The state of Internet TV: Consumers may pay for content; Aggregators win

Bernstein's annual consumer survey reveals that folks may be interested in cutting their cable connection for sites like Hulu, but are unlikely to make the move. Meanwhile, consumers may even pay up for professional content.

Those takeaways were the high level items in a report from Bernstein analyst Jeffrey Lindsay. The survey, based on more than 500 consumers, is used by Lindsay to justify his questions about YouTube's business model.

Among the findings:

- Thirty five percent of respondents said they would contemplate cutting their cable connection over the next five years. Lindsay writes:

Only a relatively modest 35% of respondents said they might contemplate cutting their cable connection over the next five years – again this under-indexes the share of the U.S. population who typically say they will consider cutting their cable or satellite connection in the next 5 years for other reasons – mostly cost-related. Interestingly, in this survey the major consideration was not cost, but rather increased content choice. Of the 35% who are contemplating "cutting the cable", only 28% (or 10% of the total) said that cost would be the major consideration.

Also see: The cure for YouTube's ills: Charge for uploads

- Internet TV viewing appears to be a "second screen experience" as 74 percent of consumers view content on their computer monitors without connecting to the TV. In other words, Internet TV doesn't supplant the traditional stuff.

- Hulu appears to have the best model now that it has three of the four major networks on board. In fact, Lindsay reckons that Hulu is the only legitimate threat to cable distribution.

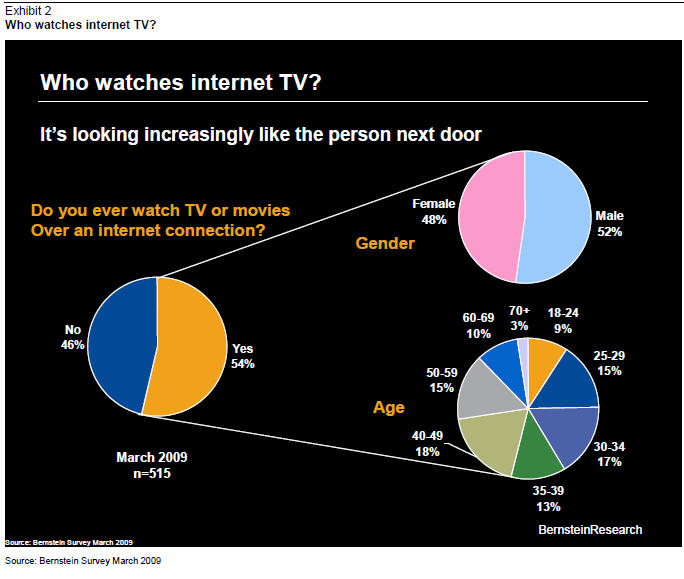

- Internet TV viewers skew younger, but increasingly match the U.S. population overall. Overall, the demographics of cable TV and Internet TV viewers are roughly the same.

- Aggregators rule Internet video distribution, but surprisingly search engines don't.

- Surprisingly 35 percent of consumers said they would pay for professional video content.

- In addition, these consumers don't mind ads overall.

- Add it all up and the shakeout in video appears to favor the aggregators. Here's how Lindsay sees the pecking order developing.

And the winning models.