VC funding in third quarter falls off pace; Early stage deals stable

Software companies regained the No. 1 spot for venture capital investing in the third quarter as big dollars for cleantech companies dried up, according to the MoneyTree Report.

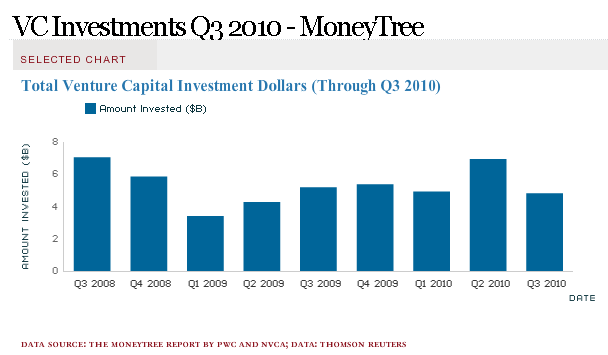

The MoneyTree Report, penned by PriceWaterhouseCoopers and the National Venture Capital Association shows that third quarter VC funding fell 31 percent in dollars and 19 percent in the number of deals from a strong second quarter.

In the third quarter, VCs invested $4.8 billion in 780 companies. That's down from $6.9 billion in 962 deals in the second quarter. In the third quarter a year ago, VC funding was $5.2 billion. Early-stage funding was stable and represented 35 percent of all VC deals. Seed rounds accounted for 11 percent of total deals.

What happened? The second quarter featured a bevy of large founds for cleantech companies and the third quarter didn't. However, all industries saw a slowdown in investment.

Among the key data points:

- Software companies garnered $1 billion in funding in 190 rounds in the third quarter. That's down from $1.1 billion in 242 rounds in the second quarter.

- Biotech landed $944 million in 108 deals, down 32 percent in dollars from the second quarter.

- Cleantech funding was more than halved in the third quarter. In the third quarter, cleantech funding was $625 million, down 59 percent from the second quarter. There was a lack of large rounds overall.

- Internet companies landed $661 million in 154 deals in the third quarter, down 25 percent from the second quarter in dollars.