Twitter makes strong IPO debut, now real work begins

Twitter made its public market debut and shares surged, but the real work is just beginning for the company: It has to fill out its potential and business model.

Shares of Twitter were trading at $46 or so, up 77 percent, from its offering price of $26.

Unlike Facebook, Twitter didn't grab ever dollar available and aim for perfect IPO pricing. As a result, Twitter enjoys better headlines, a return for those investors in at the offering price and a little bit of a glow.

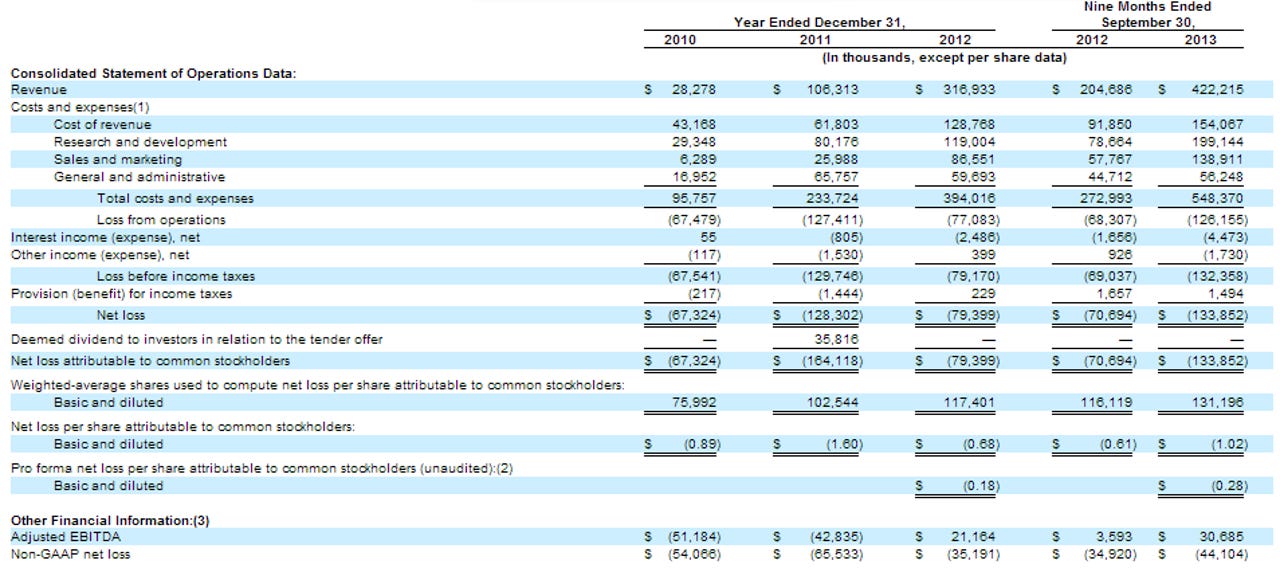

But let's get real: Twitter isn't as mature as Facebook was when it went public. Twitter lost $133.8 million for the nine months ended Sept. 30 on revenue of $422.2 million. The company's business model, which largely revolves around promoted tweets, is also a work in progress.

In Facebook's latest quarter, the company showed its monetization potential and looked like a company that knew the balance between growth and profits.

If all goes well, we'll see something similar from Twitter. After all, Twitter will have to grow into its current market valuation of more than $30 billion.