Western Digital to buy SanDisk for $19bn

Western Digital is to buy fellow storage supplier SanDisk for around $19bn.

The deal marks the largest consolidation in the storage market to date.

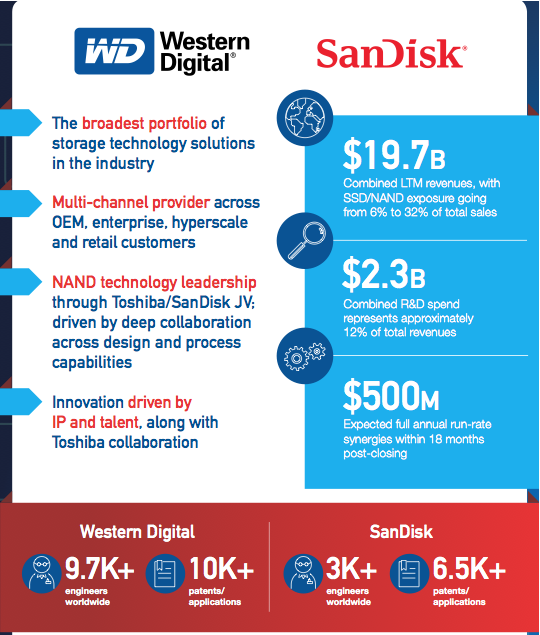

Western Digital said the deal will double its addressable market and expand its position in higher-growth segments, in particular non-volatile memory where SanDisk has a 27-year history. Western Digital said the deal will also allow it to vertically integrate into NAND "securing long-term access to solid state technology at lower cost".

"This transformational acquisition aligns with our long-term strategy to be an innovative leader in the storage industry by providing compelling, high-quality products with leading technology," said Western Digital CEO Steve Milligan.

"The combined company will be ideally positioned to capture the growth opportunities created by the rapidly evolving storage industr," he said.

Western Digital said the two companies' complementary product lines, including hard disk drives, solid-state drives, cloud datacenter storage solutions, and flash storage solutions, "will provide the foundation for a broader set of products and technologies from consumer to datacenter". The transaction is expected to close in the third quarter of 2016.

The company argues there's still plenty of growth left in the storage market, predicting double digit growth in SSDs for the next five years and a 10 percent compound annual growth rate in the global NAND flash market.

SSD and NAND will account for 32 percent of the combined company's sales, while the combined R&D spend is $2.3bn. Western Digital said it expected $500m in annual 'synergies' within 18 months of the deal.

Western Digital has a market capitalisation of nearly $22bn and earlier in the month was in the news after it received a $3.8bn investment from China's Tsinghua University. According to Bloomberg, this new cash infusion is expected to be used for acquisitions.

SanDisk is the third largest flash memory manufacturer after Samsung and Toshiba. While SanDisk is strong in the memory chip market, Western Digital is one of the largest makers of computer hard disk drives. A merger of the two would chime nicely with the consolidation currently underway in the storage market, by combining a dominant force in the hard drive market with a leader in flash storage.

As evidence of the consolidation in the market: in March, NXP and Freescale announced a $40bn merger; in May, Avago bought Broadcom for $37 billion; and in June, Intel bought Altera for $16.7bn.

Further Reading: