Why the Alibaba IPO could be a very big deal for the Tech Industry

It is rumoured that Chinese Internet company Alibaba will issue its registration statement to the Securities and Exchange Commission (SEC) in the US as early as next week. It may also announce its intention to go to IPO later this summer.

This IPO could raise $15 billion in revenue for the company — just shy of Facebook’s $16b in 2012. Alibaba is the largest e-commerce company in China. According to the WSJ, it handled over $240 billion in commerce transactions in 2013. Its quarterly profits are just over one billion dollars with 44 percent net margins.

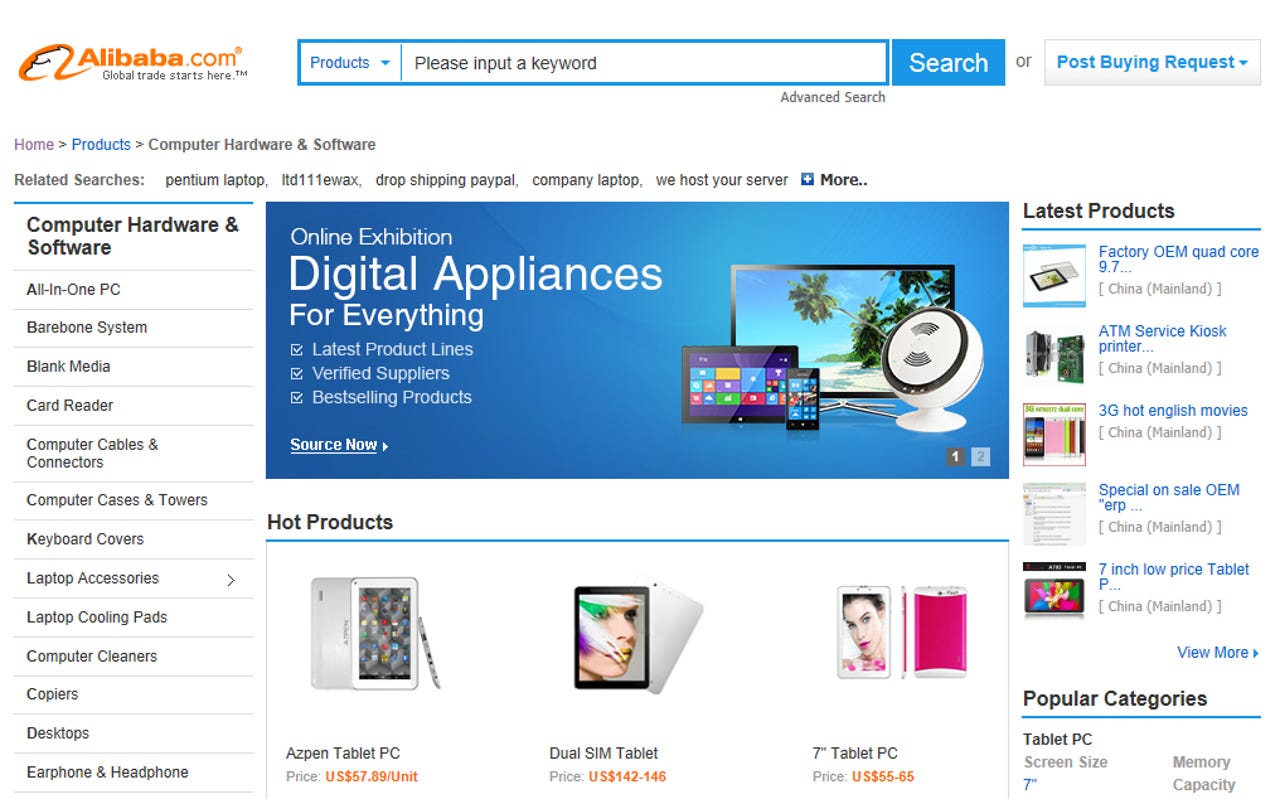

It is best described as an eBay, PayPal and Amazon hybrid. It is bigger than eBay and Amazon combined and it handles over 80 percent of China’s e-commerce. This is a huge market — and it is still growing. In contrast, eBay shut down its site in China in 2006.

Featured

Its revenue was up 66 percent to $3.06 billion during the fourth quarter of 1013. For every dollar that the company took, it generated 73 cents of operating profit.

Interestingly Alibaba chose New York instead of Hong Kong for its IPO. The rules in Hong Kong are a little more restrictive on share offerings. One-to-one voting (one vote for one share) is mandated in Hong Kong whereas the rules are a little more flexible in the US.

Analysts estimate Alababa’s value to be $150b or more, so it will need to show some growth after IPO. And this growth could be found outside of China.

It surfaces products through its e-commerce marketplace site Taobao. This market place operates in the same way as Amazon. Merchants sell products directly to consumers. But Tabao has a key advantage over Amazon.

It does not hold any product stock. It has no distribution warehouses. Amazon on the other hand has a huge warehousing and logistics infrastructure — all at a huge cost to the business. Amazon’s margins are really low compared to Alibaba’s.

Taobao also has a vendor rating system and an online chat service, AliWangWang. This service enables buyers to speak with the merchant about the goods and potentially negotiate a discount. Buyers rate the vendor based on quality and service delivery.

Alibaba’s online shopping comparison search engine, eTao, powered by Microsoft Bing, uses Taobao or Alipay logins to search the site.

There you can find one of the 760 million items you want from its seven million merchants who pay to appear at the top of search results.

Customers at TMall, the online retail spin off from Taobao, can purchase items from 70,000 brands.

The Alipay payment system is fast becoming the de facto payment platform system across China. It is linked to the buyer’s bank account. The system protects buyers from payment irregularities when dealing with smaller or unknown vendors.

The buyer states that they are satisfied with the product before the escrow module releases payment to the merchant.

Currently, logistics are poor at Taobao. The merchant is responsible for delivering the goods to the buyer — although Alibaba intends to create a distribution network across China to ease this process.

Alibaba might have some challenges as it looks to the west for its business. Amazon, PayPal, and eBay have been around for a long time. We are comfortable buying goods in this established marketplace.

Alibaba does not actually need to venture west. There is a huge e-commerce market in China and across Asia.

The high revenue technology sector will be Alibaba’s primary focus. But Alibaba has quietly set up shop in the US already. In January 2014 it made a $15 million investment in 1stdibs which sits at the high end of the e-commerce market.

In February two of Alibaba’s subsidiaries started to prepare its US e-commerce site 11Main. The site will be for established local merchants to join their marketplace who already successfully sell their fashion, home, entertainment, or tech goods online.

But don’t close your Amazon account just yet. There are concerns that Chinese companies that list on US stock markets do not have to undergo such stringent levels of scrutiny that every other company, regardless of origin, except China do.

This is because the Chinese government will not give access to the work files or other documents of these audited companies to the SEC.

This IPO is a big deal for the tech industry. Yahoo holds a 24 percent stake in Alibaba — and has owned stock in Alibaba for almost ten years. According to the Financial Times over half of Yahoo’s net income comes from Alibaba and its stake in Yahoo Japan.

Yahoo’s stock surged in March in anticipation of a large payoff when Alibaba goes public. Yahoo could receive a potential payout of $15.4 billion as a result of the Alibaba IPO.

This IPO could start to change the playing field for the e-commerce landscape. Smart vendors will shift their focus to prepare for the seismic shift in the way we are soon going to shop online.

Related stories: