Westpac Keyboard launches through Facebook, Twitter

Westpac Keyboard

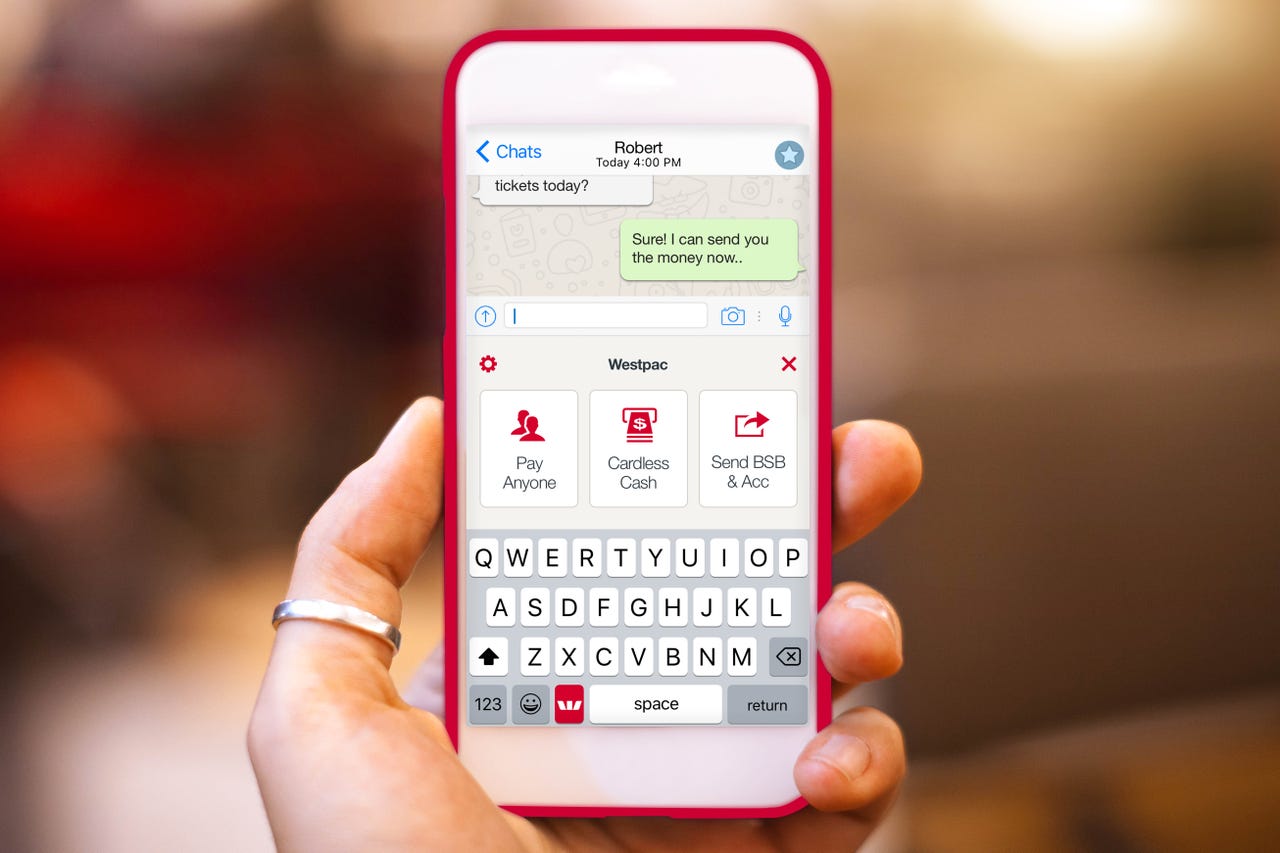

Westpac Banking Corporation is targeting tech-savvy customers, making some banking features available via social media messaging apps such as Facebook Messenger, WhatsApp, Twitter, Snapchat, and WeChat, as well as old-school SMS.

Westpac Keyboard has been touted by Westpac chief executive of Consumer Bank George Frazis as the "ultimate" mobile banking experience for those who love social media and messaging apps, labelling it one of the biggest developments in Australia's digital banking space.

Using a secured payment keyboard developed by fintech startup PayKey, the new function will prevent customers from having to exit a social messaging or SMS screen to log into Westpac Live to make payments, or send their account details to others.

Westpac explained that customers can also create and send a six-digit Cardless Cash code to their contacts, which can be used to withdraw cash from any Westpac, St George, Bank of Melbourne, or BankSA ATM.

"We really want customers to be able to access their money in an efficient and convenient way, particularly when they socialise. With SMS and social messaging apps now an everyday part of our lives, it was time to close the gap between social media and mobile banking," Frazis added.

Westpac Keyboard will be available to customers using Apple devices running iOS 9.0 and above within the next week.

For the 2016 financial year, Westpac reported AU$7.4 billion in after-tax profit, representing a 7 percent drop year on year.

For the 12 months to September 30, 2016, Westpac spent AU$1.9 billion on technology-related expenses as part of its ongoing digital transformation.

At the time, the bank said its main focus over the 12-month period has been its "digital transformation", with the company telling shareholders it has been heavily investing in technology in a bid to improve customer experience as well as improving productivity and risk management within the organisation.

During this time, Westpac has continued with ongoing investment programs that saw the delivery of a number of technology developments, such as the ability for customers to connect directly with the bank's call centres via its mobile banking app.