UK will enjoy rapid growth in VR, gaming, video streaming and internet spending in the next four years, reports PwC

The headlines from PwC's UK Entertainment and Media Outlook for 2018-2022...

PwC has predicted that the UK's entertainment and media sector will enjoy a compound annual growth rate (CAGR) of 3.2 percent over the next four years, and be worth £76 billion by 2022. The growth will be technology led, with virtual reality (VR) growing fastest from a very low base. Some sectors will see declines, including newspapers and magazines.

In the report, Mark Maitland, PwC's UK Head of Entertainment and Media, says: "The main drivers of growth will be the technology and digital companies, which are redefining the competitive playing field to the point where the borders that once separated entertainment, technology and telecoms are dissolving to create a third revolution of convergence."

Internet access - mobile phone data and broadband - will be the biggest element in consumer spending, and will reach £17bn a year by 2022. PwC predicts that "the UK will overtake France as the biggest spenders in Europe on internet access".

PwC says: "Last year, for the first time, consumers spent more on mobile internet access than fixed broadband access. PwC now expects smartphone ownership in the UK to hit more than 70 million and, as a result, mobile internet access is forecast to account for more than half of overall internet access revenue in four years' time."

Data consumption will grow by 22 percent CAGR to 57 trillion megabytes in 2022, says PwC, thanks to superfast broadband. It says that "video will account for over 80 percent of data traffic over the next five years with the popularity of services such as Netflix, Amazon Prime Video and Sky's digital offerings fuelling traffic, as well as the BBC's iPlayer."

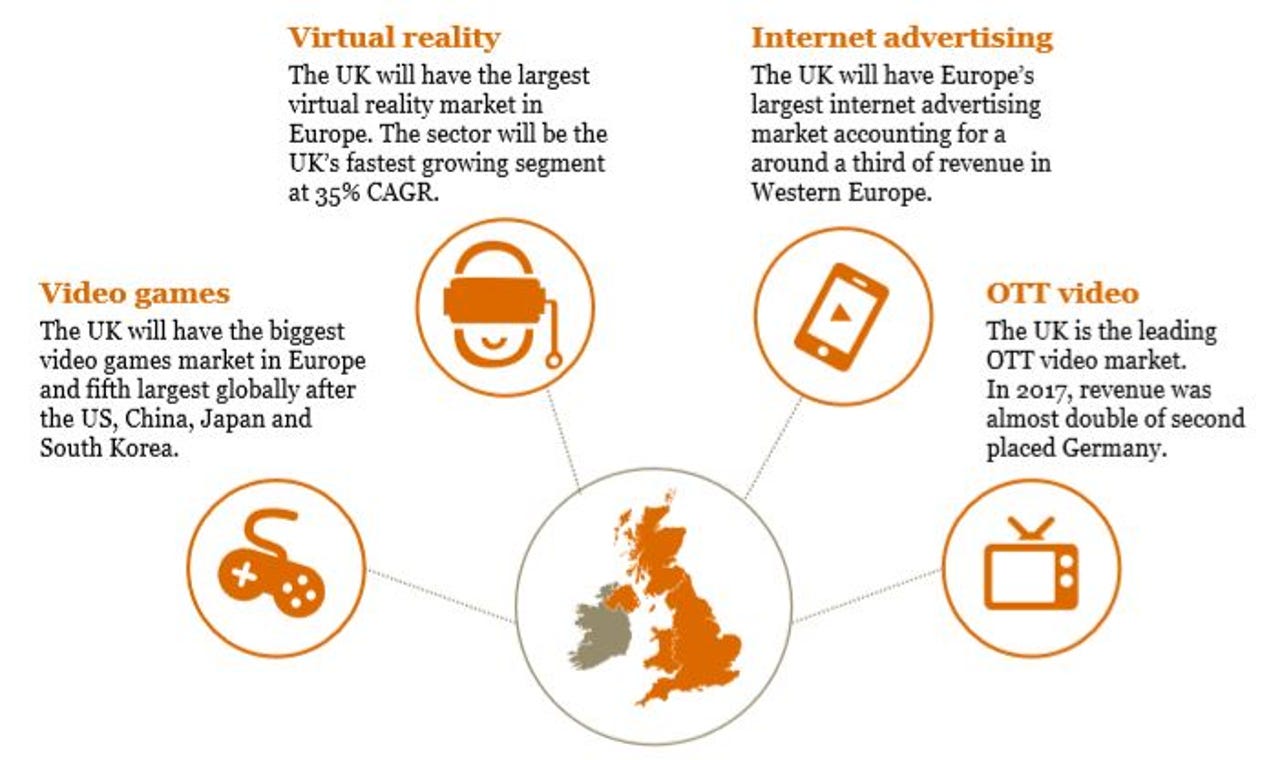

PwC reckons that "the UK will maintain its position as the largest video games market in Europe and for the first time, we forecast digital game purchases for consoles to overtake physical game purchases for consoles." If it grows at the forecast 6 percent CAGR, the market will be worth £5.5bn in 2022.

While PwC notes that the UK is the fifth-largest consumer gaming market by total revenues, it remains "well behind the four top markets of the US, China, Japan and South Korea".

PwC is bullish about VR, which it reckons will have a CAGR of 35 percent and reach £1.2bn by 2022. "Gaming revenue will stay comfortably in front with 59 percent of the total," it says.

If PwC is correct, there will be 7.8m VR headsets in the UK by 2022. This compares with a predicted 55.1 million active VR headsets in the USA.

PwC also expects the UK to maintain its position as the largest OTT (over the top) video streaming market in Europe. In 2017, UK spending of £1.3bn "was almost double that of second-placed Germany". Globally, the UK is fourth behind the USA, China and Japan, with the US market being worth $20.1 billion in 2017.

Conversely, PwC expects the UK's subscription TV market to fall by -0.8 percent CAGR to £8.9bn in 2022, putting the UK behind Germany.

However, PwC expects the UK will continue to dominate the Internet advertising market, which will grow by 7 percent CAGR from £11bn in 2017 to £15bn in 2022. PwC is predicting strong growth in mobile advertising, particularly in three sub-segments: "paid search, display and, most significantly, video".

For comparison, PwC expects the Internet advertising market in the USA to grow at a 7.7 percent CAGR to $127.4 billion in 2022.

Most of the UK data has been extracted from PwC's Global Entertainment & Media Outlook 2018-2022, which includes data from 15 market segments across 53 territories. It is continuously updated, and access is sold on an annual subscription basis.

Global growth rates from PwC's Global Entertainment & Media Outlook 2018-2022 suggest that the UK market's developments are following trends....