Understanding the enterprise startup lifecycle

The millennium-era dot-com bubble showed how easy it was to found a technology-led company -- and the bubble's inevitable puncture also provided an object lesson for venture capitalists and other investors who allowed the torrents of internet-related hype to affect their standards of due diligence. Now, as the world economy emerges from the banking-crisis recession, the tech investment climate is looking increasingly healthy: the likelihood of another Boo.com is slim, and the emphasis has shifted from high-burn-rate consumer plays to enterprise startups like Cloudera (big data), Workday (human/financial capital management), New Relic (software analytics), MobileIron (enterprise mobile management), Nutanix (storage virtualisation) and Docker (application containerisation), among many others.

Such companies may be less 'sexy' than headline-grabbers like Oculus VR (Facebook-owned since March 2014), but they're the ones likely to take today's SMAC (Social, Mobile, Analytics, Cloud) era to the next level.

But what is the typical lifecycle of an enterprise startup? We examine this, first in general terms and then with reference to the fortunes of companies that have been mentioned in 'startups to watch' articles since 2010.

The startup lifecycle

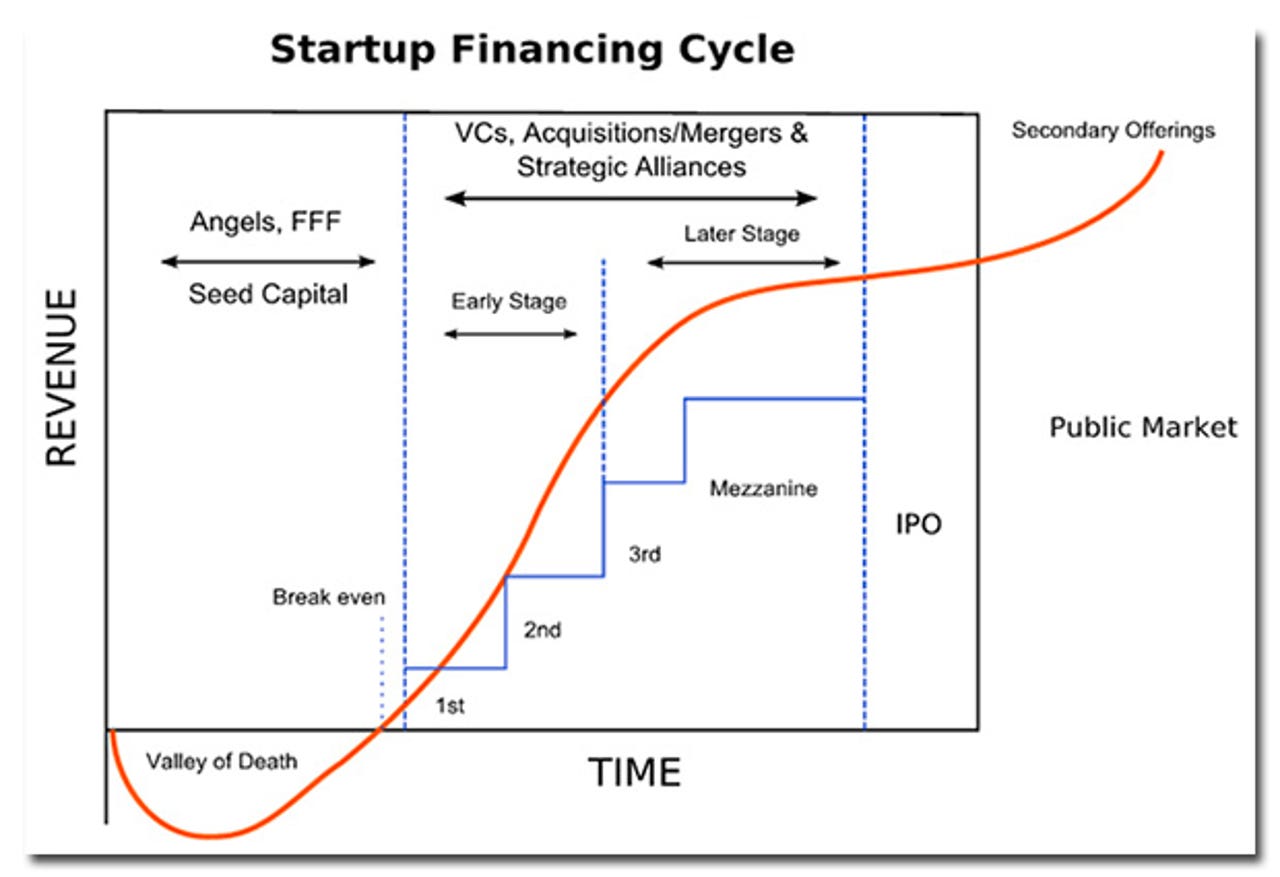

Getting a business off the ground and into profitability, and then either growing to become a thriving independent company or implementing an 'exit strategy' -- being acquired or going public -- typically involves a number of stages, outlined here:

Businesses can obviously fail too, and this is most likely to occur in the early stages, when the company is funded by seed capital, angel investors and/or 'friends, family and fools' (FFF), and is yet to generate significant revenue (see the Valley of Death, above).

Assuming the business survives to break-even, various early-stage and later-stage financing rounds may then be negotiated, allowing first- and subsequent-generation products to mature and hopefully penetrate their markets. Many promising companies are acquired during this period; if they're not, the next major milestone is often the IPO (Initial Public Offering), following which, all being well, a healthy share price provides existing private investors with a tangible return. Not all IPOs go as planned, however, and many startups choose to remain in private hands if they have the means to finance their growth plans. Occasionally, public companies return to private ownership -- the most notable enterprise-tech example being Dell, which implemented a $24.4 billion leveraged buyout in February 2013.

Enterprise startups

We've noted that enterprise startups are inherently less sexy than their consumer counterparts -- but what are the particular distinguishing features of the enterprise market that startups need to be aware of?

Enterprise technology is generally, by definition, mission-critical -- hardware, software, services and connectivity that businesses need in order to function. This leads to a degree of (understandable) inertia in the IT department: even if a company's incumbent ERP vendor, for example, is delivering a suboptimal combination of functionality and pricing, the CIO is likely to think long and hard before switching to an upstart newcomer. It's a big undertaking, and the business's core operations are at stake -- and the bigger the company, the harder it's likely to be for an enterprise startup to get a foot in the door.

But change does happen, of course, because enterprise startups that deliver the right technology at the right time, and at the right price, can disrupt even the most entrenched status quo. Companies like Google (founded 1998), VMware (1998), Salesforce (1999), Facebook (2004) and Twitter (2006), and services like AWS (launched 2006), were startups not so long ago -- and yet they (and others) managed to forge today's enterprise technology landscape and flourish under the noses of giant incumbents such as Microsoft (founded 1975), IBM (1911), HP (1939) and Oracle (1977).

Once they have detected which way the wind is blowing, those giant incumbents usually seek to maintain their positions by acquiring promising enterprise startups (for some of whom this is the preferred 'exit strategy' from the outset). Notable recent examples include Microsoft and social networking platform Yammer (2012), IBM and cybersecurity company Trusteer (2013), HP and cloud computing platform Eucalyptus (2014), and Oracle and talent management software firm Taleo (2012).

Today's SMAC-dominated IT landscape emerged from developments in virtualisation, internet connectivity and software/service delivery (SaaS, IaaS, PaaS), allied to continuing hardware commoditisation, miniaturisation and consumerisation. This allowed new technology to be introduced to businesses under the traditional IT-department radar (business units trialing SaaS and other rentable cloud services, for example), making it easier, in theory, for enterprise startups to gain a foothold. Once that foothold has been gained, these startups will flourish if they themselves can become 'incumbent' (but inherently more flexible) technology suppliers that CIOs are loath to dislodge without good reason.

The key hurdle for enterprise startups is likely to be their ability, or otherwise, to add large enterprises to the SME and mid-market customer base they will typically rely on in the early stages of their lifecycle.

Where are the 'hot enterprise startups' now?

To get an idea of the enterprise startup lifecycle in practice, we examined a selection of 'enterprise startups to watch'-style articles published between 2010 and 2014 and noted the following metrics: the number of times each startup was mentioned; the company's founding date; its area of operation; whether it has been acquired, gone public, gone out of business or remains independent; and details of its funding (data from CrunchBase).

Here are the summary statistics:

| Number of startups | Average founding date | Number now out of business | Number now acquired | Number now public | Number still private | Average funding raised ($m) | Average number of funding rounds | Average number of investors |

| 130 | 2007 | 2 (1.5%) | 20 (15.4%) | 8 (6.2%) | 100 (76.9%) | $109.24 | 4 | 7.5 |

| data range | 1996-2013 | $0.42 - $1,200 | 1-12 | 1-34 |

We noted 130 different 'enterprise startups to watch', founded between 1996 and 2013 (average 2007), 100 of which (76.9 percent) remain in private hands at the time of writing. Only two (1.5 percent) have gone out of business (both in 2013) since being flagged as promising startups -- ARM server chip vendor Calxeda and travel shopping/pricing engine Everbread.

There have been 20 acquisitions (15.4 percent of the sample), nearly half of which (9) have taken place this year. The most acquisitive company is VMware with three purchases (AirWatch, Nicira and Wanova), followed by Salesforce (Buddy Media and RelateIQ) and Google (Divide and Firebase) with two each.

The economic climate was not conducive to IPOs in 2010 and 2011, so it's no surprise to find none in our sample for those years. There are eight IPOs in total (6.2 percent of the sample), with just one in 2012 (Workday), four in 2013 (FireEye, Marin Software, Nimble Storage and Veeva Systems) and three so far this year (HubSpot, MobileIron and Zendesk).

When it comes to funding, the amounts raised vary widely, ranging from $418,500 (MyBuilder) to $1.2 billion (Cloudera), averaging out at $109.24 million. The enterprise startups in our sample received four rounds of funding from between 7 and 8 investors on average, although again there is considerable variation (see table above). The funding pattern for an enterprise startup will depend critically on the nature of the business, how quickly it can move into profitability and its growth strategy, among other factors.

The enterprise startups that got repeated mentions in the roundup articles we examined are all familiar names, headed by Cloudera, Box, GitHub and Pure Storage:

| Company | Number of mentions | Business | Number of acquisitions |

| Cloudera | 4 | big data analytics (Hadoop) | 3 |

| Box | 3 | cloud storage, file sharing | 6 |

| GitHub | 3 | code hosting | 2 |

| Pure Storage | 3 | enterprise flash storage | 2 |

| Acquia | 2 | social publishing (Drupal) | 3 |

| Atlassian | 2 | collaboration | 5 |

| Big Switch Networks | 2 | software-defined networking | 0 |

| Blue Jeans Network | 2 | video as a service | 0 |

| Erply | 2 | retail inventory & e-commerce | 0 |

| Hootsuite | 2 | social media management | 9 |

| Huddle | 2 | collaboration | 0 |

| Lithium Technologies | 2 | social customer management | 4 |

| MongoDB | 2 | big data analytics (NoSQL) | 0 |

| Numecent | 2 | cloud paging | 1 |

| Okta | 2 | identity & mobility management | 0 |

| Puppet Labs | 2 | IT automation | 2 |

| Roambi | 2 | mobile business intelligence | 0 |

| SugarCRM | 2 | customer relationship management | 0 |

| Workday | 2 | HR & finance management | 1 |

| Zuora | 2 | recurring revenue management | 0 |

As the above table also shows, several of these leading enterprise startups have themselves made multiple acquisitions -- notably Hootsuite (9), Box (6), Atlassian (5) and Lithium Technologies (4). Such activity is a good indication that these companies are 'stayers' (to use a horse-racing analogy): indeed, all of these startups have been the subject of recent IPO rumours (especially Box, which filed for an IPO in March and is widely expected to go public in 2015).

Predicting 2015's winners

The leading enterprise startups listed above all have significant track records and can be expected to continue to flourish, either as private or public companies. But where are the new 'stars' of tomorrow? We've found a couple of 'enterprise startups to watch in 2015' articles, which are summarised here (source articles from Tech Cocktail and TechCrunch, data from CrunchBase):

| Company | Business | Founding date | Funding raised ($m) | Number of funding rounds | Number of investors |

| ChowNow | online ordering tools for restaurants | 2012 | $7.70 | 4 | 5 |

| DataRPM | business intelligence | 2012 | $5.90 | 2 | 3 |

| CirroSecure | cloud security | 2013 | $1.40 | 2 | 1 |

| Skubana | e-commerce portal | 2013 | $0.75 | 1 | 1 |

| KEYPR | hotel management | 2013 | $1.30 | 2 | 1 |

| ElasticBox | flexible cloud app deployment | 2011 | $13.60 | 3 | 5 |

| Zimperium | intelligent mobile security | 2010 | $8.00 | 1 | 5 |

| ZenPayroll | payroll management | 2011 | $26.10 | 3 | 26 |

| OneLogin | SSO & identity management | 2009 | $17.70 | 2 | 2 |

| Conjur | cloud app management | 2011 | n/a | 1 | 2 |

| Illumio | datacentre & cloud security | 2013 | $42.50 | 2 | 3 |

| RelateIQ | relationship intelligence platform | 2011 | $69.00 | 4 | 11 |

| average | 2012 | $17.63 | 2.3 | 5.4 |

These much younger companies (average founding year 2012) offer services aimed at verticals (restaurants and hotels), line-of-business operations (business intelligence, e-commerce, payroll management, customer relationship management) and IT infrastructure (datacentre, cloud and mobile security; cloud app deployment and management; and SSO and identity management).

Although we examined around 140 different enterprise startups in this article, that's a mere drop in the ocean of creativity and funding that's flowing into this sector. Not all will survive or prosper, of course, but there's every chance that the next Google or Amazon is currently in the early stages of the enterprise startup lifecycle.