The dawning of the age of mature entrepreneurs

The movies would have you believe that billion-dollar businesses sprout after a single, Jolt Cola-fuelled night of furious coding by a 20-something college dropout, lurking in the dark recesses of his parents' garage, which is sparsely illuminated by the cold, blue light emitted by his LCD screens.

But this is far removed from the reality of experienced professionals who quit corporate life to gradually grow a good idea into a sustainable business with the government's help.

The Australian Taxation Office (ATO) recently started refunding 45 cents for every dollar spent on risky and experimental research and development (R&D); a scheme that can be accessed by startups with no income — a tax-loss position — and revenues of under AU$20 million.

In one case, the R&D tax incentive salvaged a lifetime's work. Melbourne travel startup Adioso had virtually exhausted its investors' cash to develop a key feature of its travel search engine — a prototype that they planned to use to raise more funding. The founders tapped the R&D tax credit to stretch its last pennies, and were able to push the final product out to the web.

Developing a new model of research

On July 1, 2011, the Australian government redefined research. Previously, systematic investigative and experimental activities should have been either innovative or risky, but not both. Now, experimentation is key, shifting the focus from projects to activities: not what you do, but how you do it. It means that entrepreneurs have reopened their high school textbooks to explain their R&D in scientific terms — hypothesis, experiments, outcome.

Last year, 9,000 companies registered around AU$20 billion R&D spend, which provided AU$1.8 billion in tax relief. Big companies spend the most on R&D, but smaller companies make up the lion's share of participants.

TCF Services lodges R&D tax-incentive claims for about 50 software companies. Specialist Andrew Flick said that the founders they service are primarily over 30, have worked in their target industry, and apply a business-to-business (B2B) sales model.

"They were all young, and at some point they were probably all very talented, young programmers at some point. Quite a few of them probably started their businesses in their 20s, but a lot of their businesses are more sustainable now — so they have more capital and money behind them, and they're willing to spend that money and take a risk," Flick said. "They're beyond the point of doing a sweat equity-type startup, because they have those resources to draw on."

He said that the R&D tax incentive navigates the product versus business balance, which unsettles some entrepreneurs.

"I think it's business focus versus a product-focus mentality. I think younger people tend to have more of a product focus, but the R&D is very much a business-focus kind of thing: it's like doing your tax at the end of the year.

"They're both required to be successful," Flick said. "If you don't have a good product, the business is not going to be that great — and if you don't have a solid business, you won't be able to feed the resources to develop a great product. That's what the R&D tax is about: feeding resources into the company to be able to build a better product and get it out into the market."

Maturity comes of age

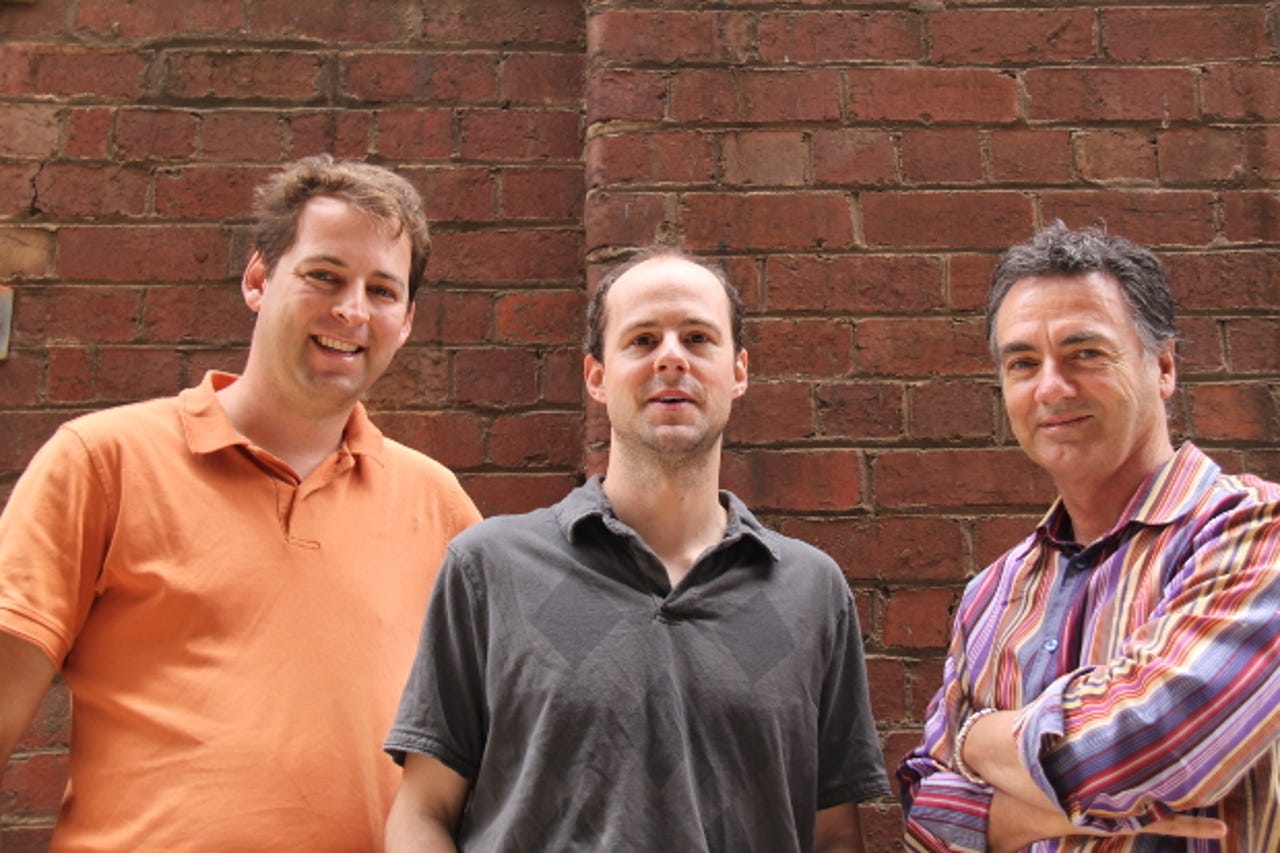

The tension between product and business defined the early struggles of Rome2rio co-founders Michael Cameron and Bernie Tschirren. They are now applying for the R&D tax refund for the costs spent to develop their "multi-modal" travel search engine, which navigates users from point A to point B using various forms of transport. Much like a Rome2rio search result, the founders' journey to this point has not been direct.

Cameron and Tschirren founded Rome2rio in 2010, when they quit their engineering jobs in Microsoft's Bing search group and developer tools group. They repatriated to Melbourne from the software giant's campus in Redmond, Washington, and upon their return pursued the traditional route to create a startup, diligently coding in a garage without any sales efforts. However, this approach failed to bring in the revenue.

They appointed long-time adviser Rod Cuthbert as CEO, who convinced them to ditch their consumer focus to avoid the unwinnable war against entrenched online travel booking giants.

"The one thing that Michael and Bernie got right is they understood they were engineers, and engineers are not business people," Cuthbert said. "They understood in order to launch themselves on the world, they needed to complete the team, and there are a lot of engineers out there who don't get that, and I think entrepreneurs have to be wary of that."

The B2B strategy targeting web travel businesses resonated with several investors, including the founders of RetailMeNot, who earlier this year plugged AU$450,000 into Rome2rio. Part of the founders' pitch to investors was that the R&D tax incentive would multiply the value of their dollar.

Cameron believes that it qualifies for the R&D tax-incentive claim based on development tweaks that return search results faster and with greater accuracy, as well as its efforts to replace the Google Maps API with a in-house, open-source geocoder. He said that the technology doesn't exist.

"You start very naive — 'oh yeah, I'll build a product, get it out there, everyone will love it, and I'll be really rich' — but about six months in, you realise the reality: it takes quite a while to build a substantial, high-impact, profitable business. You're relying on investors to fund this large project, and you're going to want to utilise grants to reduce your burn rate."

Cameron completed a PhD before he learned the discipline to persevere with the red-tape-strewn application process.

"People were advising us, 'Hey, check out this grant program, these government grants really do work,' but we heard it a few times before it really sunk in, and then we decided to investigate.

"I think some entrepreneurs — maybe they're younger entrepreneurs — just don't take that advice onboard. 'Oh, grants, that sounds like a lot of hard work; sounds really boring; I'd rather just keeping working on what I'm doing and building my product.'

"Perhaps a younger Michael Cameron may not have listened as much. He may have networked as much, but he may not have taken on as much advice.

"It takes a lot of discipline to say, 'OK, this is something really worth pursuing, I'm going to set aside some time for it,'" said Cameron. "I guess you get that discipline with age and maturity."

The return of the tech journeyman

99designs foundation investor Leni Mayo has just started to evaluate the R&D tax incentive as a resource to multiply the value of his and his partners' investment dollars in a host of other startups.

The R&D tax incentive offers "free money" to the savvy, established companies that have spent at least AU$20,000 on development and associated costs. It allows experienced professionals — developers who have accumulated a large amount of company shares over time — to try their hand at entrepreneurship. But for the garage entrepreneur, building a business using sweat equity, it remains beyond their grasp.

"We've been there before. As co-founders, we were running around trying to build a business, trying to find products ,customers, markets, and all that. Applying for the R&D grant was not a priority," Mayo said. "The main reason is that people just don't have the headspace or time to look at this.

"We were advised that you should have spent at least AU$30,000 on development — which excludes sales and all the rest of it — and that you really want to be spending at least AU$60,000 to AU$70,000," said Mayo, who is evaluating the merits for SitePoint spinoffs Learnable and Flippa.

"Realistically, how is someone under 25 going to get that money for their startup?" he said. "For an older developer that's saved some money, or cashed out some stock, then it could be an opportunity."

Mayo passed through every part of the Australian startup supply chain. He oversaw 99designs' spinoff from the discussion forums of developer education website SitePoint to the world's number one design competitions website, which netted it US$35 million from Silicon Valley venture capital (VC) firm Accel Partners.

The tax credit effectively multiplies the value of an investment, extending it to the "sweet spot" of 18 months to two years of development. It mitigates the risk, and entrepreneurs and investors share the benefits.

"Less than 18 months is too distracting for management team, because if it's a bit short, you come back to raise more money — more than two years is too long to demonstrate the value. Between one and two years tends to be the number, and part of that quantity of runway can be bought through the R&D credit.

"The company is effectively getting the same amount of money, but giving up less equity. Investors also get more of that value; they're putting in half or two thirds of the money they would put in. Because [investors] put in less money, then they're willing to take on more risk, and they can invest in more companies because you distribute the risk."

The sweet spot of entrepreneurship.

The tax credit's risk-mitigation effects could invigorate Australia's historically prudish investors.

"Australia is very different to Silicon Valley," Mayo said. "In Silicon Valley, you can raise money on an idea — in Australia, even if you have a prototype, it's still very difficult, unless you're someone with a great track record. There has to have been some evidence of traction, revenue, or users, providing quality to investors; it's very hard."

Younger entrepreneurs should capitalise on the incentive, TCF Services' Flick said, especially if they've just secured their first seed funding.

"It's really tax-free money, it's available there, there's a few hoops to jump through, but they're not insurmountable."

For the mature entrepreneur, such as Rome2rio's Cameron, the credit is a "means to an end."

"The quick 'let's rush something into production, let's move to Silicon Valley,' that sort of approach probably doesn't lend itself as well to government grants, which do take a while to apply for, get accepted and then utilise.

"When I was younger, would I have the discipline to go through the grants process? Probably not. It's less about generation, and more about maturity through experience in life.

"The downside, though, is that [as] you get older, you're not as quick. You're not going to pull those all-nighters working till five in the morning getting your prototype up; you're more married with children; it's just not your lifestyle anymore. Certainly, you lose some of that youth and agility, but you gain that experience. There's a sweet spot, somewhere in your 20s and 30s, and then it becomes harder to do your startup."