threat to wireless giants

T-Mobile added 1.8 million total net additions to its network and 1.1 million postpaid accounts in a push that should make it the No. 3 wireless carrier in the U.S.

With the move T-Mobile has transformed from a bombastic rival to AT&T and Verizon that could be dismissed to something resembling a real threat. Certainly, Sprint is going to have to worry.

T-Mobile's first quarter earnings report put up growth that's not common in the saturated wireless market. The company delivered a first quarter net loss of $63 million on revenue of $7.79 billion, up 13 percent from a year ago.

Related:T-Mobile extends benefits to businesses, launches simpler plans

The carrier's adjusted EBITDA was $1.4 billion, up 27.6 percent from a year ago. Postpaid churn was 1.3 percent in the first quarter.

In addition, T-Mobile upped its subscriber outlook for 2015 and now plans to add 3 million to 3.5 million net postpaid subscribers.

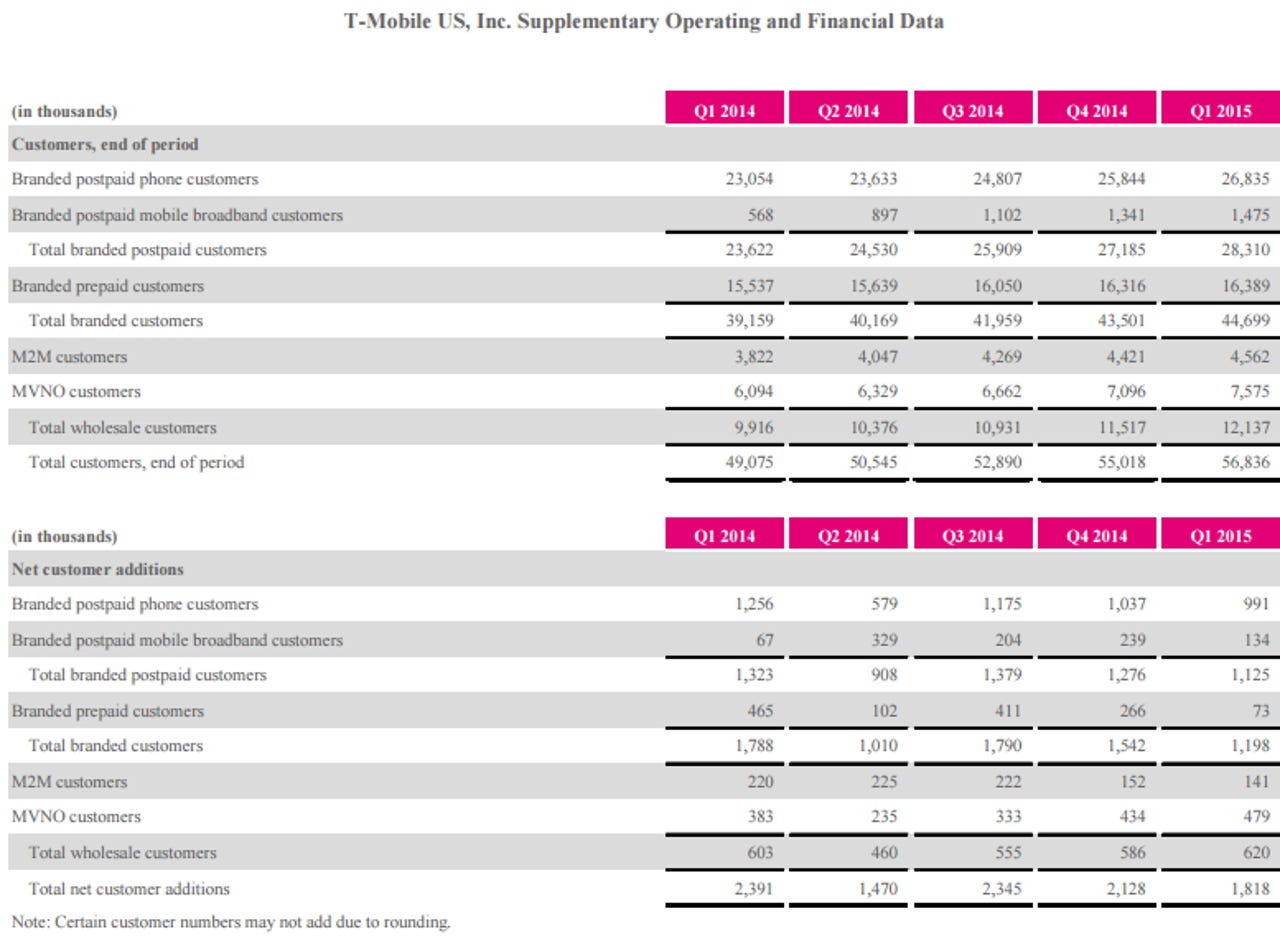

As CNET News' Roger Cheng noted, T-Mobile's growth in the first quarter should vault it to No. 3. Sprint and T-Mobile exchanged barbs over the subscriber counts last quarter. T-Mobile ended the quarter with 56.8 million customers at the end of the quarter. Here's the breakdown.

Add it up and T-Mobile's Uncarrier approach to plans and programs like Data Stash are working well. AT&T and Verizon aren't adding subscribers at the same clip T-Mobile enjoys.

For now, T-Mobile is planning to capture all the postpaid wireless growth in the industry.

Meanwhile, Verizon and AT&T are focusing on other wireless connections. AT&T has been adding connected cars and Verizon has upped its focus on the Internet of things.

On that front T-Mobile's M2M connections have been flattish. T-Mobile is going for consumers and now eyeing business accounts too and can make Sprint miserable for quarters to come.

Ultimately, Verizon and AT&T may be correct to focus on connecting things. After all, the saturated wireless market in the U.S. may be a scrum that doesn't make a lot of business sense.