ASC subsea cable to go live mid-2018 as Vocus announces AU$1.5b net loss

Vocus Communications has announced that it will be completing the Australia Singapore Cable (ASC) subsea cable system ahead of schedule, with services expected to be launched in July 2018.

Initially planned to launch in September next year, Vocus said that despite adding a spur to Christmas Island, the subsea cable will be ready to go live in less than a year, ahead of competitor cable systems Indigo and Trident.

"We've been able to achieve the earlier date through condensing the program of works," Vocus Group CEO Geoff Horth explained during the company's FY17 financial results presentation on Wednesday morning.

"The Vocus and Alcatel build teams are familiar with each other, having worked together on the successful delivery of our North West Cable System, which has facilitated the shorter timeframe for completion."

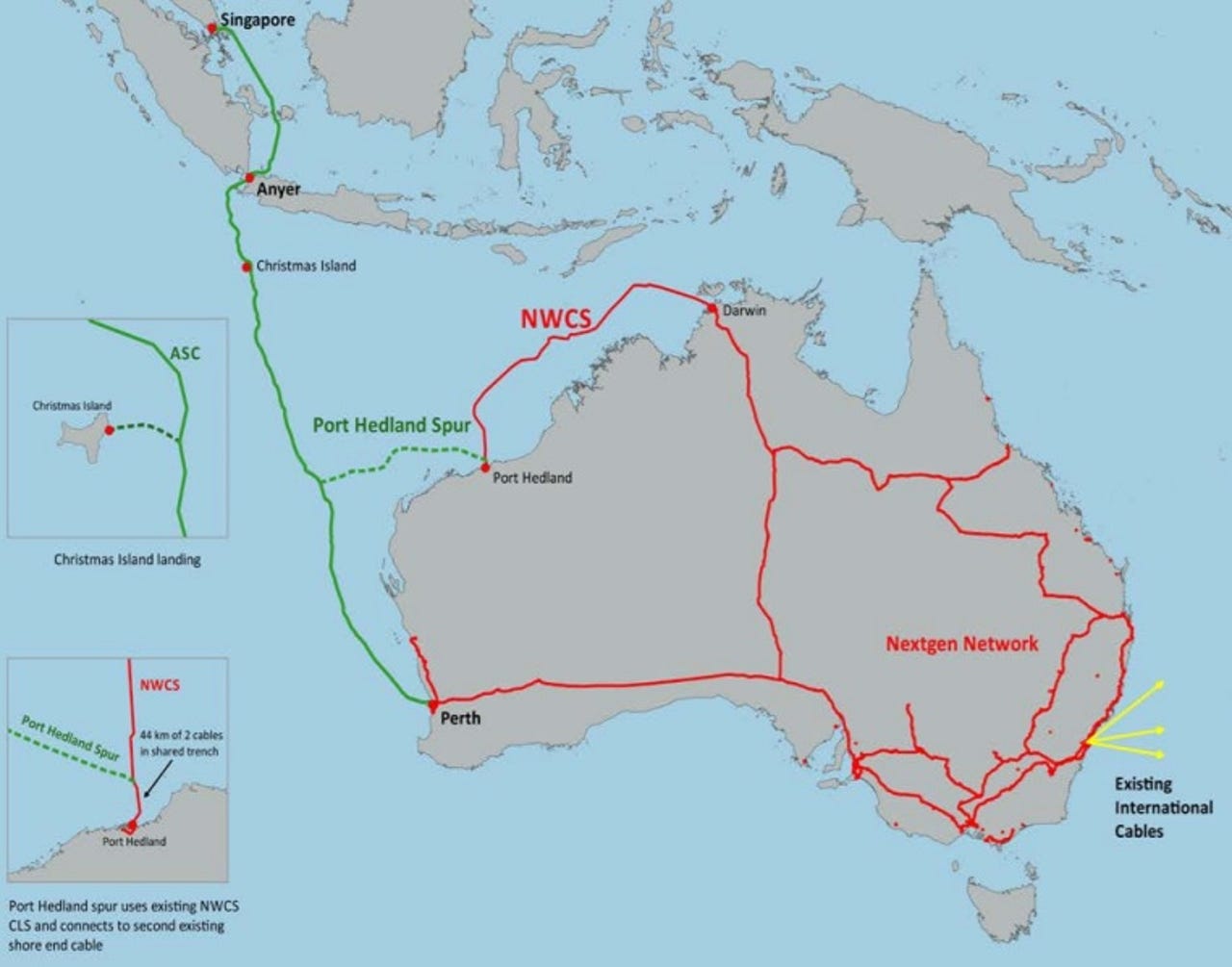

Vocus signed Alcatel-Lucent Submarine Networks in December to help build the 4,600 kilometre ASC, which is designed to carry 40Tbps at a minimum across four fibre pairs.

According to Vocus, the ASC is the only submarine cable system to have all landing party permits and approvals in both Indonesia and Singapore, and to have a "ready and waiting" fibre network across Australia that's able to transport traffic from Asia to all Australian capital cities, with construction now under way at the landing sites in Singapore, Indonesia, and Perth.

The marine route survey and full system design have been completed and the marine transmission system manufacturing is "in full swing", Vocus said, with 50 percent of the work done on the marine cable, 80 percent on the land-based electronics and power systems, and 40 percent on the subsea electronics systems.

Originally a 50-50 joint-venture deal between Vocus and Nextgen Networks, the ASC will connect Perth with Singapore and Indonesia at a cost of AU$170 million.

Vocus subsequently purchased Nextgen Networks for AU$700 million in June 2016, paying an additional AU$27 million for the ASC and AU$134 million for the North West Cable System (NWCS).

The $139 million 2,100km fibre-optic NWCS went live in September last year.

Vocus' full-year financial results saw a turnaround in its FY16 net profit of AU$64.1 million to a net loss of AU$1.5 billion for FY17 due to "higher than forecast net finance costs and a higher effective tax rate", along with what Horth called "a more competitive business environment" in both Australia and New Zealand. Underlying net profit was AU$152.3 million.

Statutory earnings before interest, tax, depreciation, and amortisation (EBITDA) was AU$335.5 million, up 72.7 percent -- while underlying EBITDA, not including significant items during the year, was AU$366.4 million, up 70 percent.

Revenue grew by 119 percent year on year to AU$1.8 billion, while net debt increased by 35 percent to AU$1.03 billion and is expected to climb even higher, to up to AU$1.06 billion for FY18.

All three of Vocus' business arms grew over the period, with Enterprise and Wholesale Australia making AU$702.5 million in revenue, up 77 percent; Consumer Australia making AU$795.1 million, up 176 percent; and New Zealand making AU$323 million, up 123 percent.

For Enterprise and Wholesale Australia, M2 wholesale contributed AU$185 million during the 12-month period, while Nextgen contributed AU$127.1 million between October 26, when the acquisition completed, and June 30.

Datacentre revenue was down slightly from AU$44 million to AU$42 million; on-net buildings grew from 3,037 to more than 5,000; and Vocus' fibre network leaped by more than 1,000 percent to over 30,000km thanks to the Nextgen acquisition.

In the Consumer Australia segment, 49 percent of revenue came from broadband, 27 percent from energy, 11 percent from voice-only customers, 7 percent from mobile, and 6 percent from Fetch subscriptions, which more than doubled to 30,568 customers, and other sources.

Consumer Australia broadband services in operation (SIO) grew by 4 percent, to 547,000; energy SIOs grew by 10 percent, to 161,000; and mobile SIOs fell to 163,000. Vocus' National Broadband Network (NBN) market share excluding satellite now stands at 7.3 percent, up by almost 1 percentage point over the year, while NBN average revenue per user (ARPU) was AU$64.23 per month as of June 30.

Lastly, Vocus' New Zealand business gained 61 percent of its revenue from data, 16 percent from voice, 13 percent from fibre and Ethernet, 4 percent from energy, and 3 percent from mobile.

In New Zealand, mobile SIOs grew from 19,000 to 21,000, while both DSL customer numbers and SMB SIOs remained the same, at 51,000 and 21,000, respectively.

Vocus connected 18,664 Ultra-Fast Broadband (UFB) SIOs during the period for a total of 45,000 UFB customers and UFB market share of 13 percent, up by 2 percentage points over last year. Broadband ARPU was down slightly, to NZ$71.21 per month.

M2 NZ contributed AU$163.6 million during the 12-month period and acquired Switch Energy, moving Vocus' energy SIOs from 2,000 to 5,000.

"The underlying result reflects another strong year of growth for Vocus, however it was not at the level we anticipated at the beginning of the financial year and we are working through a number of projects to address this," Horth said.

"The FY17 year and in particular 2HFY17, has been a period of transition as the business has focused on the completion and integration of Nextgen, and the implementation of business plans that will maximise returns and leverage the infrastructure platform and operational scale that has been created through recent acquisitions."

Vocus additionally announced that chair David Spence will be retiring from the board on October 24.

On Monday, Vocus had announced that takeover proposals were terminated from Kohlberg Kravis Roberts & Co (KKR) and Affinity Equity Partners after its board decided to "conclude the sale process" due to the company's positive outlook for FY18.

"Throughout the due diligence process, the bidders indicated support for management's strategic plans and transformation program," Vocus said.

"However, the bidders have now advised that they are unable to support a transaction on terms acceptable to the board. Accordingly, all discussions have now ceased."

The company, which merged with M2 a year and a half ago to form the third-largest telecommunications provider in New Zealand and the fourth-largest in Australia, worth more than AU$3 billion, had in June received KKR's initial takeover proposal to acquire 100 percent of its shares at a price of AU$3.50 per share via a scheme of arrangement.

Vocus then allowed KKR to conduct due diligence to explore whether a binding transaction could be agreed upon last month, subject to Vocus' net debt not exceeding AU$1.1 billion as of June 30, EBITDA being between AU$365 million to AU$375 million, and its existing asset base maintained.

Affinity then submitted a takeover proposal in July to acquire 100 percent of Vocus' shares at a price of AU$3.50 per share via a scheme of arrangement to be paid in cash.

The proposals followed Vocus revising its guidance for the 2017 financial year in May, with revenue down by AU$100 million, underlying EBITDA down by between AU$65 million and AU$75 million, and net profit down by AU$45 million to AU$50 million. Vocus' net debt is expected to be between AU$1 billion and AU$1.1 billion.

CFO Mark Wratten had expressed confidence that Vocus would be able to hit its revised guidance.