Tech spending solidifies as hardware upgrade cycle takes hold

The technology recovery is well underway courtesy of a hardware upgrade cycle featuring PCs, servers, storage systems and peripherals, according to Forrester Research.

Forrester updated its 2010 outlook and made a few modifications. For starters, Forrester is predicting the U.S. IT market to grow 8.4 percent, up from 8.1 percent previously. Global IT spending will be 7.7 percent, down a bit from Forrester's previous estimate largely due to currency fluctuations.

From Forrester's report (blog):

In the US, we continue to see the strongest sectors in 2010 as computer equipment (up 11.1%) and software (10.5%). For computer equipment, replacement of old PCs, servers, and storage equipment is the main growth engine. For software, growth will result from a mixture of the revival of deferred licensed software purchases following the 2009 capital freeze, ongoing growth in SaaS software, and continued strong growth in Smart Computing platform technologies like service oriented architecture (SOA) infrastructure, virtualization software, and analytics.

A few facts and figures worth noting:

- U.S. business and government spending on IT in the U.S. will total $741 billion in 2010.

- Of that sum, software accounts for the biggest chunk with $194 million in spending. Broken down further, applications accounts for $88 billion; custom-built app spending will be $43 billion; middleware checks in at $52 billion and operating systems at $11 billion.

- Computer equipment spending will be $83 billion with PCs accounting for a $39 billion chunk.

- Communications equipment spending will be $108 billion.

- Telecom services outlays will total $191 billion.

- IT services and IT outsourcing spending will come in at $86 billion and $79 billion, respectively.

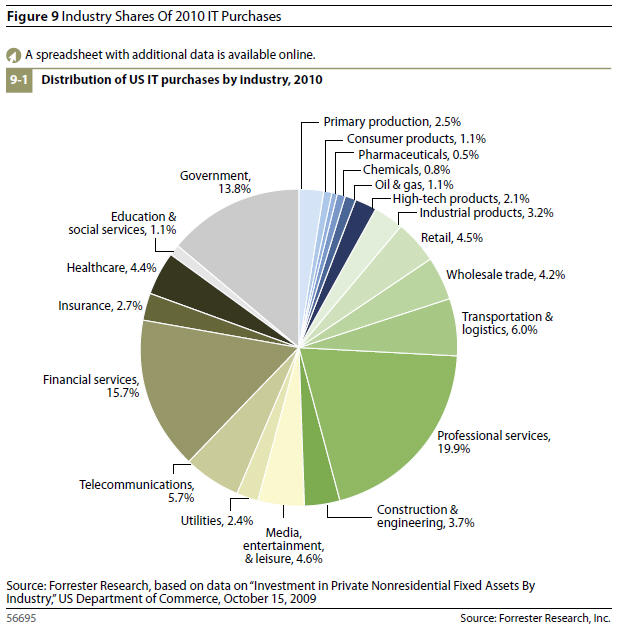

In the report, Forrester also laid out big IT spenders by category. Given the growth outlined Oracle big focus on specific industries makes a lot of sense. IBM, HP and others target specific verticals too. To wit:

- Manufacturing IT spending will grow 9.8 percent in 2010.

- Business services IT spending will jump 7.9 percent in 2010.

- The media, entertainment and leisure industry will boost IT spending by 10.6 percent.

- Utilities and telecom will raise IT spending at a 9 percent clip.

- Financial services and insurance companies will raise IT spending 11.4 percent.

- And public sector IT spending will gain 8.6 percent with healthcare and government outlays leading the growth.

Here's how this industry IT spending distribution looks in a flywheel: